Conveying Equipment Market

Conveying Equipment Market By Product (Bulk Handling Equipment, Unit Handling Equipment, Parts & Attachments), By Application (Durable Manufacturing, Food & Beverage, General Merchandise, Mining & Construction, Transportation, Warehouse & Distribution), Industry Analysis Report, Regional Outlook (U.S., Canada, UK, Germany, France, Italy, Spain, Netherlands, Russia, China, India, Japan, Australia, South Korea, Malaysia, Indonesia, Brazil, Mexico, Argentina, Chile, Colombia, Peru, GCC, South Africa)

- Report ID : MD1408 |

- Pages : 222 |

- Tables : 85 |

- Formats :

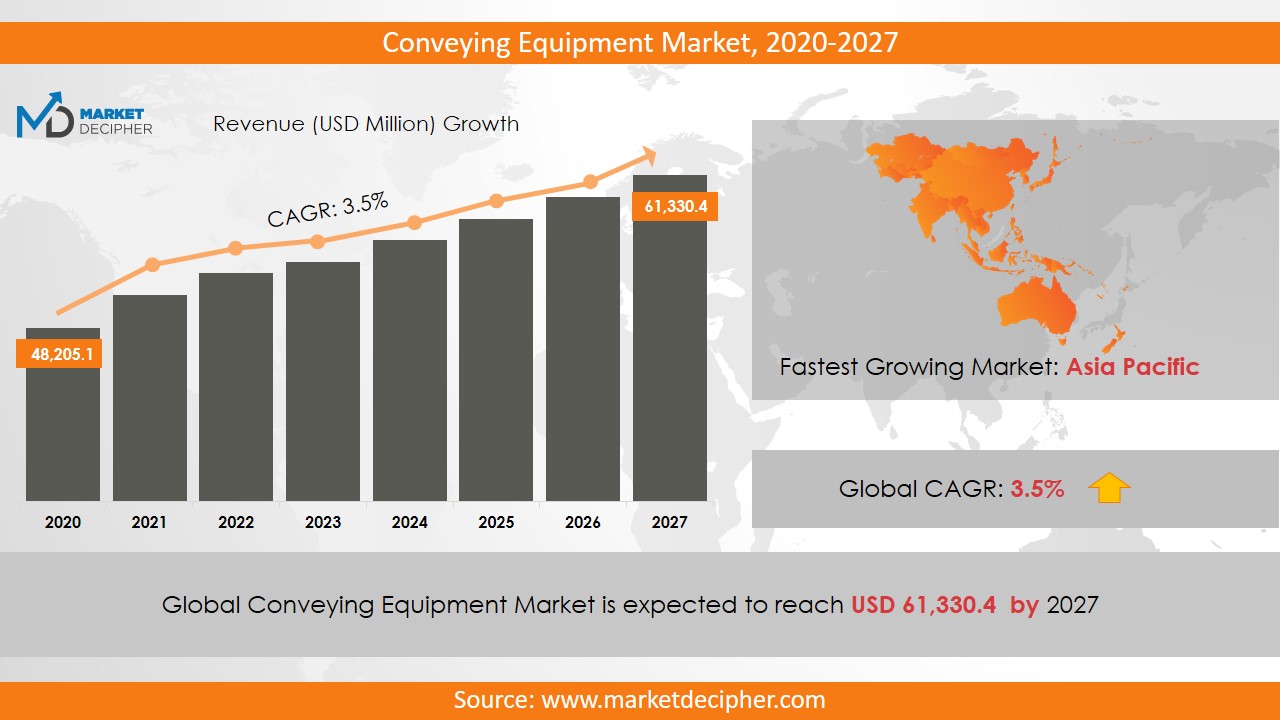

Conveying Equipment Market size was estimated at $48,205.2 Million in 2019 and is expected to reach $61,330.4 Million by 2027, growing at a CAGR of 3.5% during the forecast period of 2020 to 2027.

Conveying equipment are used in the supply chain of businesses typically where products of varying weight and dimensions need to be safely handled. The conveying equipment enables the repetitive tasks to be automated to the level required to reduce errors and accidents.

Analysis by Product

According to the product, the three main segments are Bulk Handling Equipment, Unit Handling Equipment, and Parts & Attachments.

Bulk Handling equipment is on a very stable business model. These systems are used in sectors that are irreplaceable for humanity. These include Coal mining, Cement production, and Chemicals. Bulk handling equipment will always be required in such cases as this work can simply not be done by human workers directly. Thus, the demand for these systems has a very strong correlation with the rise and advent of the heavy industries.

Another area of an excellent return on investment for Bulk Handling equipment providers is Airports. The commercial airspace is growing rapidly and thus the need for sophisticated bulk handling equipment will increase in the forecasted period.

Analysis by Application

According to the application, the main segments are Durable Manufacturing, Food & Beverage, General Merchandise, Mining & Construction, Transportation, and Warehouse & Distribution.

The Durable manufacturing industry is a perennial source of demand for conveying equipment. This is largely because these businesses need conveying equipment for a large portion of their operational activities. These include handling of the raw materials arriving onto the manufacturing floor, their assembly, and inventorying them till loading onto the logistics suppliers is required. Thus, this segment will be competed very fiercely by the manufacturers in the Conveying equipment space.

The Transportation segment along with Food & Beverage businesses will continue to be large demand-centers for conveying equipment. As businesses in these segments grow, most of them infuse capital to upgrade their conveying infrastructure to include higher levels of automation. This business opportunity will become prevalent at a faster pace in the upcoming future owing to the excellent levels of efficiencies that they bring to the operators.

Analysis by Region

The Asia-Pacific region already has a daunting share of the market considering its population. This dominant share will continue to rise owing to the fast economic growth of the countries in this region, especially China, Singapore, India, and Thailand. The major sectors likely to be at the forefront of the development are Automotive, E-commerce, and Food & Beverages.

A large pool of customers is shifting over to E-commerce as their preferred source of shopping. This is, in turn, creating a very interesting business proposition for the automation of the material handling equipment. These trends are on the rise and present fruitful investment options for large-scale investments.

Analysis by Advanced companies

The industry is brimming with innovations led by Beumer Group GmbH & Co., KG, Daifuku Co., Ltd., Fenner Group Holdings Ltd., Fives Group, Flexlink, Intelligrated, Inc., Kardex Group, Kion Group AG, KUKA AG, Mecalux S.A., Phoenix Conveyor Belt Systems, Siemens AG, SSI Schaefer Group, Taikisha Global, TGW Logistics Group GmbH, Toyota Industries Corporation, and Viastore Systems, Inc.

Strategic partnerships between the manufacturers of conveying equipment and the distributors will enable the servicing of new markets. This eco-system will also have start-ups collaborate with bigger players to gain vital business experience in diverse functions. Software development will be key in delivering a robust product with enhanced automation capabilities and least down-time.

COVERAGE HIGHLIGHTS

● Market Revenue Estimation and Forecast (2019 – 2026)

● Market Production Estimation and Forecast (2019 – 2026)

● Market Sales/Consumption Volume Estimation and Forecast (2019 – 2026)

● Breakdown of Revenue by Segments (2019 – 2026)

● Breakdown of Production by Segments (2019 – 2026)

● Breakdown of Sales Volume by Segments (2019 – 2026)

● Gross Margin and Profitability Analysis of Companies

● Business Trend and Expansion Analysis

● Import and Export Analysis

● Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Product Outlook ($Revenue and Unit Sales, 2019-2026)

• Bulk Handling Equipment

• Unit Handling Equipment

• Parts & Attachments

By Application Outlook ($Revenue and Unit Sales, 2019-2026)

• Durable Manufacturing

• Food & Beverage

• General Merchandise

• Mining & Construction

• Transportation

• Warehouse & Distribution

By Regional Outlook ($Revenue and Unit Sales, 2019-2026)

• U.S.

• Canada

• UK

• Germany

• France

• Italy

• Spain

• Netherlands

• Russia

• China

• India

• Japan

• Australia

• South Korea

• Malaysia

• Indonesia

• Brazil

• Mexico

• Argentina

• Chile

• Colombia

• Peru

• GCC

• South Africa

Advanced companies

• Beumer Group GmbH & Co.

• KG

• Caterpillar Inc.

• Daifuku Co. Ltd.

• Fenner Group Holdings Ltd.

• Fives Group

• Flexlink

• Intelligrated, Inc.

• Jungheinrich AG

• Kardex Group

• Kion Group AG

• KUKA AG

• Mecalux S.A.

• Murata Machinery, Ltd.

• Phoenix Conveyor Belt Systems

• Siemens AG

• SSI Schaefer Group

• Taikisha Global

• TGW Logistics Group GmbH

• Toyota Industries Corporation

• Viastore Systems, Inc.

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved