- Report ID : MD1166 |

- Pages : 189 |

- Tables : 87 |

- Formats :

By Type (On premise and Cloud based), By Application (IT and Telecom, Healthcare, BFSI, Defense and others), By Region (North America, Europe, APAC and Rest of the World

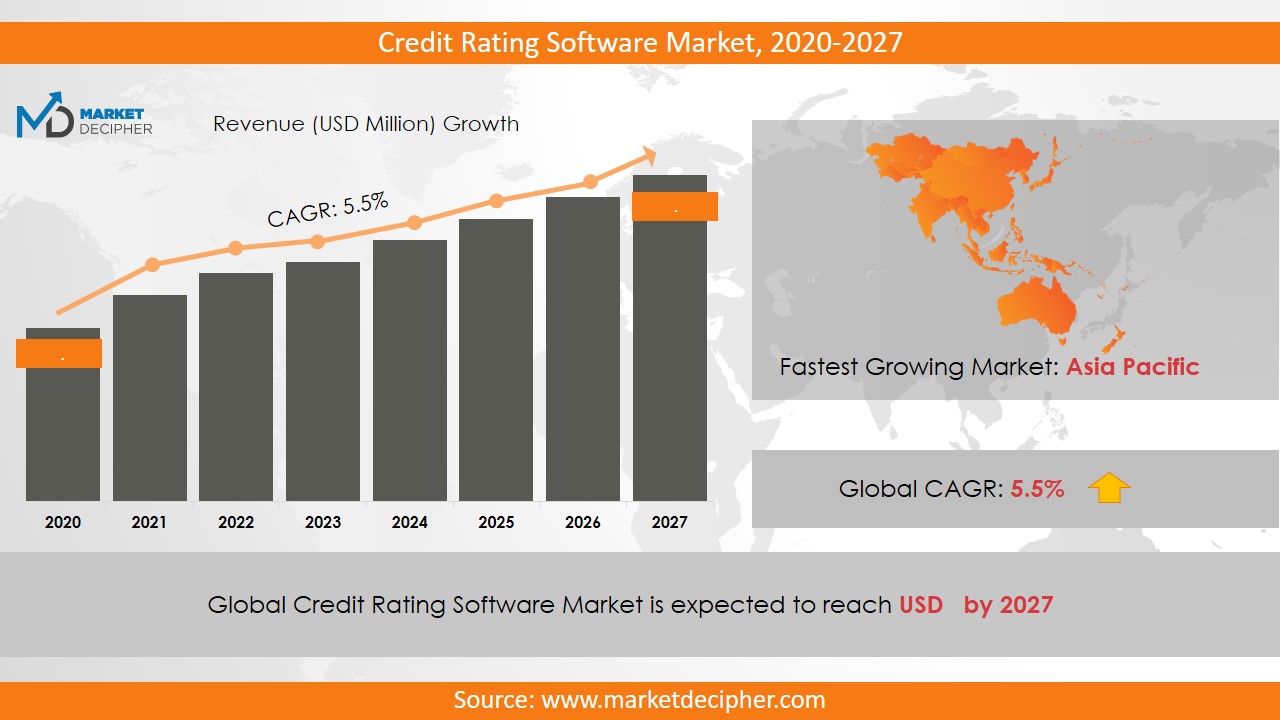

Credit rating software market revenue is estimated to be $XX Billion in 2018 and shall grow with a CAGR of XX.X% during the forecast period of 2019 to 2026.

Credit rating is basically the process of evaluating and verifying the credibility of a person or company. This whole process makes the credit rating software very easy and affordable. This software evaluates the credit rate using the companys previous records, transactions, and banking behavior. In addition, credit analysis is about identifying the risks in situations where banks have the potential to provide loans. It actually helps in ensuring that whether the person or the company would be able to pay back the debt or not. quantitative and qualitative assessments are part of the overall evaluation of customers. Credit ratings are issued by credit agencies and it is used to assess the risks associated with the ability to meet the financial obligations of a government or company. These ratings are definitely important in assessing the quality of fixed income securities. The issuer of bad credit ratings may have to offer higher yields.

Credit rating software collects and stores the past data of the customer’s deals and transactions for generating credit rates when needed. Modern credit ratings involve highly advanced primitive techniques for giving credit rating to companies. As modern accounting and financing techniques have developed during the industrial revolution. Thus, banks have adopted the credit rating software at large scale in order to make credit rating analysis more precise and systematic. Further, the government sector has made significant contributions to the credit rating software market revenue owing to the increasing sophistication in national bureaucracy operations. Large banking and financing houses have faced the demands of international trade.

Asia Pacific region to grow with the highest CAGR during the forecast period:

North America has dominated the market in terms of revenue owing to the presence of advanced technology in this region. Further, stringency in the rules implemented by the government is anticipated to make positive changes in the credit rating software market trend during the forecast period. Asia-Pacific region, owing to the rapid development of IT and Telecom sector is going to generate the highest share of overall credit rating software market revenue. Further, CRISIL acquired about 56.6 of the market revenue in 2018. Moreover, it is expected to hold about 70% of the market revenue of Indian credit rating software.

IT and Telecom industries to implement credit rating software extensively in coming years:

On the basis of deployment, the market has been bifurcated as on-premise and cloud. By application, the market has been segmented as IT and Telecom, Healthcare, BFSI, Defense and others. With the use of credit rating software it has become much easier for the organizations to predict the productivity of their business. Thus, due to rapid development of IT and Telecom industries across the world, these industries are using this software at a significant level. Moreover, increasing complications in defense sector is further responsible for propelling the credit rating software market sales.

Credit Rating Software Market Companies:

Major market players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These market players include CRISIL, ICRA, CARE Ratings, DCR India, Fitch Rating, Next Advisor, Accredited business, SMERA, MOOD, and Standard and Poors. Fitch credit rating software has generated a significant market revenue in recent years and in the standard and poors software in integration with Fitch generated approximately 40% of the total market revenue. Further, ICRA software generated around 15% of the overall market revenue. Other industries in this domain that are growing at a high CAGR include Financial Modeling Software Market and Flood Vents Market.

Key Points covered in the Credit Rating Software Market Report:

• Revenue Estimation and Forecast (2018 – 2025)

• Production Estimation and Forecast (2018 – 2025)

• Breakdown of Revenue by Segments (2018 – 2025)

• Breakdown of Production by Segments (2018 – 2025)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Type Outlook ($Revenue, 2018-2025)

• On-premise

• Cloud-based

By Application Outlook ($Revenue, 2018-2025)

• IT and Telecom

• Healthcare

• BFSI

• Defense

• others

By Regional Outlook ($Revenue, 2018-2025)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• France

• U.K

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• Rest of Asia Pacific

• Rest of the World

• The Middle East and Africa

• Latin America

Market Vendors of Credit rating software:

• CRISIL

• ICRA

• CARE Ratings

• DCR India

• Fitch Rating

• Next Advisor

• Accredited business

• SMERA

• MOOD’S

• Standard and Poors

CHAPTER 1: INTRODUCTION

1.1. Research Methodology

1.1.1. Desk Research

1.1.2. Data Synthesis

1.1.3. Data Validation & Market Feedback

1.1.4. Data Sources

CHAPTER 2: EXECUTIVE SUMMARY

2.1. Global Market Outlook

2.2. Core Insights - Type

2.3. Core Insights – Application

2.4. Core Insights – Geography

CHAPTER 3: MARKET OVERVIEW

3.1. Market Definition and Scope

3.2. Key Forces Shaping the Industry

3.2.1. Bargaining Power of Suppliers

3.2.2. Bargaining Power of Buyers

3.2.3. Threat of Substitutes

3.2.4. Threat of New Entrants

3.3. Market Dynamics

3.3.1. Drivers

3.3.1.1. Supply-side Drivers

3.3.1.2. Demand-side Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.4. Industry Landscape - PESTEL Analysis

3.4.1. Political Landscape

3.4.2. Environmental Landscape

3.4.3. Social Landscape

3.4.4. Technology Landscape

3.4.5. Economic Landscape

CHAPTER 4: MARKET BACKGROUND

4.1. Industry Value Chain Analysis

4.1.1. Upstream Participants

4.1.2. Downstream participants

4.2. Pricing Analysis and Forecast, 2018-2026

4.2.1. By Type

4.2.2. By Region

CHAPTER 5: GLOBAL CREDIT RATING SOFTWARE MARKET, BY TYPE

5.1. Overview

5.1.1. Market Volume and Forecast, 2018-2026

5.1.2. Market Revenue (US$ Million) and Forecast, 2018-2026

5.2. On-premise

5.2.1. Key Market Trends, Growth Factors and Opportunities

5.2.2. Market Volume and Forecast, By Region

5.2.3. Market Revenue (US$ Million) and Forecast, By Region

5.3. Cloud-based

5.3.1. Key Market Trends, Growth Factors and Opportunities

5.3.2. Market Volume and Forecast, By Region

5.3.3. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 6: GLOBAL CREDIT RATING SOFTWARE MARKET, BY APPLICATION

6.1. Overview

6.1.1. Market Volume and Forecast, 2018-2026

6.1.2. Market Revenue (US$ Million) and Forecast, 2018-2026

6.2. IT and Telecom

6.2.1. Key Market Trends, Growth Factors and Opportunities

6.2.2. Market Volume and Forecast, By Region

6.2.3. Market Revenue (US$ Million) and Forecast, By Region

6.3. Healthcare

6.3.1. Key Market Trends, Growth Factors and Opportunities

6.3.2. Market Volume and Forecast, By Region

6.3.3. Market Revenue (US$ Million) and Forecast, By Region

6.4. BFSI

6.4.1. Key Market Trends, Growth Factors and Opportunities

6.4.2. Market Volume and Forecast, By Region

6.4.3. Market Revenue (US$ Million) and Forecast, By Region

6.5. Defense

6.5.1. Key Market Trends, Growth Factors and Opportunities

6.5.2. Market Volume and Forecast, By Region

6.5.3. Market Revenue (US$ Million) and Forecast, By Region

6.6. others

6.6.1. Key Market Trends, Growth Factors and Opportunities

6.6.2. Market Volume and Forecast, By Region

6.6.3. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 7: GLOBAL CREDIT RATING SOFTWARE MARKET, BY GEOGRAPHY

7.1. Overview

7.2. North America

7.2.1. Key Market Trends, Growth Factors and Opportunities

7.2.2. Market Volume and Forecast, By Type

7.2.3. Market Volume and Forecast, By Application

7.2.4. Market Revenue and Forecast, By Type

7.2.5. Market Revenue and Forecast, By Application

7.2.6. Market Revenue and Forecast, By Country

7.2.7. U.S.

7.2.7.1. Market Volume and Forecast

7.2.7.2. Market Revenue and Forecast

7.2.8. Canada

7.2.8.1. Market Volume and Forecast

7.2.8.2. Market Revenue and Forecast

7.2.9. Mexico

7.2.9.1. Market Volume and Forecast

7.2.9.2. Market Revenue and Forecast

7.3. Europe

7.3.1. Market Volume and Forecast, By Type

7.3.2. Market Volume and Forecast, By Application

7.3.3. Market Revenue and Forecast, By Type

7.3.4. Market Revenue and Forecast, By Application

7.3.5. Market Revenue and Forecast, By Country

7.3.6. Germany

7.3.6.1. Market Volume and Forecast, By Type

7.3.6.2. Market Revenue and Forecast, By Application

7.3.7. UK

7.3.7.1. Market Volume and Forecast, By Type

7.3.7.2. Market Revenue and Forecast, By Application

7.3.8. France

7.3.8.1. Market Volume and Forecast, By Type

7.3.8.2. Market Revenue and Forecast, By Application

7.3.9. Italy

7.3.9.1. Market Volume and Forecast, By Type

7.3.9.2. Market Revenue and Forecast, By Application

7.3.10. Rest of Europe

7.3.10.1. Market Volume and Forecast, By Type

7.3.10.2. Market Revenue and Forecast, By Application

7.4. Asia-Pacific

7.4.1. Market Volume and Forecast, By Type

7.4.2. Market Volume and Forecast, By Application

7.4.3. Market Revenue and Forecast, By Type

7.4.4. Market Revenue and Forecast, By Application

7.4.5. Market Revenue and Forecast, By Country

7.4.6. China

7.4.6.1. Market Volume and Forecast, By Type

7.4.6.2. Market Revenue and Forecast, By Application

7.4.7. India

7.4.7.1. Market Volume and Forecast, By Type

7.4.7.2. Market Revenue and Forecast, By Application

7.4.8. Japan

7.4.8.1. Market Volume and Forecast, By Type

7.4.8.2. Market Revenue and Forecast, By Application

7.4.9. South Korea

7.4.9.1. Market Volume and Forecast, By Type

7.4.9.2. Market Revenue and Forecast, By Application

7.4.10. Rest of Asia-Pacific

7.4.10.1. Market Volume and Forecast, By Type

7.4.10.2. Market Revenue and Forecast, By Application

7.5. REST OF THE WORLD

7.5.1. Market Volume and Forecast, By Type

7.5.2. Market Volume and Forecast, By Application

7.5.3. Market Revenue and Forecast, By Type

7.5.4. Market Revenue and Forecast, By Application

7.5.5. Market Revenue and Forecast, By Country

7.5.6. Latin America

7.5.6.1. Market Volume and Forecast, By Type

7.5.6.2. Market Revenue and Forecast, By Application

7.5.7. Middle East

7.5.7.1. Market Volume and Forecast, By Type

7.5.7.2. Market Revenue and Forecast, By Application

7.5.8. Africa

7.5.8.1. Market Volume and Forecast, By Type

7.5.8.2. Market Revenue and Forecast, By Application

CHAPTER 8: COMPETITIVE LANDSCAPE

8.1. Credit Rating Software Market Share Analysis, 2018

CHAPTER 9: COMPANY PROFILES

9.1. CRISIL

9.1.1. Company Overview

9.1.2. Financial Performance

9.1.3. SWOT Analysis

9.2. ICRA

9.2.1. Company Overview

9.2.2. Financial Performance

9.2.3. SWOT Analysis

9.3. CARE Ratings

9.3.1. Company Overview

9.3.2. Financial Performance

9.3.3. SWOT Analysis

9.4. DCR India

9.4.1. Company Overview

9.4.2. Financial Performance

9.4.3. SWOT Analysis

9.5. Fitch Rating

9.5.1. Company Overview

9.5.2. Financial Performance

9.5.3. SWOT Analysis

9.6. Next Advisor

9.6.1. Company Overview

9.6.2. Financial Performance

9.6.3. SWOT Analysis

9.7. Accredited business

9.7.1. Company Overview

9.7.2. Financial Performance

9.7.3. SWOT Analysis

9.8. SMERA

9.8.1. Company Overview

9.8.2. Financial Performance

9.8.3. SWOT Analysis

9.9. MOOD’S

9.9.1. Company Overview

9.9.2. Financial Performance

9.9.3. SWOT Analysis

9.10. Standard and Poors

9.10.1. Company Overview

9.10.2. Financial Performance

9.10.3. SWOT Analysis

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Please fill in the form below to Request for free Sample Report

Office Hours Mon - Sat 10:00 - 16:00

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved