- Report ID : MD2891 |

- Pages : 220 |

- Tables : 80 |

- Formats :

Email sales@marketdecipher.com

Contact +91 6201075429

GCC Facility Management Market is segmented by Service (Property (Heating, ventilation, and air conditioning (HVAC) maintenance, Mechanical and electrical maintenance), Cleaning, Security, Catering, Support, Environmental Management), by End-User (Commercial, Industrial, Residential), by Mode of facility (In-house, Outsourced, Integrated, Bundled, Single), by Country (Saudi Arabia, Kuwait, UAE, Qatar, Oman, and Bahrain) and GCC Facility Management Market companies (EMCOR Group Inc., Khidmah LLC, Interserve plc, Musanadah Facilities Management Co. Ltd., Engie Cofely, Kharafi National for Infrastructure Projects Developments Construction and Services S.A.E., United Facilities Management, Emrill Services LLC, Imdaad LLC, and Farnek Services LLC)

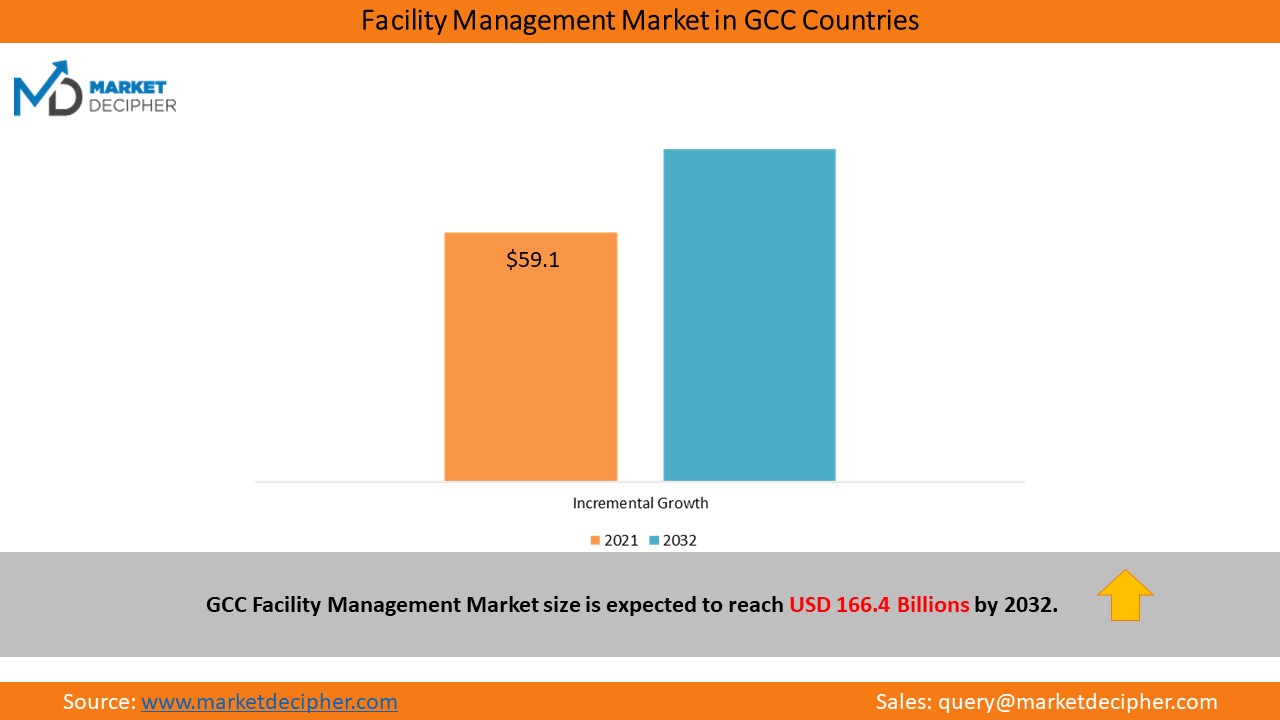

By 2032, the GCC Facility Management Market is expected to reach USD 166,130.4 million, growing at a compound annual growth rate of 10.1%.

With an increase in urbanization and industrialization, the facility management industry, defined as the ability to provide maintenance support, user management, and project management, has grown significantly over the past two decades. In recent years, the demand for facility management solutions and services has increased, which is expected to continue over the forecast period. The governments increased investment in industries like transportation, energy, construction, and others is leading to an increase in the GCC facility management market revenue. Facility management companies’ contract with building managers to provide their services. These services include staffing, equipment, and other items.

Growth in the Infrastructure Sector to Boost the Facility Management Market Growth

Infrastructure investment is a priority for several GCC countries such as Kuwait, Dubai, Saudi Arabia, and Oman. Their investments in railways, ports, airports, and other sectors have increased dramatically. There has been numerous collaborations with private contractors, including service providers, that help in keeping the infrastructure clean and green. In addition, governments in these countries are signing contracts with several international players to complete and link their infrastructure both internally and across borders.

The government of Saudi Arabia raised USD 36 billion (*135 billion Riyals) for transportation infrastructure development over the next 11 years. In this initiative, railways, airports, ports, and roads are primarily targeted. The government and several private companies are financing the project. Saudi Arabia is planning to invest USD 425 billion (*1.6 trillion Riyals) in its infrastructure and industrial programs over the next ten years. Saudi Crown Prince Mohammed bin Salmans Vision 2030 program will be supported by this private sector investment. Thus, the growth of the infrastructure sector is expected to drive the market. In addition, service providers throughout the world have plenty of options for getting contracts from the private sector.

A rise in foreign direct investment in the energy management, real estate, and construction industries makes hard services the largest type category.

Among all facility management services in the GCC, hard services accounted for the largest value share in 2021. Hard services include building fabric maintenance, decoration & refurbishment, m&e plant maintenance, plumbing & drainage, and lift & escalator maintenance. By 2032, there will be rapid consolidation of the facility management market, with a proliferation of international facilities management companies in the country. This will boost the demand of soft services such as security, cleaning, waste disposal, recycling, pest control, and grounds maintenance across GCC Countries. As a result, different sectors are adopting advanced hard services that require minimal staff to organize the work atmosphere. Furthermore, the entry of multinational corporations into GCC countries is fuelling the demand for hard facility management services. In addition, foreign direct investments in energy management and real estate sectors drove the market for hard services in member countries.

| Report Attribute | Details |

| Historical Years | 2018-2021 |

| Forecast Years | 2022-2032 |

| Base Year (2021) Market Size | $65,102.8 Million |

| Market Size Forecast in 2032 | $166,130.4 Million |

| Forecast Period CAGR | 10.1% |

| Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19;Companies’ Strategic Developments; List of Mega Projects; Major Contracts Won by Key Players; End User Capacity & Workforce Analysis; Company Profiling |

| Market Size by Segments | By Service Type, By End User, By Mode |

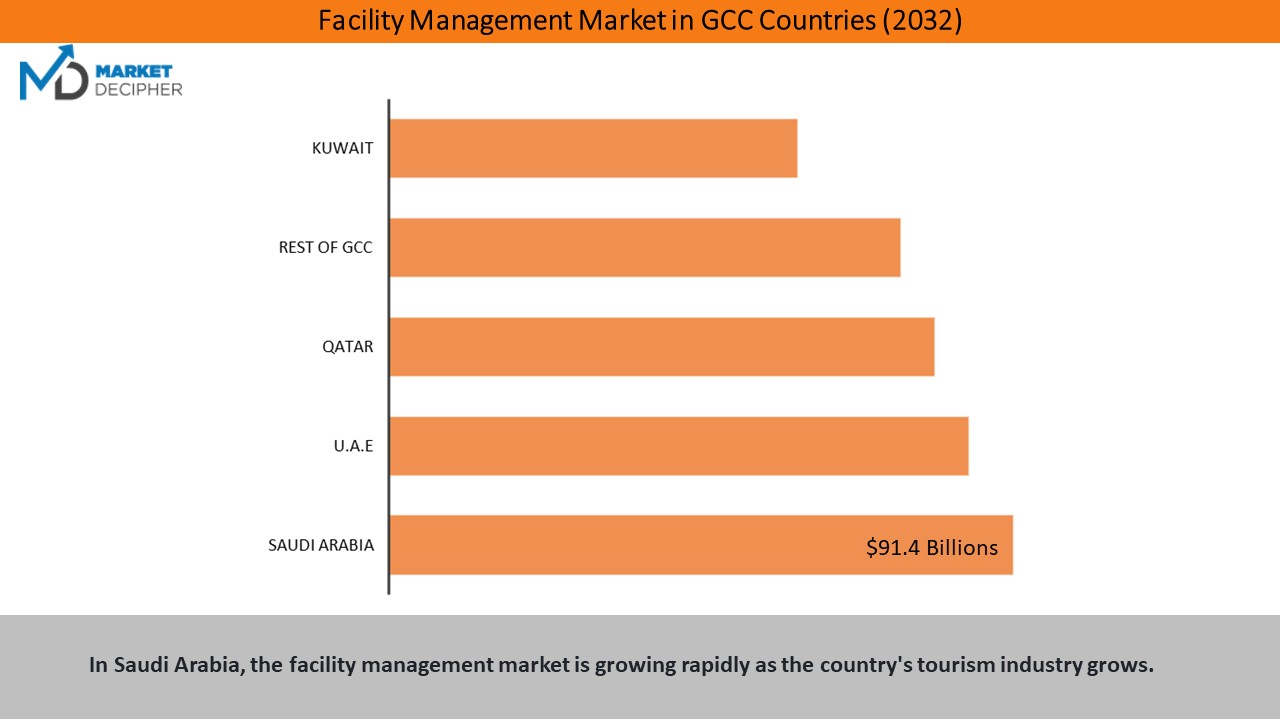

"As a consequence of the growing infrastructure and tourism sectors in the GCC, Saudi Arabia held the largest share of facility management during the historical period. Furthermore, as the government is heavily investing in the development of other sectors, such as infrastructure and construction, an increase in revenue from oil and gas is fuelling the Saudi Arabia Facility Management industrys growth."

Several factors will make Qatar Facility Management market the most expeditious in the region, including the FIFA World Cup 2022 and Qatar Vision 2030.

In Qatar, the steady development of residential and commercial properties is a major factor driving market growth. It is expected that the facility management market will grow exponentially in the coming years as more and more towers, malls, stadiums, and other structures are constructed. Facility managers are being encouraged, educated, and empowered about sustainable practices through a new initiative launched in the country. A Facility Management Interest Group has been formed by the Qatar Green Building Council (QGBC) and the Middle East Facility Management Association (MEFMA) to share best practices in facility management. Additionally, the facility management services market in Qatar is expected to grow due to the FIFA World Cup 20 and Qatar Vision 2030.

Contribution of facilities management to achieving objectives of Vision 2030 in GCC countries

• GCC Facility Management companies will enhance the competitiveness of commercial and industrial enterprises by enabling them to focus on their core operations.

• The expansion of small and medium scale facility management companies would promote the SME sector in the country.

• Capital infusion by GCC facility management companies would further boost the services sector, thus increasing employment opportunities.

Lack of stable contracts, limited use of technology, and insufficient resources to impede the Facility Management Market growth in Dubai, Kuwait, and Saudi Arabia.

Companies with large investment amounts do not usually have to deal with such challenges since they usually sign long-term contracts. In addition, large enterprises integrate innovative technologies to provide hard and soft services, which enable them to offer better and enhanced products and services. Due to the lack of financial resources and funding in these countries, small and medium-sized businesses face similar challenges frequently. The fast-growing infrastructure sector also requires more workers, which affects domestic facility management across Dubai and Saudi Arabia. This is what influences the growth of this market. Nonetheless, controlling costs and the workforce will be crucial to resolving these issues.

Service contracts have been awarded by GCC Facility Management Market companies in recent years to stay ahead of their competitors.

There are a number of companies operating in the GCC facility management market, including EMCOR Group Inc., Kharafi National for Infrastructure Projects Developments Construction and Services S.A.E., Khidmah LLC, Interserve plc, Musanadah Facilities Management Co. Ltd., Engie Cofely, United Facilities Management, Emrill Services LLC, Imdaad LLC, and Farnek Services LLC.

• Earlier this year, Farnek Services LLC announced the signing of a contract with Galadari Brothers Co LLC. The contract calls for Farnek Services LLC to provide security services at Galadaris facilities in Dubai, Abu Dhabi, Al Ain, Sharjah, and Ras Al Khaimah.

• Galadari operates in the automotive, printing & publishing, construction equipment, rubber product, and real estate sectors through facilities located in these cities. Two facility management contracts were acquired by Engie Cofely, a division of Engie S.A., in February 2020. The company signed a contract to provide computer-aided facility management services to King Salman Energy Park (SPARK) and International Maritime Industries (IMI) in Saudi Arabia. The agreements were signed at the Aramco IKTVA Forum and Exhibition 2020.

• Emirates Foundation will partner with Dawamee in November 2020 in order to provide work opportunities for Emiratis. Under the program, EFS has hired its first batch of 15 UAE nationals with diverse qualifications, promising to work closely with Dawamee to train UAE talent for the local facilities management sector.

Years considered for this report

• Historical Years: Available on Request

• Base Year: 2021

• Forecast Period: 2022-2032

GCC Facility Management Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue (2022 – 2032)

• Data breakdown for every market segment (2022 – 2032)

• Gross margin and profitability analysis of companies

• Price analysis of each product type

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategy

Industry Segmentation and Revenue Breakdown

Service Type Analysis (Revenue, USD Million, 2022 - 2032)

• Property

• Heating, ventilation, and air conditioning (HVAC) maintenance

• Mechanical and electrical maintenance

• Cleaning

• Security

• Catering

• Support

• Environmental Management

End-User Analysis (Revenue, USD Million, 2022 - 2032)

• Commercial

• Industrial

• Residential

Mode Analysis (Revenue, USD Million, 2022 - 2032)

• In-house

• Outsourced

• Integrated

• Bundled

• Single

By Country (Revenue, USD Million, 2022 - 2032):

• Saudi Arabia

• Kuwait

• UAE

• Qatar

• Oman

• Bahrain

GCC Facility Management Market companies:

• EMCOR Group Inc.

• Khidmah LLC

• Interserve plc

• Musanadah Facilities Management Co. Ltd.

• Engie Cofely

• Kharafi National for Infrastructure Projects, Developments Construction and Services S.A.E.

• United Facilities Management

• Emrill Services LLC

• Imdaad LLC

• Farnek Services LLC

Available Versions of The Gulf Cooperation Council (GCC) Facility Management Market: -

Kuwait Facility Management Market Research Report

Qatar Facility Management Market Research Report

Kingdom of Saudi Arabia (KSA) Facility Management Market Research Report

United Arab Emirates (U.A.E) Facility Management Market Research Report

• Customization can be done in the existing research scope to cater to your specific

requirements without any extra charges* (terms and conditions apply)

• Send us a query to get the Table of Contents and Research Scope along with the research scope and proposal.

Fill the sample request form OR reach out directly to David Correa at his email: - david@marketdecipher.com

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Please fill in the form below to Request for free Sample Report

Office Hours Mon - Sat 10:00 - 16:00

Call Us +91 6201075429

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved