Global Loan Origination & Servicing Software Market Report 2019 – 2026, Sales Volume, Revenue, Growth Trend and Estimation Forecast

Global Loan Origination & Servicing Software by Type (On-Demand, and On-Premise), By Application (Mortgage Lenders & Brokers, Banks, Credit Unions, and Others), By Region (North America, Europe, APAC, MEA, and Latin America)

- Report ID : MD1279 |

- Pages : 210 |

- Tables : 85 |

- Formats :

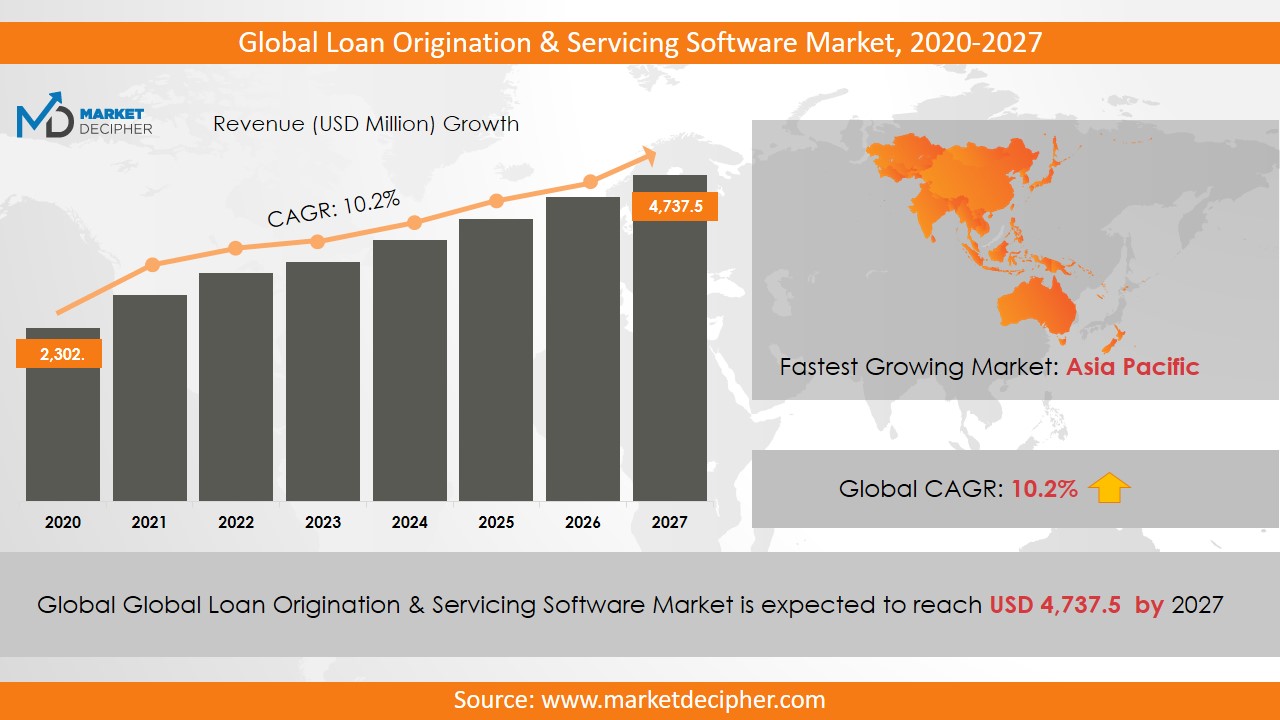

Global loan origination & servicing software market revenue shall reach a value of USD Million in 2026, growing with a CAGR of XX.X% during the forecast period of 2019 to 2026. In terms of volume sales, the market is anticipated to reach XX Units.

Global Loan origination & servicing software market is anticipated to have remarkable growth throughout the years 2018 to 2026 according to the latest research made by Market Decipher.

Loan origination & servicing software is developed especially to support the loan application, processing requirements of banks and financial institutions. It utilizes workflow technology to monitor and control the numerous work steps in loan processing and uses digital imaging technology to trim down the delays and inefficiencies in handling paper documents. This software automates the complete loan origination process from underwriting to financial approvals to operational steps, from pre-application to application, from systems check to deviations. Some of the drivers propelling the growth of the market are calculating interests, manages to bill and pay off statements and, it is highly integrative with the system. It also covers the mortgages. Moreover, it is simple in use and learns curve is simple and can manage bills, and the amortization schedule easily is the factors likely to spur the market growth. An increase in the demand for advanced digital lending solutions for retail banking, and an increase in the adoption of ai, machine learning, and Blockchain would generate profitable opportunities for the global Loan origination & servicing software market.

SEGMENT ANALYSIS

The global Loan origination & servicing software market is classified based on type, application, and geography. Based on type, the market is bifurcated into on-demand, and on-premise. The application segment comprises mortgage lenders & brokers, banks, credit unions, and others.

MARKET PLAYER ANALYSIS

The global loan origination & servicing software market is highly competitive with numerous global and local market players. Major companies operating in the global market include Ellie Mae, Inc., Calyx Technology, Inc., Fiserv, Inc., Byte Software, Altisource, Mortgage Cadence, Wipro Limited, Tavant Technologies, Lendingqb, Black Knight IP Holding Company, LLC, and JuristechSdnBhd, among others.

COVERAGE HIGHLIGHTS

• Market Revenue Estimation and Forecast (2018 – 2026)

• Market Production Units Estimation and Forecast (2018 – 2026)

• Market Sales/Consumption Volume Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production Volume by Segments (2018 – 2026)

• Breakdown of Sales Volume by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend, Price Trend, and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Type Outlook ($Revenue, 2018-2026)

• On-demand

• On-premise

By Application Outlook ($Revenue, 2018-2026)

• Mortgage Lenders & Brokers

• Banks

• Credit Unions

• Others.

By Regional Outlook ($Revenue and Unit Sales, 2018-2026)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• U.K

• France

• Netherlands

• Austria

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• South Korea

• Australia

• Rest of Asia Pacific

• The Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East

• Africa

• South America

• Brazil

• Argentina

• Rest of South America

MARKET PLAYER

• Ellie Mae, Inc.

• Calyx Technology, Inc.

• Fiserv, Inc.

• Byte Software

• Altisource

• Mortgage Cadence

• Wipro Limited

• Tavant Technologies

• Lending

• Black Knight IP Holding Company, LLC

• JuristechSdnBhd

CHAPTER 1: INTRODUCTION

1.1. Research Methodology

1.1.1. Desk Research

1.1.2. Data Synthesis

1.1.3. Data Validation & Market Feedback

1.1.4. Data Sources

CHAPTER 2: EXECUTIVE SUMMARY

2.1. Global Market Outlook

2.2. Core Insights - Type

2.3. Core Insights – Application

2.4. Core Insights – Geography

CHAPTER 3: MARKET OVERVIEW

3.1. Market Definition and Scope

3.2. Key Forces Shaping the Industry

3.2.1. Bargaining Power of Suppliers

3.2.2. Bargaining Power of Buyers

3.2.3. Threat of Substitutes

3.2.4. Threat of New Entrants

3.3. Market Dynamics

3.3.1. Drivers

3.3.1.1. Supply-side Drivers

3.3.1.2. Demand-side Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.4. Industry Landscape - PESTEL Analysis

3.4.1. Political Landscape

3.4.2. Environmental Landscape

3.4.3. Social Landscape

3.4.4. Technology Landscape

3.4.5. Economic Landscape

CHAPTER 4: MARKET BACKGROUND

4.1. Industry Value Chain Analysis

4.1.1. Upstream Participants

4.1.2. Downstream participants

4.2. Pricing Analysis and Forecast, 2018-2026

4.2.1. By Type

4.2.2. By Region

CHAPTER 5: GLOBAL LOAN ORIGINATION & SERVICING SOFTWARE MARKET, BY TYPE

5.1. Overview

5.1.1. Market Volume and Forecast, 2018-2026

5.1.2. Market Revenue (US$ Million) and Forecast, 2018-2026

5.2. On-demand

5.2.1. Key Market Trends, Growth Factors and Opportunities

5.2.2. Market Volume and Forecast, By Region

5.2.3. Market Revenue (US$ Million) and Forecast, By Region

5.3. On-premise

5.3.1. Key Market Trends, Growth Factors and Opportunities

5.3.2. Market Volume and Forecast, By Region

5.3.3. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 6: GLOBAL LOAN ORIGINATION & SERVICING SOFTWARE MARKET, BY APLICATION

6.1. Overview

6.1.1. Market Volume and Forecast, 2018-2026

6.1.2. Market Revenue (US$ Million) and Forecast, 2018-2026

6.2. Mortgage Lenders & Brokers

6.2.1. Key Market Trends, Growth Factors and Opportunities

6.2.2. Market Volume and Forecast, By Region

6.2.3. Market Revenue (US$ Million) and Forecast, By Region

6.3. Banks

6.3.1. Key Market Trends, Growth Factors and Opportunities

6.3.2. Market Volume and Forecast, By Region

6.3.3. Market Revenue (US$ Million) and Forecast, By Region

6.4. Credit Unions

6.4.1. Key Market Trends, Growth Factors and Opportunities

6.4.2. Market Volume and Forecast, By Region

6.4.3. Market Revenue (US$ Million) and Forecast, By Region

6.5. Others

6.5.1. Key Market Trends, Growth Factors and Opportunities

6.5.2. Market Volume and Forecast, By Region

6.5.3. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 7: GLOBAL LOAN ORIGINATION & SERVICING SOFTWARE MARKET, BY GEOGRAPHY

7.1. Overview

7.2. North America

7.2.1. Key Market Trends, Growth Factors and Opportunities

7.2.2. Market Volume and Forecast, By Type

7.2.3. Market Volume and Forecast, By Application

7.2.4. Market Revenue and Forecast, By Type

7.2.5. Market Revenue and Forecast, By Application

7.2.6. Market Revenue and Forecast, By Country

7.2.7. U.S.

7.2.7.1. Market Volume and Forecast

7.2.7.2. Market Revenue and Forecast

7.2.8. Canada

7.2.8.1. Market Volume and Forecast

7.2.8.2. Market Revenue and Forecast

7.2.9. Mexico

7.2.9.1. Market Volume and Forecast

7.2.9.2. Market Revenue and Forecast

7.3. Europe

7.3.1. Market Volume and Forecast, By Type

7.3.2. Market Volume and Forecast, By Application

7.3.3. Market Revenue and Forecast, By Type

7.3.4. Market Revenue and Forecast, By Application

7.3.5. Market Revenue and Forecast, By Country

7.3.6. Germany

7.3.6.1. Market Volume and Forecast, By Type

7.3.6.2. Market Revenue and Forecast, By Application

7.3.7. UK

7.3.7.1. Market Volume and Forecast, By Type

7.3.7.2. Market Revenue and Forecast, By Application

7.3.8. France

7.3.8.1. Market Volume and Forecast, By Type

7.3.8.2. Market Revenue and Forecast, By Application

7.3.9. Italy

7.3.9.1. Market Volume and Forecast, By Type

7.3.9.2. Market Revenue and Forecast, By Application

7.3.10. Rest of Europe

7.3.10.1. Market Volume and Forecast, By Type

7.3.10.2. Market Revenue and Forecast, By Application

7.4. Asia-Pacific

7.4.1. Market Volume and Forecast, By Type

7.4.2. Market Volume and Forecast, By Application

7.4.3. Market Revenue and Forecast, By Type

7.4.4. Market Revenue and Forecast, By Application

7.4.5. Market Revenue and Forecast, By Country

7.4.6. China

7.4.6.1. Market Volume and Forecast, By Type

7.4.6.2. Market Revenue and Forecast, By Application

7.4.7. India

7.4.7.1. Market Volume and Forecast, By Type

7.4.7.2. Market Revenue and Forecast, By Application

7.4.8. Japan

7.4.8.1. Market Volume and Forecast, By Type

7.4.8.2. Market Revenue and Forecast, By Application

7.4.9. South Korea

7.4.9.1. Market Volume and Forecast, By Type

7.4.9.2. Market Revenue and Forecast, By Application

7.4.10. Rest of Asia-Pacific

7.4.10.1. Market Volume and Forecast, By Type

7.4.10.2. Market Revenue and Forecast, By Application

7.5. REST OF THE WORLD

7.5.1. Market Volume and Forecast, By Type

7.5.2. Market Volume and Forecast, By Application

7.5.3. Market Revenue and Forecast, By Type

7.5.4. Market Revenue and Forecast, By Application

7.5.5. Market Revenue and Forecast, By Country

7.5.6. Latin America

7.5.6.1. Market Volume and Forecast, By Type

7.5.6.2. Market Revenue and Forecast, By Application

7.5.7. Middle East

7.5.7.1. Market Volume and Forecast, By Type

7.5.7.2. Market Revenue and Forecast, By Application

7.5.8. Africa

7.5.8.1. Market Volume and Forecast, By Type

7.5.8.2. Market Revenue and Forecast, By Application

CHAPTER 8: COMPETITIVE LANDSCAPE

8.1. Loan Origination & Servicing Software Market Share Analysis, 2018

CHAPTER 9: COMPANY PROFILES

9.1. Ellie Mae, Inc.

9.1.1. Company Overview

9.1.2. Financial Performance

9.1.3. SWOT Analysis

9.2. Calyx Technology, Inc.

9.2.1. Company Overview

9.2.2. Financial Performance

9.2.3. SWOT Analysis

9.3. Fiserv, Inc.

9.3.1. Company Overview

9.3.2. Financial Performance

9.3.3. SWOT Analysis

9.4. Byte Software

9.4.1. Company Overview

9.4.2. Financial Performance

9.4.3. SWOT Analysis

9.5. Altisource

9.5.1. Company Overview

9.5.2. Financial Performance

9.5.3. SWOT Analysis

9.6. Mortgage Cadence

9.6.1. Company Overview

9.6.2. Financial Performance

9.6.3. SWOT Analysis

9.7. Wipro Limited

9.7.1. Company Overview

9.7.2. Financial Performance

9.7.3. SWOT Analysis

9.8. Tavant Technologies

9.8.1. Company Overview

9.8.2. Financial Performance

9.8.3. SWOT Analysis

9.9. Lending

9.9.1. Company Overview

9.9.2. Financial Performance

9.9.3. SWOT Analysis

9.10. Black Knight IP Holding Company, LLC

9.10.1. Company Overview

9.10.2. Financial Performance

9.10.3. SWOT Analysis

9.11. JuristechSdnBhd

9.11.1. Company Overview

9.11.2. Financial Performance

9.11.3. SWOT Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved