Device Vulnerability Management Market

By Component (Service and Solution), By Deployment (On-Premise and Cloud), By Industry (Retail, Banking, IT & telecom, Financial Services, Government, Health care, Energy & utilities, Defense and Others), By Region (North America, Europe, APAC and Rest of the World)

- Report ID : MD1083 |

- Pages : 198 |

- Tables : 97 |

- Formats :

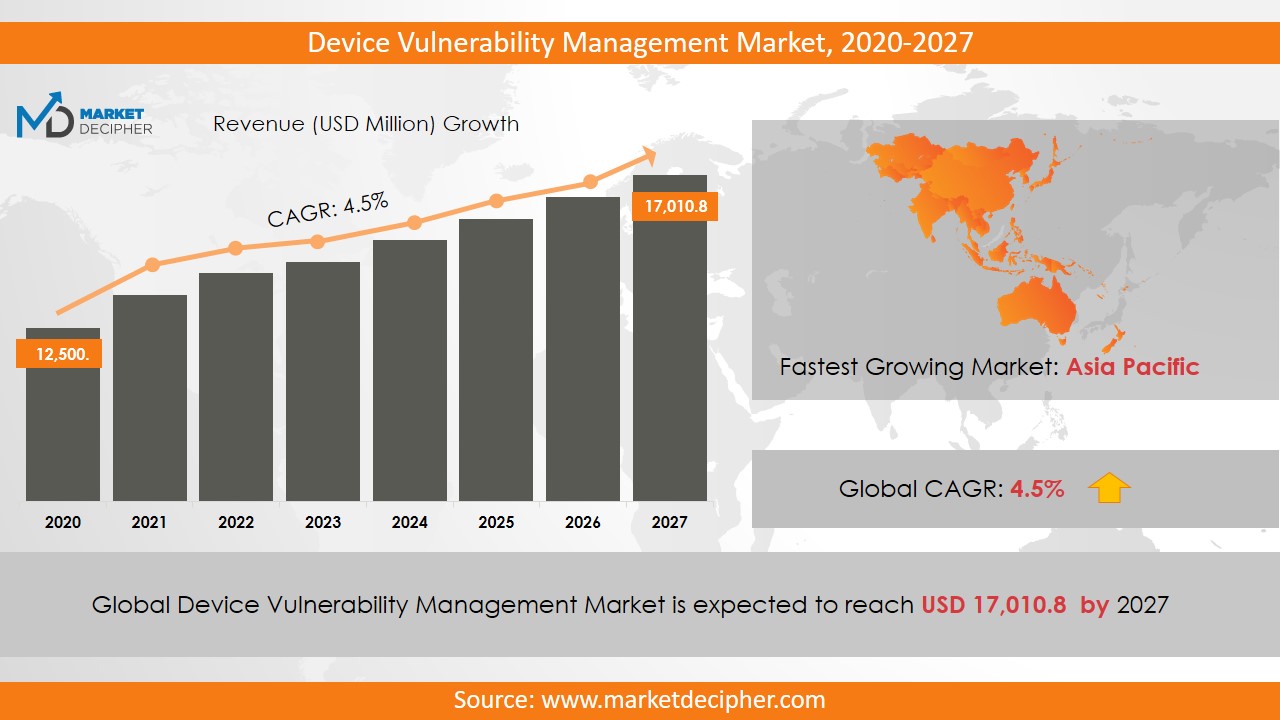

Data vulnerability management simply means protecting sensitive data by eliminating threats on it. This market is expected to show a great increment in its revenue owing to rising cyber-attacks and increasing the use of the internet. Further, the major influential device vulnerability management market trends are increasing demand for high-speed data, the emergence of BYOD technology and increased use of cloud computing. The increasing availability of service providers and the affordable price of vulnerability management is driving the device vulnerability management market shares. Nowadays, many advanced technologies have been adopted by the BFSI and IT sectors. However, the extensive use of these technologies has increased the chances for data loss and theft and there is a high need for data vulnerability management which further supports the industry growth.

Data vulnerability management market revenue shall reach a value of $15.25 Million in 2031, growing with a CAGR of 21.9% during the forecast period of 2022 to 2031.

Lack of awareness about the benefits of vulnerability management is expected to negatively influence the device vulnerability management market growth. Apart from this, the high cost of establishing data vulnerability management solutions is estimated to hinder the market growth. However, due to the increasing use of Internet services and the high adoption of electronic devices such as smartphones, laptops, and tablets, network data in different organizations have become weak against cyber-attacks. Therefore, the growing trend of using electronic equipment is playing a vital role in increasing the device vulnerability management market size.

REGIONAL ANALYSIS

The Asia Pacific and Central and South America regions are estimated to account for substantial growth of the market over the forecast period owing. The adoption of new technologies and the emergence of several small and medium enterprises in this region is responsible for significant market growth. Further, developing economies such as China and India are expected to show a significant rate over the forecast period. Owing to the significant investment in data center infrastructure the Middle and East Africa region is anticipated to witness tremendous growth over the forecast period.

SEGMENT ANALYSIS

Based on the component, the device vulnerability management market report classifies this service as service and solution. In terms of deployment, the market has been segmented as on-premise and cloud. Out of which, the cloud segment has established its dominance over the revenue. Cloud computing is being deployed extensively in the industries. But the excessive deployment of cloud computing is making the data highly sensitive for cyber attacks and thereby increasing the demand for highly advanced security services to protect valuable data from security breaches.

Major end-use industries are retail, banking, IT & telecom, financial services, government, health care, energy & utilities, defense, and Others. The high demand for data security and management in the defense sector, the market is estimated to witness commendable growth in its revenue during the forecast period. Also, the stringency in various rules and regulations imposed by law officials and government sector for increasing the adoption of data vulnerability management solutions owing to the increasing number of cyber attacks.

INDUSTRY PLAYER ANALYSIS

Major industry players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These industry players include Packard Company, McAfee LLC, Micro Focus International Plc (NetIQ), IBM Corporation, Qualys Incorporated, GFI Software, Symantec Corporation, EMC Corporation, Tripwire Incorporated, Rapid7Incorporated. Various industry players are adopting advanced strategies to increase the device vulnerability management business size.

COVERAGE HIGHLIGHTS

• Revenue Estimation and Forecast (2022 – 2031)

• Sales Estimation and Forecast (2022 – 2031)

• Breakdown of Revenue by Segments (2022 – 2031)

• Breakdown of Sales by Segments (2022 – 2031)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Regional Analysis and Data Breakdown

SEGMENTAL ANALYSIS:

By Component Outlook ($Revenue, 2022-2031)

· Service

· Solution

By Deployment Outlook ($Revenue, 2022-2031)

· On-premise

· Cloud

By Industry Outlook ($Revenue, 2022-2031)

· Retail

· Banking

· IT & telecom

· Financial services

· Government

· Health care

· Energy & utilities

· Defense

· Others

By Regional Outlook ($Revenue and Unit Sales, 2022-2031)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• U.K

• France

• Netherlands

• Austria

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• South Korea

• Australia

• Rest of Asia Pacific

• The Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East

• Africa

• South America

• Brazil

• Argentina

• Rest of South America

INDUSTRY PLAYERS ANALYSIS:

· Packard Company

· McAfee LLC

· Micro Focus International Plc (NetIQ)

· IBM Corporation

· Qualys Incorporated

· GFI Software

· Symantec Corporation

· EMC Corporation

· Tripwire Incorporated

· Rapid7Incorporated

Need Report on a particular Country OR need a Tailored/Customized Research? Budget Limits/Price Discounts Query...!

Email to David Correa

OR Fill the below "Sample Request FORM" with your queries in the message box.

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. DEVICE VULNERABILITY MANAGEMENT MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL DEVICE VULNERABILITY MANAGEMENT MARKET DEMAND SIDE ANALYSIS

2.1. DEVICE VULNERABILITY MANAGEMENT MARKET CONSUMPTION VOLUME (BILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (BILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.6. DEVICE VULNERABILITY MANAGEMENT MARKET REVENUE SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL DEVICE VULNERABILITY MANAGEMENT MARKET SUPPLY SIDE ANALYSIS

3.1. DEVICE VULNERABILITY MANAGEMENT MARKET PRODUCTION VOLUME (BILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL DEVICE VULNERABILITY MANAGEMENT MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL DEVICE VULNERABILITY MANAGEMENT MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL DEVICE VULNERABILITY MANAGEMENT MARKET BY COMPONENT

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY COMPONENT, $BILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY COMPONENT, BILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY COMPONENT, BILLION UNITS, 2018 – 2025

6.4. SERVICE

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. SOLUTION

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL DEVICE VULNERABILITY MANAGEMENT MARKET BY DEPLOYMENT

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY DEPLOYMENT, $BILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY DEPLOYMENT, BILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY DEPLOYMENT, BILLION UNITS, 2018 – 2025

7.4. ON PREMISE

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. CLOUD

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL DEVICE VULNERABILITY MANAGEMENT MARKET BY INDUSTRY

8.1. SEGMENT OUTLINE

8.2. REVENUE SHARE BY INDUSTRY, $BILLION, 2018 – 2025

8.2. CONSUMPTION SHARE BY INDUSTRY, BILLION UNITS, 2018 - 2025

8.3. PRODUCTION SHARE BY INDUSTRY, BILLION UNITS, 2018 – 2025

8.4. RETAIL

8.4.1. Market determinants and trend analysis

8.4.2. Market revenue, sales and production volume, 2018 – 2025

8.5. BANKING

8.5.1. Market determinants and trend analysis

8.5.2. Market revenue, sales and production volume, 2018 – 2025

8.6. IT & TELECOM

8.6.1. Market determinants and trend analysis

8.6.2. Market revenue, sales and production volume, 2018 – 2025

8.7. FINANCIAL SERVICES

8.7.1. Market determinants and trend analysis

8.7.2. Market revenue, sales and production volume, 2018 – 2025

8.8. GOVERNMENT

8.8.1. Market determinants and trend analysis

8.8.2. Market revenue, sales and production volume, 2018 – 2025

8.9. HEALTH CARE

8.9.1. Market determinants and trend analysis

8.9.2. Market revenue, sales and production volume, 2018 – 2025

8.10. ENERGY & UTILITIES

8.10.1. Market determinants and trend analysis

8.10.2. Market revenue, sales and production volume, 2018 – 2025

8.11. DEFENSE

8.11.1. Market determinants and trend analysis

8.11.2. Market revenue, sales and production volume, 2018 – 2025

8.12. OTHERS

8.12.1. Market determinants and trend analysis

8.12.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 9. GLOBAL DEVICE VULNERABILITY MANAGEMENT MARKET BY REGIONS

9.1. REGIONAL OUTLOOK

9.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

9.3. NORTH AMERICA

9.3.1. Current Trends and Future Prospects

9.3.2. North America market revenue, sales and production volume, 2018 – 2025

9.3.3. The U.S.

9.3.3.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.3.3.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.3.3.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.3.4. Canada

9.3.4.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.3.4.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.3.4.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.3.5. Mexico

9.3.5.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.3.5.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.3.5.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.4. EUROPE

9.4.1. Current Trends and Future Prospects

9.4.2. Europe market revenue, sales and production volume, 2018 – 2025

9.4.3. U.K

9.4.3.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.4.3.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.4.3.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.4.4. Germany

9.4.4.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.4.4.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.4.4.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.4.5. France

9.4.5.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.4.5.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.4.5.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.4.6. Italy

9.4.6.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.4.6.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.4.6.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.4.7. Rest of Europe

9.4.7.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.4.7.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.4.7.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.5. ASIA PACIFIC

9.5.1. Current Trends and Future Prospects

9.5.2. Europe market revenue, sales and production volume, 2018 – 2025

9.5.3. India

9.5.3.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.5.3.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.5.3.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.5.4. Japan

9.5.4.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.5.4.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.5.4.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.5.5. China

9.5.5.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.5.5.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.5.5.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.5.6. South Korea

9.5.6.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.5.6.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.5.6.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.5.7. Rest of APAC

9.5.7.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.5.7.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.5.7.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.6. REST OF THE WORLD

9.6.1. Current Trends and Future Prospects

9.6.2. Europe market revenue, sales and production volume, 2018 – 2025

9.6.3. Latin America

9.6.3.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.6.3.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.6.3.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.6.4. Middle East

9.6.4.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.6.4.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.6.4.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

9.6.5. Africa

9.6.5.1. Device Vulnerability Management Market Revenue $BILLION (2018 – 2025)

9.6.5.2. Device Vulnerability Management Market Consumption BILLION Units (2018 – 2025)

9.6.5.3. Device Vulnerability Management Market Production BILLION Units (2018 – 2025)

CHAPTER 10. KEY VENDOR PROFILES

10.1. Packard Company

10.1.1. Company overview

10.1.2. Portfolio Analysis

10.1.3. Estimated revenue from device vulnerability management business and market share

10.1.4. Regional & business segment Revenue Analysis

10.2. McAfee LLC

10.2.1. Company overview

10.2.2. Portfolio Analysis

10.2.3. Estimated revenue from device vulnerability management business and market share

10.2.4. Regional & business segment Revenue Analysis

10.3. Micro Focus International Plc (NetIQ)

10.3.1. Company overview

10.3.2. Portfolio Analysis

10.3.3. Estimated revenue from device vulnerability management business and market share

10.3.4. Regional & business segment Revenue Analysis

10.4. IBM Corporation

10.4.1. Company overview

10.4.2. Portfolio Analysis

10.4.3. Estimated revenue from device vulnerability management business and market share

10.4.4. Regional & business segment Revenue Analysis

10.5. Qualys Incorporated

10.5.1. Company overview

10.5.2. Portfolio Analysis

10.5.3. Estimated revenue from device vulnerability management business and market share

10.5.4. Regional & business segment Revenue Analysis

10.6. GFI Software

10.6.1. Company overview

10.6.2. Portfolio Analysis

10.6.3. Estimated revenue from device vulnerability management business and market share

10.6.4. Regional & business segment Revenue Analysis

10.7. Symantec Corporation

10.7.1. Company overview

10.7.2. Portfolio Analysis

10.7.3. Estimated revenue from device vulnerability management business and market share

10.7.4. Regional & business segment Revenue Analysis

10.8. EMC Corporation

10.8.1. Company overview

10.8.2. Portfolio Analysis

10.8.3. Estimated revenue from device vulnerability management business and market share

10.8.4. Regional & business segment Revenue Analysis

10.9. Tripwire Incorporated

10.9.1. Company overview

10.9.2. Portfolio Analysis

10.9.3. Estimated revenue from device vulnerability management business and market share

10.9.4. Regional & business segment Revenue Analysis

10.10. Rapid7Incorporated

10.10.1. Company overview

10.10.2. Portfolio Analysis

10.10.3. Estimated revenue from device vulnerability management business and market share

10.10.4. Regional & business segment Revenue Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved