- Report ID : MD2848 |

- Pages : 180 |

- Tables : 35 |

- Formats :

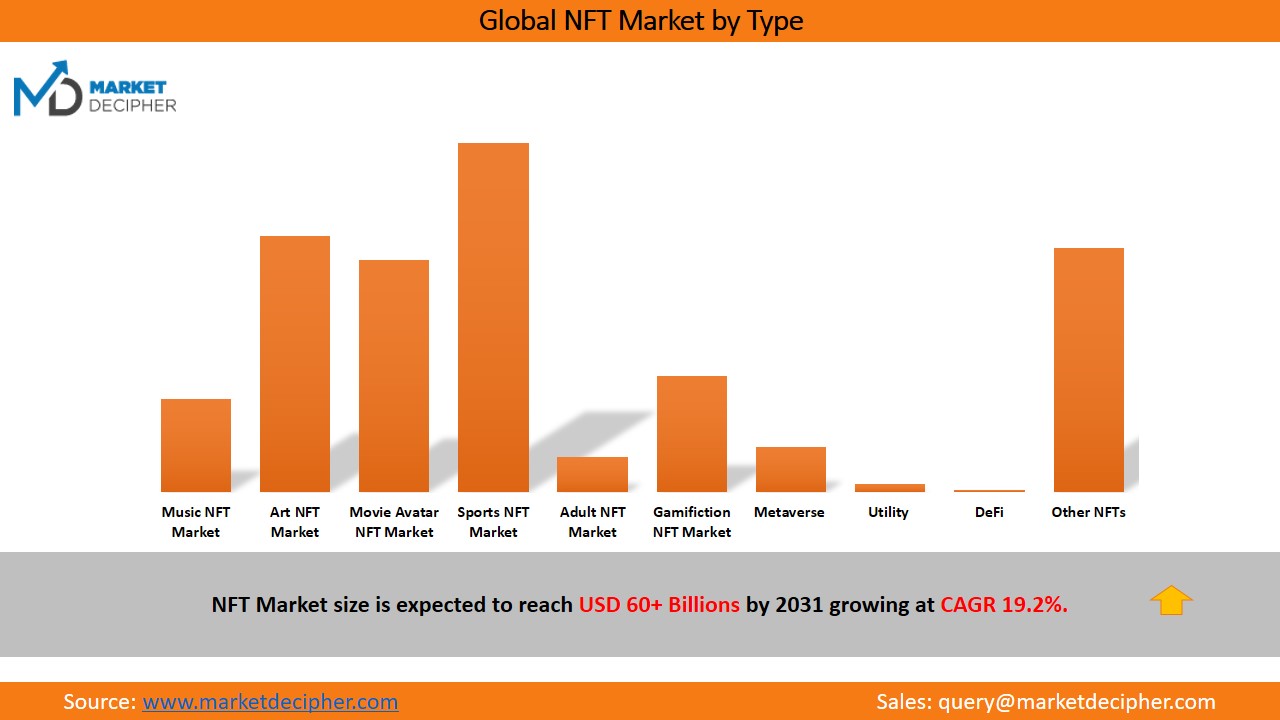

NFT Market is segmented based on sales type (primary and secondary market), product type (Collectible Images, Collectible Videos, Collectible Audio, Others), NFT Market by Sector (Music NFT, Art NFT, Movie Avatar NFT, Sports NFT, Adult NFT, Gamification NFT, Metaverse, Utility, DeFi, Others).

In 2020 the non-fungible token or NFT market size was estimated at $232 Million. Then in 2021 it was valued at $22 Billion, which is a huge increase. This upward trend is expected to continue due to its growing popularity in collectible trading together with the increasing importance of decentralised finance (DeFi), and the market is expected to increase around 3 times by 2031. Avatar NFTs, which are essentially digital headshots, are the most promising product within the collectibles segment of this digital transaction industry. Non-fungible tokens work on a similar programming and format of block chain that is used as the platform for crypto currency. However, NFTs are not currencies. They are digital tokens or an address generated on a block chain, which are completely unique and cannot be copied. No two NFTs are the same. This makes NFT a universally accepted and verifiable digital asset. NFT generally work on Ethereum Block chain along with other platforms such as Matic, Flow, and Wax.

Digital Twin as a Reinvention in Collectibles Industry with Popularity of NFT

Apart from general NFT digital asset ownership, digital twins is another famous block chain based technology that is used to bring authenticity to physical asset trading. A digital twin represents a digital copy of any physical real world product that is purchased along with the real asset to confirm the authenticity and ownership of the product in digital format. In other words it acts as a digital token. This token is used to enable the ownership and exchange of physical assets in digital marketplaces. As this technology is based on block chain technology, the ownership of the asset cannot be tampered with for the reason that it is available on a distributed ledger that has no single location for tampering. Digital twin technology will evolve as a medium that creates correlation between real and virtual world.

Recent Strategic Attempts by Companies and Investors

In March 2021, Tapinator Inc., a smartphone gaming company, developed NFT500, which is a subscription casting service and collection platform focussing on blue chip NFTs. “Casting” refers to something different to normal NFTs. It refers to the display of a digital art asset as an NFT on a physical display.

April 2021, the Hall of Fame Resort & Entertainment Company started a non-fungible tokens offering in partnership with Dolphin Entertainment, Inc.

Why is the NFT Market Growing? Key Reasons for the Growth of the NFT Market

NFT has huge potential for application in a plethora of domains to be used as a medium for ownership validation and authenticity for virtual as well as physical products. These days, even event tickets and houses are being sold as NFT tokens. With the growing influence of block chain and globalization, fuelled by increasing internet technology, the tokenization of products will reach even the slow growing economies.

Sports, Art and Entertainment: The Propellers of the Non Fungible Token’s Industry

Digital art was the engine for NFT demand because this was a highly innovative form of contemporary art, achieving great fame and acceptance, but in great of a method to authenticate ownership. That is the environment in which NFT evolved as the answer. As NFT is based on a block chain-based distributed ledger, which leaves a track of its transaction from its creation to the last transaction ever done, the creator can receive royalty for every transaction after the initial sale. This is also referred to as the primary and secondary NFT market. This particular correlation works superbly in the Sports Collectibles Market as well as the entertainment collectibles NFT market. For example, NBA’s Top Shoot block chain product of Sports Star LeBron James got highlighted for $200K.

Gamification as Virtual Real Estate: The Metaverse (Virtual Universe by Meta)

Metaverse is a novel concept that is being explored by Meta (a social media giant and the rebranded company of Facebook). It is about creating a virtual world in a game based platform where gamers can buy virtual real estate such as houses, land and more. The initial real estate on auction by Meta has already been sold. Metaverse holds a significant market share in the NFT market as per the sales realized in 2021. Further, forecast suggests that this very sector is set to witness humongous growth. Strategy role playing games allow players to create virtual game characters that are AI-based and can evolve in intelligence fed by the player or learnt during the game. These characters may get tokenized and can be later on be sold as NFTs - like an AI digital robot character - on various marketplaces (Rarible, OpenSea, etc.). In future, this technology, along with AI, can be huge due to growing millennial involvement in digital gaming.

What are the Applications of NFT? Now and in the Future

NFT holds huge potential for its application in a plethora of domains. Regular evolution of new applications is are being witnessed and the possibilities are limitless. As of now, we see the following major applications of this technology – domain names, virtual real estate, trading card, tickets, game assets, collectibles, art, and entertainment media.

What are the Risks and Disadvantages?

One major disadvantage of this technology is that anyone is free to tokenize a product and scarcity of an item does not necessarily guarantee its value. What’s more, this is an area where the use of pseudonyms is commonplace, which does not engender trust, and fraud is a potential element.

There are several different ways that fraud can creep into this market. It is possible to set up fake NFT stores that look similar to authentic stores, copying their logo and even content, but the NFTs they claim to sell are not even there. Another cyber security issue is the possibility of counterfeit NFTs, where impersonators sell fake NFTs in a famous NFT artist’s name.

NFT Market Segmentation Analysis

Digital art, sports and gaming currently contributes to the maximum share of the NFT market. Digital art is an exciting and innovative field for creators and we are continuously witnessing new forms of digital art. And with new forms of art has come new forms of authentication and transaction and now we have digital artists using NFT marketplaces to regulate and control their ownership. NFTs are increasingly being used in digital art, and in future it is likely that NFTs will help the digital art world itself expand as artists see digital art becoming a more financially viable medium. It is worthwhile noting that digital art is mainly of primary market potential for NFTs, but of limited secondary market value. The primary market or primary sale here refers to the first time sale of an NFT, and the secondary market or secondary sale refers to any subsequent resale of that same NFT. The secondary market for digital art as NFTs is limited because art is typically considered as a holding asset, with the buyer hoping to get a good return on their investment much later in time.

When it comes to gaming, NFTs are changing the in-app purchasing system. Although in-game digital product consumption (such as buying virtual currency or skins) has been popular for a while, they come with user permission restrictions and, further, were relegated to the specific app or game they were bought from and could not be withdrawn or transferred across apps or platforms. This represented a major limitation in the market. NFTs, however, are changing this situation, because something that is bought as an NFT actually belongs to the owner and thus allowing for more flexibility. Now it is possible to re-sell a virtual product in-game between users, and what’s more, it opens the possibility of being able to transfer virtual products outside the game. In the case of gaming, as opposed to digital art, the potential for the secondary market is high because users are more likely to quickly re-sell their NFT products. In fact, it is estimated that as much of 75% of transactions in this segment are secondary sales.

Crypto currency Usage in the NFT Market

Crypto currencies are commonly used for buying and selling NFTs because of the security they offer. There are several different crypto currencies being used in the NFT market. Ethereum was the first block chain to support NFTs and is still the most popular. Ethereum makes it so that the transaction history and token metadata is accessible and transparent, in a sort of “public ledger”, so it is simple to verify and track ownership. This makes it difficult to steal NFTs because the ownership data can’t be manipulated by malicious agents. In addition, with Ethereum, NFT-related transactions can occur peer-to-peer without third-party platforms taking hefty fees.

U.S. Leads the Industry with Asia Holding Immense Potential

The non-fungible token market is enjoying massive momentum in the U.S. where Taco, for instance, released a series of NFTs to celebrate its signature dish, selling out in half an hour. In the U.S., Gucci (a fashion brand), has rolled out digital-only sneakers and artists like Beeple have set records by way of multi-million dollar auctioned-off artworks. The NBA and Canadian-based Dapper Labs, makers of the Crypto Kitties game, partnered together to make its version of a collectible digital asset. NBA Top Shot is another type of crypto-collectible that consumers can buy as a non-fungible token. In Asia, WazirX, Indias Bitcoin and crypto currency exchange and trading platform, has launched a NFT marketplace for creators to sell and profit from their digital works. In China, although NFTs are becoming popular, Chinese regulations are exceptionally strict with regards to crypto-technologies. Europe has seen many start-ups popping up recently, such as the French NFT start-up, Arianne, which certifies ownership of virtual luxury goods. And the Great British Olympic team (Team GB) has become the first Olympic team to release an official NFT collection.

Is this a Soap Bubble? Companies must invest or NOT?

Investors and companies, are trying to understand if this is a sudden rise in demand for NFT due to growth in virtual life or is this actually a solid industry. There is a lot of hype and speculation surrounding NFTs and we very well might be witnessing a peak. Transactional data from Open Sea indicates that only 28.5% of NFTs purchased during minting (the process for turning digital files into NFTs) and sold on the platform resulted in a profit. That being said, buying NFTs on the secondary market, in other words from other users, results in profit 65.1% of the time.

Our report will offer you a future forecast of this market with potential investment opportunities. Our research will help you control and regulate you investment capital if a company is planning to start new NFT product line. Also, there are a variety of sales and monetizing model for NFT creators that can be implemented at a low cost capital method. Understanding the primary and secondary market is essential as the source of profit for marketplaces and original creators is not necessarily associated with every sale.

User Investment – Understanding the Customer Perspective

A key tactic for investing in NFTs is to get “whitelisted”. NFT creators allow their loyal followers to be added to a whitelist, which lets them buy new NFTs at a much lower price during minting. According to OpenSea, users who are whitelisted and later flip their newly minted NFT can gain a profit 75.7% of the time. This trend indicates that community involvement is a major aspect of the NFT marketplace. Being a dedicated fan, taking part in the conversation on social media and helping the creator promote the upcoming NFT release is how people can turn NFT hype into profit.

Report Coverage

| Report Attributes | Details |

| Study Period | 2018 - 2031 |

| Historical Period | 2018 - 2021 |

| Forecast Period | 2022 - 2031 |

| Segments Covered | Deep Dive Segmentation (check below) |

| Company Analysis | 20 Companies Covered (with per segment company analysis for easier understanding) |

| Report Format | PDF + Excel Spreadsheet |

| Delivery Time | 1 Business Day |

| Customization Available | 20% Zero cost customization |

NFT Collectibles Market Segment Revenue Breakdown

Analysis by Buying (Revenue, USD Million, 2021 to 2031)

Analysis by Industry (Revenue, USD Million, 2021 to 2031)

Analysis by Type (Revenue, USD Million, 2021 to 2031)

Analysis by Sales Channel (Revenue, USD Million, 2021 to 2031)

Analysis by Country (Revenue, USD Million, 2021 to 2031)

NFT Company Profiles

Detailed Collectibles Market Study: https://www.marketdecipher.com/report/collectibles-market

Want to customize the report or need something different? Email us at david@marketdecipher.com

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Please fill in the form below to Request for free Sample Report

Office Hours Mon - Sat 10:00 - 16:00

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved