- Report ID : MD2899 |

- Pages : 220 |

- Tables : 79 |

- Formats :

Email sales@marketdecipher.com

Contact +91 6201075429

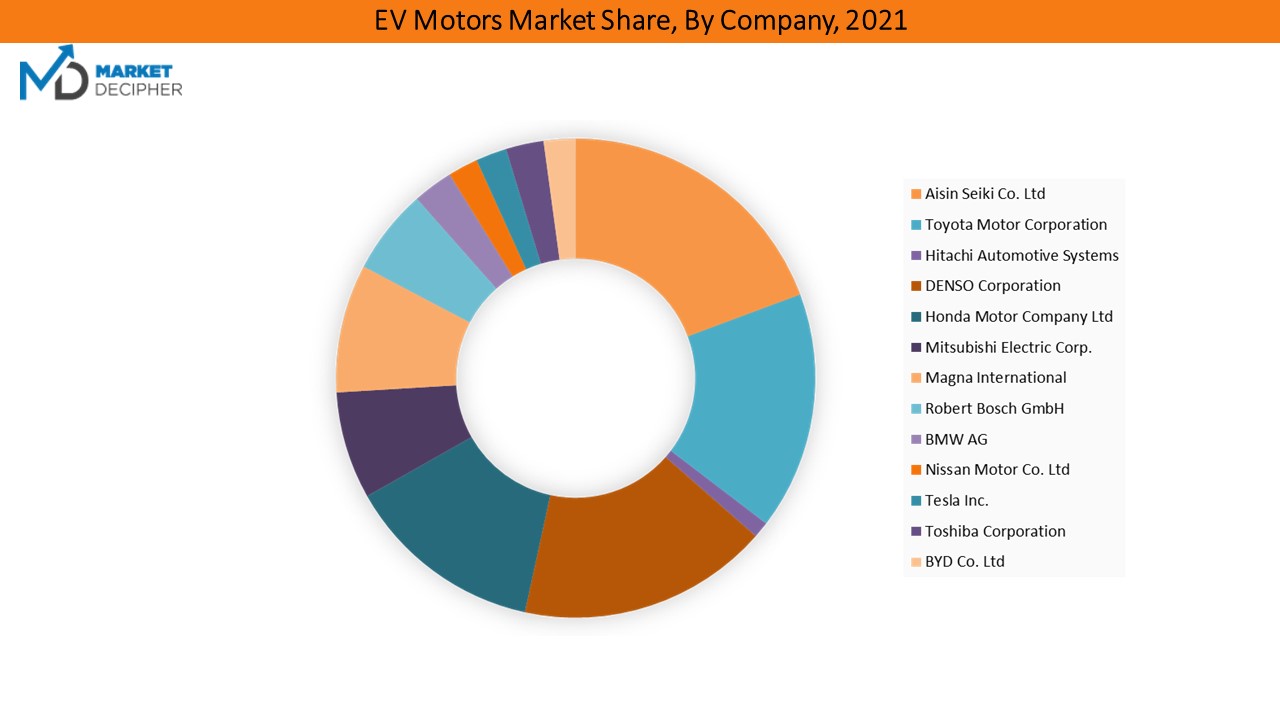

EV Motors Market is segmented by Motor Type (AC Motor and DC Motor), by Vehicle Type (Hybrid Electric Vehicle (HEV), Plug-in Hybrid Electric Vehicle (PHEV), and Battery/Pure Electric Vehicle (PEV)), by Powertrain type (Single Motor, Dual Motor, Triple Motor, and Four Motor), by Application (Passenger Cars and Commercial Vehicles), by Region (United States, Canada, Mexico, France, Germany, Italy, Spain, United Kingdom, Russia, China, India, Philippines, Malaysia, Australia, Austria, South Korea, Middle East, Japan, Africa, Rest of World) and EV Motors Market companies (Aisin Seiki Co. Ltd, Toyota Motor Corporation, Hitachi, Automotive Systems, DENSO Corporation, Honda Motor Company Ltd, Mitsubishi Electric Corp., Magna International, Robert Bosch GmbH, BMW AG, Nissan Motor Co. Ltd, Tesla Inc., Toshiba Corporation, and BYD Co. Ltd)

Electric vehicle motors convert electric energy into mechanical energy to drive electric vehicles. The electric vehicle motor markets growth is attributed to an increase in sales of electric vehicles, which feature zero emissions, low maintenance costs, high efficiency, and automatic control. Depending on their size and purpose, two-wheelers and passenger vehicles use two or more electric motors, while commercial vehicles use two or more electric motors.

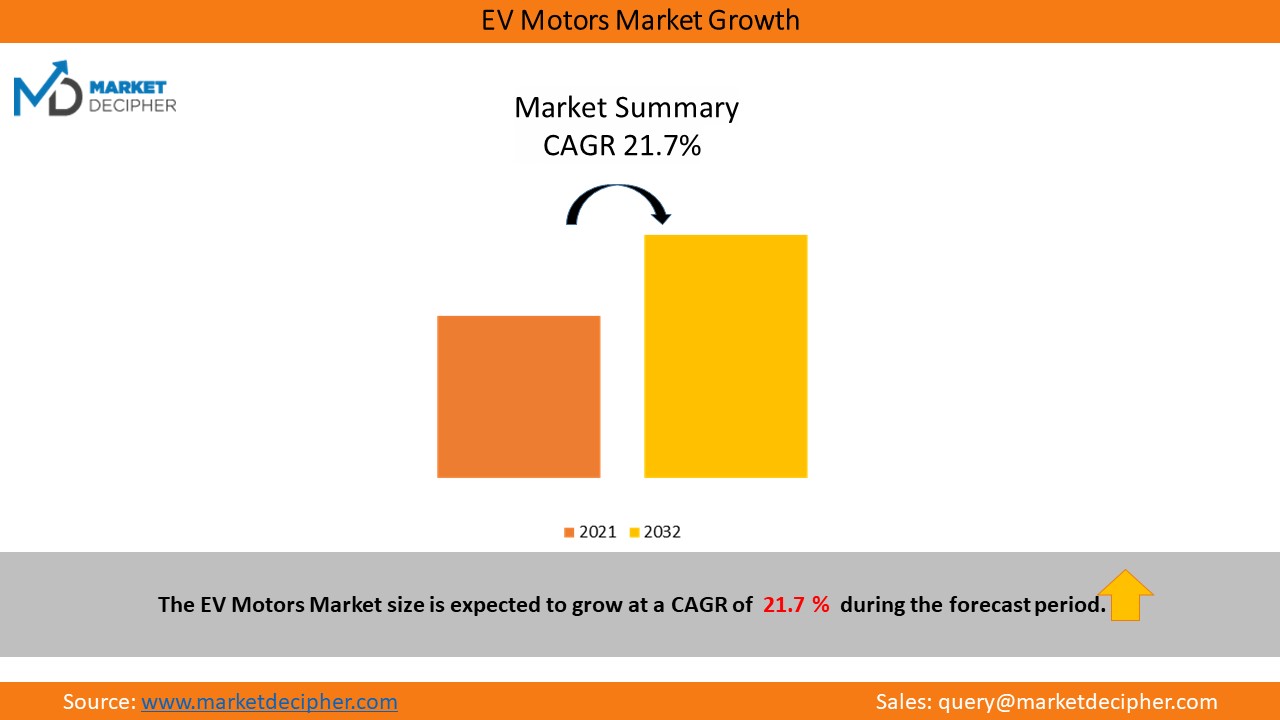

The Electric Vehicle Traction Motor Market was estimated at USD 9.2 billion in 2022 and is forecast to grow at a CAGR of 21.7 % during the forecast period.

The International Organization of Motor Vehicle Manufacturers (OICA) estimated that road transport is responsible for 16% of man-made carbon dioxide emissions worldwide. In the EU, 72% of these emissions are attributed to road transport, and in the U.S., 29%. Automobile manufacturers and consumers are looking for cleaner alternatives. Consequently, the global market for electric vehicles has grown rapidly. In 2020, the electric car market grew by 40% despite supply shocks associated with the COVID-19 pandemic. In that year, a record three million electric cars were sold. Meanwhile, the conventional automotive industry contracted 16% in the same fiscal year.

Vehicle sales of electric vehicles will continue to grow during the forecast period

The automotive industry has integrated electric vehicles into its product line. This represents a potential path toward achieving energy efficiency as well as reducing emissions of pollutants and other greenhouse gases. Environmental concerns, along with government initiatives, are the major factors driving this growth. Electric passenger cars are expected to pass the 5-million-unit mark by the end of 2025, and they will account for 15% of vehicle sales by the end of that year.

The overall sales of electric vehicles have been increasing at a fast pace in recent years. As a result of government and organization regulations aimed at controlling emission levels and promoting zero-emission vehicles, sales of these vehicles have skyrocketed over the last few years.

Automakers have benefited from these norms by increasing their R&D expenditures, which allowed them to eventually market electric vehicles. There was a considerable shift in purchasing patterns from conventional IC engines to electric vehicles as a result of this strategy. This change has not decreased sales of IC engines, but rather created a promising market for electric vehicles both in the present and in the future. In the forecast period, electric motor demand is expected to increase due to the growth of electric vehicles.

Electric motors for electric vehicles continue to be dominated by Asia-Pacific

Traction Electric motor sales in the electric vehicle market have been booming in Asia-Pacific owing to high EV sales, primarily in China. Chinese electric vehicles are among the worlds most popular. Domestic demand is bolstered by national sales targets, favourable laws, and municipal air-quality targets. China, for example, has imposed a quota on electric or hybrid vehicle manufacturers, which must represent at least 10% of new sales. Additionally, Beijing issues only 10,000 permits per month for combustion engine vehicle registrations to promote the use of electric vehicles.

Due to the steady growth of the electric vehicle market, it is likely that demand for electric motors for electric vehicles will rise over the forecast as most OEMs are cooperating with electric vehicle manufacturers, making joint ventures, etc. In March 2020, Wolong Electric Group Co., Ltd (Wolong Electric) signed a joint venture agreement with ZF (China) Investment Co., Ltd. (ZF China). Wolong Electric Group Co., Ltd. (Wolong Electric) signed a joint venture agreement with ZF (China) Investment Co. Ltd (ZF China). Located in Shaoxing, Zhejiang Province, the company may be engaged primarily in designing, producing and selling automotive traction motors used in electric vehicles (EVs), plug-in hybrid vehicles (PHVs) and mild hybrid vehicles (HVs).

EV motors market growth is attributed to the tremendous adoption of the electric vehicles in developing as well as developed nations.

Several factors contribute to the growth of the EV market in Asia Pacific region: from increased product availability to massive subsidies under FAME II and, of course, to the rising price of fuel. The phenomenon is not limited to Asia Pacific. US EV sales rose sharply in the first quarter of 2022, led by Tesla and Volvo. Fuel prices soared in the US as well, resulting in a decrease in overall passenger car sales. In March 2022, total vehicle sales in India decreased by 3% over March 2021 and by 30% compared to March 2020.

| Report Attribute | Details |

| Historical Years | 2018-2021 |

| Forecast Years | 2022-2032 |

| Base Year (2021) Market Size | $7,635.1 Million |

| Forecast Period CAGR | 21.7% |

| Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19;Companies’ Strategic Developments; List of Mega Projects; Major Contracts Won by Key Players; End User Capacity & Workforce Analysis; Company Profiling |

| Market Size by Segments | By Motor Type, By Vehicle Type, By Powertrain Type, By Application |

Competitive Landscape

There are many regional and international players in the global electric motors for electric vehicles market. The market, however, is dominated by several major automobile companies, such as Honda Motor Co., Ltd., Tesla Motors, Inc., Toyota Motor Corporation, Ford Motor Company, Ametek Incorporation, Nissan Motor Corp ABB Group Ltd., Siemens AG, Baldor Electric Company Inc., Baldor Electric Incorporation, Allied Motion Technologies Inc., Asmo Corporation Limited, ARC Systems Incorporation, Brook Crompton UK Limited, Rockwell Automation Incorporation, Franklin Electric Cooperative Incorporation, Johnson Electric, oration Ltd., and BMW AG.

Toyota has a huge presence on the Japan ev traction motor market and a motor production plant in-house, which accounted for most of the market study in 2019.In its first year of production, Toyota sold 13 million hybrid cars, making it the worlds first mass-produced hybrid car. The majority of the traction motors are produced internally by automakers such as Toyota, Nissan, Honda, and Subaru. China is manufacturer as well as huge domestic user of electric vehicle motors.

Years considered for this report

• Historical Years: 2018-2021

• Base Year: 2021

• Forecast Period: 2022-2032

EV Motors Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue and unit sales (2022 – 2032)

• Data breakdown for application Industries (2022 – 2032)

• Integration and collaboration analysis of companies

• Capacity analysis with application sector breakdown

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategies adopted by emerging companies

Industry Segmentation and Revenue Breakdown of EV Traction Motor Industry

Motor Type Analysis (Revenue, USD Million, 2022 - 2032)

• AC Motor

• DC Motor

Vehicle Type Analysis (Revenue, USD Million, 2022 - 2032)

• Hybrid Electric Vehicle (HEV)

• Plug-in Hybrid Electric Vehicle (PHEV)

• Battery/Pure Electric Vehicle (PEV)

Powertrain Type Analysis (Revenue, USD Million, 2022 - 2032)

• Single Motor

• Dual Motor

• Triple Motor

• Four Motor

Application Analysis (Revenue, USD Million, 2022 - 2032)

• Passenger Cars

• Commercial Vehicles

Country Analysis (Revenue, USD Million, 2022 – 2032)

• North America

• United States

• Canada

• Mexico

• Europe

• France

• Germany

• Italy

• Spain

• United Kingdom

• Rest of the Europe

• APAC

• China

• India

• Philippines

• Malaysia

• Australia

• Austria

• South Korea

• Rest of the APAC

• Rest of the World

• Middle East

• Japan

• Africa

• Rest of the World

EV Motors Market companies:

• Aisin Seiki Co. Ltd

• Toyota Motor Corporation

• Hitachi Automotive Systems

• DENSO Corporation

• Honda Motor Company Ltd

• Mitsubishi Electric Corp.

• Magna International

• Robert Bosch GmbH

• BMW AG

• Nissan Motor Co. Ltd

• Tesla Inc.

• Toshiba Corporation

• BYD Co. Ltd

Available Versions of EV Motors Market Report: -

United States EV Motors Market Research Report

Europe EV Motors Market Research Report

Asia Pacific EV Motors Market Research Report

India EV Motors Market Research Report

• Customization can be done in the existing research scope to cater to your specific

requirements without any extra charges* (terms and conditions apply)

• Send us a query to get the Table of Contents and Research Scope along with the research scope and proposal.

Fill the sample request form OR reach out directly to David Correa at his email:- david@marketdecipher.com

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Please fill in the form below to Request for free Sample Report

Office Hours Mon - Sat 10:00 - 16:00

Call Us +91 6201075429

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved