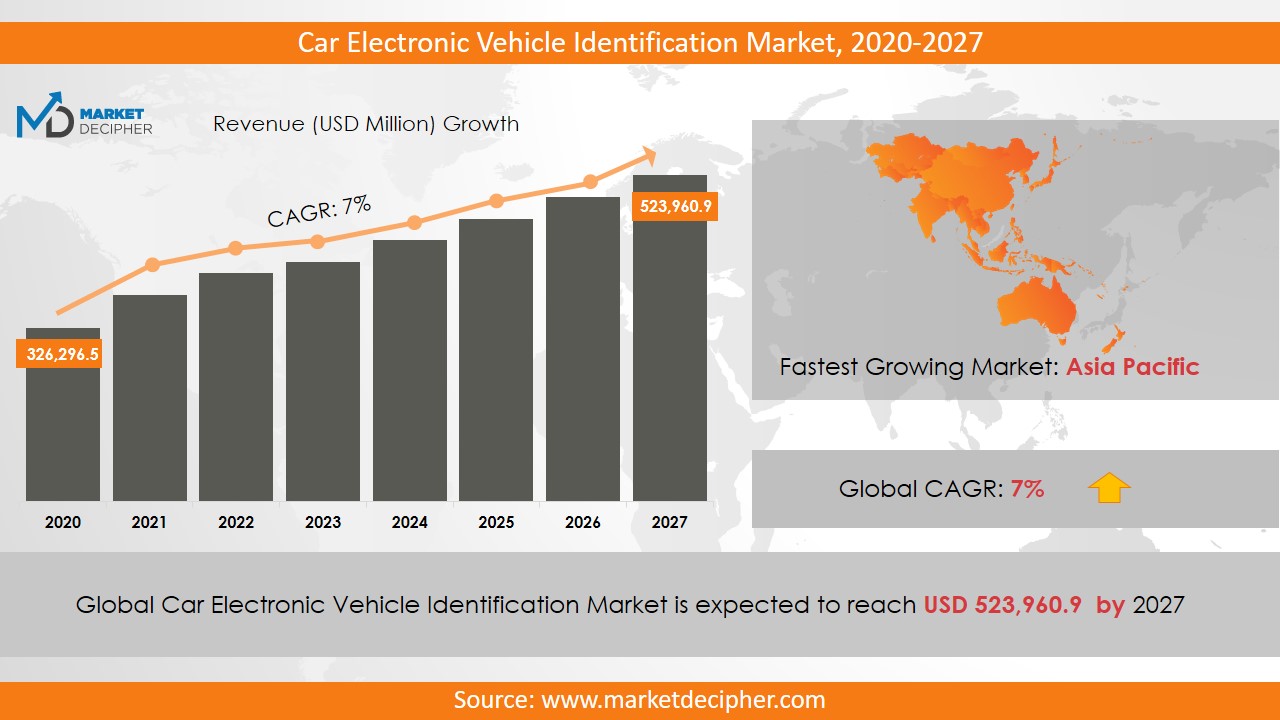

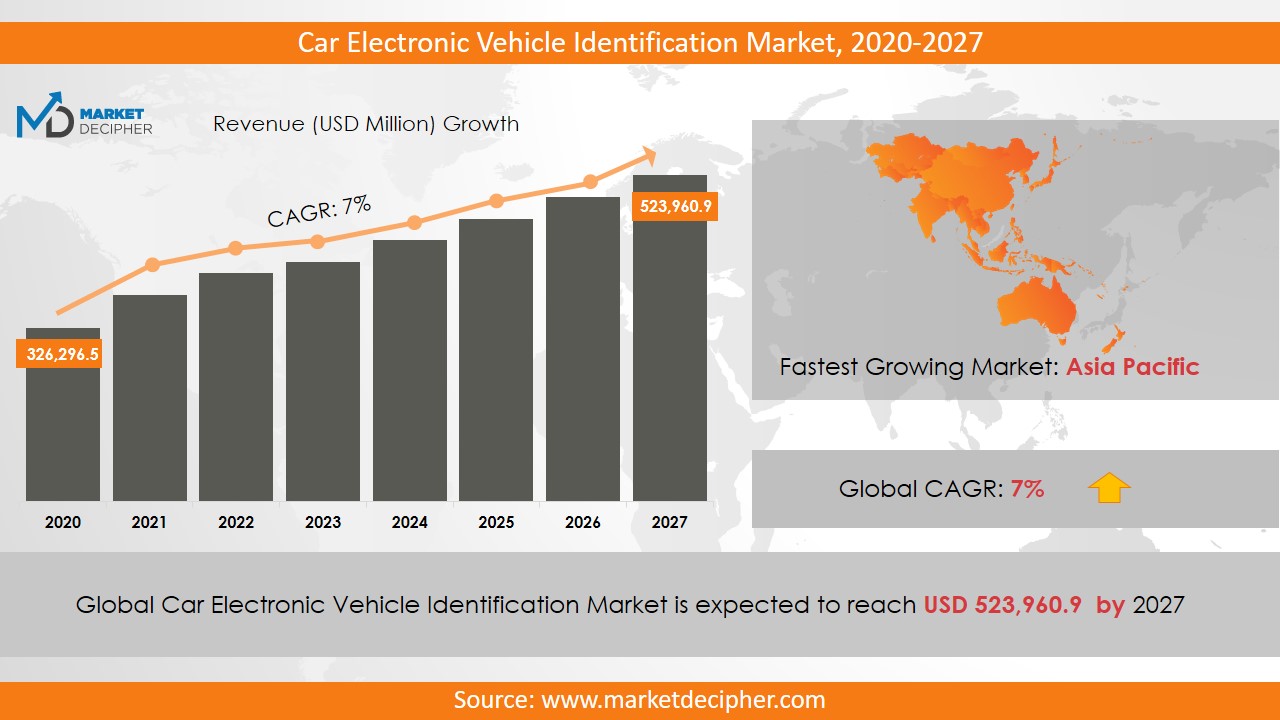

The global car electronic vehicle identification market was marked US$ 210 Million in 2017 and is expected to exceed US$ 451 Million by 2025 and is growing at a CAGR of 8.86% in the forecasting period of 2017-2025.

Introduction

The car electronic vehicle identification is a computerized magnetic chip that is attached to the front of a car and is used by the companies or the government for toll-collection, governing and managing the traffic, and various registration and identification purpose. This system provides time-saving and safer vehicle management. It is very convenient at a higher level to control the traffic and flow of vehicles by the use of such equipment. The cost of this equipment is almost US$ 8-15 and is continuously decreasing due to its use.

Analysis by Application

The application of these chips is for various purposes nowadays. The basic use being taken by these EVAs is the collection of tolls and e-tagging. The vehicles are tagged and are easier to identify the owner without checking the vehicle and the people sitting inside. Further uses include the parking control and access which is an advanced use of this equipment. The EVI are also being used as vehicle registration in modern countries. This makes it convenient for the traffic managing companies to control and detect the vehicles with the help of EVI detectors. There is one more important application of the EVI which is fuel monitoring and control. The use of EVI technology in this area ensures vehicle safety and automates enforcement.

Analysis by Technology

Currently, four technologies are available in the Electronic Vehicle Identification which is Radio-frequency identification (RFID), Dedicated Short Range Communication (DSRC), Bluetooth and Global System for Mobile (GSM). The RFID gives 95% efficiency over the other three technologies therefore; the currently used technology is RFID. The modern technology is considered to be very effective in the use of arising problems.

Analysis by Requirement

The EVI system is emerging and is increasing as the requirements are being increased. The worldwide number of vehicles is increasing day by day and there is a dire need for a system which can manage all vehicles in a better way without avoiding the flow of traffic. Road accidents cause 25% of the total deaths in a country but more than half of them are not searched for detail to eradicate the cause because of the inefficiency of the system. An annual US$ 200 Million is used on this system but the requirement is still a lot more.

Analysis by Growth and Trends

Increasing sensitivity of various governments across the globe towards a cleaner environment has increased the demand for electronic vehicles which are zero-emission vehicles. The future of these vehicles is expected to be lucrative and the price of batteries, one of the most essential components in an electronic vehicle, is decreasing significantly thus making them more affordable. The commercial vehicle segment is anticipated to be the fastest growing market. With the rising adoption of electric buses, particularly in China and India, there has been massive growth in the electric commercial segment. Several countries are aiming at replacing their existing fuel-based buses with electric buses. So the trend of replacing fossil-fuel-based modes of public transport with electric buses will certainly drive the growth of electric commercial vehicles in the future to be further fostered by the growth of logistics, e-commerce, and shared mobility. The soaring demand for reduction in carbon footprint and developing more advanced and fast charging stations are anticipated to boost the growth of the car electric vehicle identification market. This would help in improving the air quality. Governments are providing incentives and subsidies to foster the growth of this market. Automakers are making heavy investments which is expected to lead to the growing demand for electronic vehicles and play a key role in the evolution of the car electric vehicle identification market. The wide range of products has attracted many consumers and resulted in a growing market. The dependence on fossil fuels will be reduced. Further, these vehicles require lesser maintenance cost and operating cost in comparison with ICE vehicles. Their environment friendly characteristic is what makes for a thriving market.

At present, with the emergence in the Covid-19 pandemic, there is a slowdown in logistics and supply chain operations which is a temporary limiting factor of market growth.

Analysis by Company

Various companies are manufacturing these EVIs. They compete with each other by communicating with government departments and making deals with the agencies which implement such systems. The major share is held by Siemens AG, Flir Systems, Q-Free ASA and Kapsch Traffic Com AG.

Analysis by Region

The regional analysis says that the developed countries are almost already using the technology at greater levels but the need is to implement them in developing countries. Europe and the U.S. are using the technology at very vast levels but the APAC region, Africa and Arabs are required to use this service. Out of US$ 200 Million, the income of this market, more than US$ 137.3 Million is the earning from Europe and the U.S. which becomes 68.65% of the total market revenue.

COVERAGE HIGHLIGHTS

• Market Revenue Estimation and Forecast (2017 – 2025)

• Market Sales/Consumption Volume Estimation and Forecast (2017 – 2025)

• Breakdown of Revenue by Segments (2017 – 2025)

• Breakdown of Production by Segments (2017 – 2025)

• Breakdown of Sales Volume by Segments (2017 – 2025)

• Breakdown of Sales Volume by Requirement of the System

• Business Trend and Expansion Analysis

• Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Application

• Toll collection

• E-tagging

• Vehicle registration

• Fuel monitoring

• By Technology

• Radio-frequency identification (RFID)

• Dedicated Short Range Communication (DSRC)

• Bluetooth-2D/3D

• Global System for Mobile (GSM)

By Sensors

• Magnetic sensors

• Thermal sensors

• Bending plates

• Acoustic sensors

• Inductive loops

• Piezoelectric sensors

• Image sensors

• Infrared sensors

• LiDAR sensors

• Radar sensors

By Companies

• Siemens AG

• Flir Systems, Inc.

• Q-Free ASA

• Kapsch TrafficCom AG

• International Road Dynamics, Inc.

• EFKON AG

• TransCore

• Kistler Group

• TE Connectivity Ltd.

• SWARCO AG

• SICK AG

• Axis Communications AB

• Raytheon Company

By Region ($revenue and regional sales)

• North America

• The U.S.

• Canada

• Europe

• Germany

• The U.K.

• France

• Italy

• Spain

• Russia

• Poland

• Austria

• Luxembourg

• Asia-Pacific

• China

• India

• Vietnam

• Japan

• Tajikistan

• Indonesia

• Thailand

• Malaysia

• Australia

• New Zealand

• Latin America

• Colombia

• Argentina

• Bolivia

• Peru

• Middle East & Africa

• Saudi Arabia

• Ethiopia

• Botswana

• Morocco

• Nigeria