Global Non-Alcoholic Beer Market Size, Statistics, Trend Analysis and Forecast Report, 2020 - 2027

By Product (Alcohol Free {By Material [Malted Grains, Hops, Yeast and Enzymes], By Technology [Restricted Fermentation and De-alcoholization {Reverse Osmosis, Heat Treatment and Vacuum Distillation}], By Sales Channel [Liquor Stores, Convenience Stores, Supermarkets, Online Stores and Restaurants & Bars]}, Low Alcohol {By Material [Malted Grains, Hops, Yeast and Enzymes], By Technology [Restricted Fermentation and De-alcoholization {Reverse Osmosis, Heat Treatment and Vacuum Distillation}], By Sales Channel [Liquor Stores, Convenience Stores, Supermarkets, Online Stores and Restaurants]}), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Italy, Spain, Russia, Czech Republic, Sweden, China, India, Japan, Australia, South Korea, Indonesia, Malaysia, Brazil, Argentina, Mexico, South Africa, UAE, Saudi Arabia, Iran, Egypt)

- Report ID : MD1429 |

- Pages : 240 |

- Tables : 85 |

- Formats :

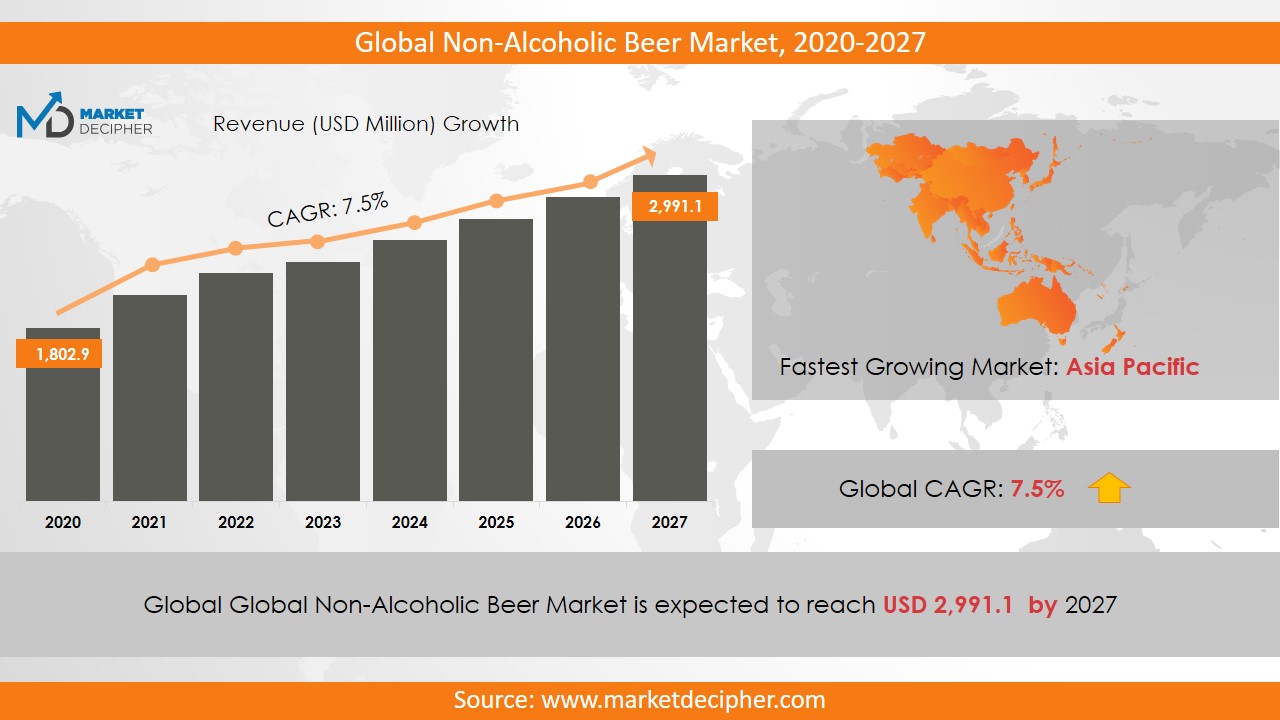

Global Non-Alcoholic Beer Market size was estimated at $18,028.9 Million in 2019 and is expected to reach $29,910.8 Million by 2027, growing at a CAGR of 7.5% during the forecast period of 2020 to 2027.

Non-alcoholic beer is beer with alcohol content of up to 0.05% by volume. This small trace of alcohol is found due to the brewing process. The alcohol is taken out in one of two ways: By boiling it off or restricting the alcohol creation during the brewing process.

Analysis by Product

There are two broad product categories: Alcohol-free & Low-alcohol. The former holds the larger market share of the two. It is finding acceptance with sportspersons as an energy drink. This is being aided because it can be easily sold through convenience stores. Moreover, the margins on these drinks are tempting for the retailer to give them top shelf-priority. Product demand is on the rise and thereby, an excellent prospect for future investors.

The Low-alcohol variant is perfect for consumers looking to enjoy responsibly. Owing to its ultra-low alcohol content, the customers are experiencing the best of both worlds. This demand too is slated to increase in the forecasted timeline.

Analysis by Technology

De-alcoholization is taking giant strides in capturing market share in this industry. It boasts of industry-leading operational benefits and is thus the choice of technology of many businessmen. Its convenient production technology will cement its numero-uno position further.

Restricted fermentation is another technology variant in this industry. It has found its application in beer and wine production. It achieves controlled fractions of alcohol content very effectively. The growing demand for these products augur very well for future revenue figures.

Analysis by Sales Channel

Supermarkets are rapidly becoming the location of preference for retail commercial activity. Consumers are much happier with shopping spaces that fulfill all their grocery needs in one place. Moreover, Supermarkets are driving the non-alcoholic beverage sales at a healthy year-on-year growth rate.

The online space has grown leaps and bounds so far and has much more ground to conquer. The marketing channels are light on the pocket. This will make the E-commerce space very attractive for companies to reach potential customers and make sales.

Analysis by Material

Malted grains are the most widely used non-alcoholic beer production raw material. It has operational as well as technical parameters that it excels in. The demand for these is going to be on a stable increase.

Customer segments are showing an uncanny demand for Craft beer. This uses hop extracts. The customer pull in the youth segment is one of the strongest in the industry.

Analysis by Region

Europe is the largest consumer of non-alcoholic beer. This is due to excellent supply chain infrastructure. Further, they have annual festivities such as Dry-January, which creates a lot of demand for the product.

The Asia-Pacific region is slated to emerge as the leader in the consumption of non-alcoholic beverages. This is primarily a result of government interventions.

Analysis by Market

A fair amount of activity will unfold among most of the players in this industry. Some prominent ones include Coors Brewing Company, Bernard Brewery, and Carlsberg Breweries. All these companies have presented a formidable market share target for the forecasted period. The usual tools of Mergers and Partnerships will ensue in this space, thereby driving market capitalization.

COVERAGE HIGHLIGHTS

● Market Revenue Estimation and Forecast (2019 – 2026)

● Market Production Estimation and Forecast (2019 – 2026)

● Market Sales/Consumption Volume Estimation and Forecast (2019 – 2026)

● Breakdown of Revenue by Segments (2019 – 2026)

● Breakdown of Production by Segments (2019 – 2026)

● Breakdown of Sales Volume by Segments (2019 – 2026)

● Gross Margin and Profitability Analysis of Companies

● Business Trend and Expansion Analysis

● Import and Export Analysis

● Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Product Outlook ($Revenue and Unit Sales, 2019-2026)

• Alcohol-free

• Low Alcohol

By Technology Outlook ($Revenue and Unit Sales, 2019-2026)

• Restricted fermentation

• De-alcoholization

1. Reverse Osmosis

2. Heat treatment

3. Vacuum Distillation

By Sales Channel Outlook ($Revenue and Unit Sales, 2019-2026)

• Liquor Stores

• Convenience Stores

• Supermarkets

• Online Store

• Restaurants & Bar

By Material Outlook ($Revenue and Unit Sales, 2019-2026)

• Malted grains

• Hops

• Yeasts

• Enzymes

• Others

By Regional Outlook ($Revenue and Unit Sales, 2019-2026)

• USA

• Canada

• Germany

• UK

• France

• Italy

• Spain

• Russia

• Czech Republic

• Sweden

• China

• India

• Japan

• Australia

• South Korea

• Indonesia

• Malaysia

• Brazil

• Mexico

• Argentina

• Saudi Arabia

• UAE

• South Africa

• Iran

• Egypt

Market Players

• Heineken N.V,

• Suntory Beer,

• Bernard Brewery,

• Big Drop Brewing Co,

• Anheuser-Busch InBev SA,

• KrombacherBrauerei,

• ErdingerWeibbrau,

• Moscow Brewing Company,

• Anheuser-Busch InBev,

• Carlsberg,

• Weihenstephan,

• Arpanoosh,

• Kirin,

• Behnoush Iran,

• Coors Brewing Company

CHAPTER 1: INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Desk Research

1.1.2. Data Synthesis

1.1.3. Data Validation & Market Feedback

1.1.4. Data Sources

CHAPTER 2: EXECUTIVE SUMMARY

2.1. GLOBAL MARKET OUTLOOK

2.2. CORE INSIGHTS –DELIVERY MODEL

2.3. CORE INSIGHTS – GLOBAL NON-ALCOHOLIC BEER

2.4. CORE INSIGHTS – SERVICE PROVIDER

2.5. CORE INSIGHTS – GEOGRAPHY

CHAPTER 3: MARKET OVERVIEW

3.1. MARKET DEFINITION AND SCOPE

3.2. KEY FORCES SHAPING THE INDUSTRY

3.2.1. Bargaining Power of Suppliers

3.2.2. Bargaining Power of Buyers

3.2.3. Threat of Substitutes

3.2.4. Threat of New Entrants

3.3. MARKET DYNAMICS

3.3.1. Drivers

3.3.1.1. Supply-side Drivers

3.3.1.2. Demand-side Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.4. INDUSTRY - ANALYSIS

3.4.1. Political Market

3.4.2. Environmental Market

3.4.3. Social Market

3.4.4. Technology Market

CHAPTER 4: MARKET BACKGROUND

4.1. Industry Value Chain Analysis

4.1.1. Upstream Participants

4.1.2. Downstream participants

4.2. Pricing Analysis and Forecast, 2019-2026

4.2.1. By Type

4.2.2. By Region

CHAPTER 5: GLOBAL NON-ALCOHOLIC BEER MARKET, BY PRODUCT OUTLOOK

5.1. Overview

5.1.1. Market Revenue (US$ Million) and Forecast, 2019-2026

5.2. Alcohol-free

5.2.1. Key Market Trends, Growth Factors and Opportunities

5.2.2. Market Revenue (US$ Million) and Forecast, By Region

5.3. Low Alcohol

5.3.1. Key Market Trends, Growth Factors and Opportunities

5.3.2. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 6: GLOBAL NON-ALCOHOLIC BEER MARKET BY TECHNOLOGY OUTLOOK

6.1. Overview

6.1.1. Market Revenue (US$ Million) and Forecast, 2019-2026

6.2. Restricted fermentation

6.2.1. Key Market Trends, Growth Factors and Opportunities

6.2.2. Market Revenue (US$ Million) and Forecast, By Region

6.3. De-alcoholization

6.3.1. Key Market Trends, Growth Factors and Opportunities

6.3.2. Market Revenue (US$ Million) and Forecast, By Region

6.4. Reverse Osmosis

6.4.1. Key Market Trends, Growth Factors and Opportunities

6.4.2. Market Revenue (US$ Million) and Forecast, By Region

6.5. Heat treatment

6.5.1. Key Market Trends, Growth Factors and Opportunities

6.5.2. Market Revenue (US$ Million) and Forecast, By Region

6.6. Vacuum Distillation

6.6.1. Key Market Trends, Growth Factors and Opportunities

6.6.2. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 7: GLOBAL NON-ALCOHOLIC BEER MARKET BY SALES CHANNEL OUTLOOK

7.1. Overview

7.1.1. Market Revenue (US$ Million) and Forecast, 2019-2026

7.2. Liquor Stores

7.2.1. Key Market Trends, Growth Factors and Opportunities

7.2.2. Market Revenue (US$ Million) and Forecast, By Region

7.3. Convenience Stores

7.3.1. Key Market Trends, Growth Factors and Opportunities

7.3.2. Market Revenue (US$ Million) and Forecast, By Region

7.4. Supermarkets

7.4.1. Key Market Trends, Growth Factors and Opportunities

7.4.2. Market Revenue (US$ Million) and Forecast, By Region

7.5. Online Store

7.5.1. Key Market Trends, Growth Factors and Opportunities

7.5.2. Market Revenue (US$ Million) and Forecast, By Region

7.6. Restaurants & Bar

7.6.1. Key Market Trends, Growth Factors and Opportunities

7.6.2. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 8: GLOBAL NON-ALCOHOLIC BEER MARKET BY MATERIAL OUTLOOK

8.1. Overview

8.1.1. Market Revenue (US$ Million) and Forecast, 2019-2026

8.2. Malted grains

8.2.1. Key Market Trends, Growth Factors and Opportunities

8.2.2. Market Revenue (US$ Million) and Forecast, By Region

8.3. Hops

8.3.1. Key Market Trends, Growth Factors and Opportunities

8.3.2. Market Revenue (US$ Million) and Forecast, By Region

8.4. Yeasts

8.4.1. Key Market Trends, Growth Factors and Opportunities

8.4.2. Market Revenue (US$ Million) and Forecast, By Region

8.5. Enzymes

8.5.1. Key Market Trends, Growth Factors and Opportunities

8.5.2. Market Revenue (US$ Million) and Forecast, By Region

8.6. Others

8.6.1. Key Market Trends, Growth Factors and Opportunities

8.6.2. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 9: GLOBAL NON-ALCOHOLIC BEER MARKET, BY GEOGRAPHY

9.1. Overview

9.2. North America

9.2.1. Key Market Trends, Growth Factors and Opportunities

9.2.2. Market Revenue and Forecast, By Delivery Model

9.2.3. Market Revenue and Forecast, By Agriculture Type

9.2.4. Market Revenue and Forecast, By Service Provider

9.2.5. Market Revenue and Forecast, By Country

9.2.6. U.S.

9.2.6.1. Market Revenue and Forecast

9.2.7. Canada

9.2.7.1. Market Revenue and Forecast

9.2.8. Mexico

9.2.8.1. Market Revenue and Forecast

9.3. Europe

9.3.1. Market Revenue and Forecast, By Delivery Model

9.3.2. Market Revenue and Forecast, By Agriculture Type

9.3.3. Market Revenue and Forecast, By Service Provider

9.3.4. Market Revenue and Forecast, By Country

9.3.5. Germany

9.3.5.1. Market Revenue and Forecast

9.3.6. UK

9.3.6.1. Market Revenue and Forecast

9.3.7. France

9.3.7.1. Market Revenue and Forecast

9.3.8. Italy

9.3.8.1. Market Revenue and Forecast

9.3.9. Spain

9.3.9.1. Market Revenue and Forecast

9.3.10. Poland

9.3.10.1. Market Revenue and Forecast

9.3.11. Austrai

9.3.11.1. Market Revenue and Forecast

9.3.12. Luxembourg

9.3.12.1. Market Revenue and Forecast

9.3.13. Rest of Europe

9.3.13.1. Market Revenue and Forecast

9.4. Asia-Pacific

9.4.1. Market Revenue and Forecast, By Delivery Model

9.4.2. Market Revenue and Forecast, By Agriculture Type

9.4.3. Market Revenue and Forecast, By Service Provider

9.4.4. Market Revenue and Forecast, By Country

9.4.5. China

9.4.5.1. Market Revenue and Forecast

9.4.6. India

9.4.6.1. Market Revenue and Forecast

9.4.7. Japan

9.4.7.1. Market Revenue and Forecast

9.4.8. South Korea

9.4.8.1. Market Revenue and Forecast

9.4.9. Rest of APAC

9.4.9.1. Market Revenue and Forecast

9.5. REST OF THE WORLD

9.5.1. Market Revenue and Forecast, By Delivery Model

9.5.2. Market Revenue and Forecast, By Agriculture Type

9.5.3. Market Revenue and Forecast, By Service Provider

9.5.4. Market Revenue and Forecast, By Country

9.5.5. Latin America

9.5.5.1. Market Revenue and Forecast

9.5.6. Middle East

9.5.6.1. Market Revenue and Forecast

9.5.7. Africa

9.5.7.1. Market Revenue and Forecast

CHAPTER 10: COMPETITIVE MARKET

10.1. GLOBAL NON-ALCOHOLIC BEER Market Share Analysis, 2019

CHAPTER 11: COMPANY PROFILES

11.1. Airbus S.A.S

11.1.1. Company Overview

11.1.2. Financial Performance

11.1.3. SWOT Analysis

11.2. Aviation Industry Corporation of China Ltd. (AVIC)

11.2.1. Company Overview

11.2.2. Financial Performance

11.2.3. SWOT Analysis

11.3. Astronics Corporation

11.3.1. Company Overview

11.3.2. Financial Performance

11.3.3. SWOT Analysis

11.4. Boeing

11.4.1. Company Overview

11.4.2. Financial Performance

11.4.3. SWOT Analysis

11.5. Ball Corporation

11.5.1. Company Overview

11.5.2. Financial Performance

11.5.3. SWOT Analysis

11.6. BAE Systems

11.6.1. Company Overview

11.6.2. Financial Performance

11.6.3. SWOT Analysis

11.7. Cobham plc

11.7.1. Company Overview

11.7.2. Financial Performance

11.7.3. SWOT Analysis

11.8. Curtiss Wright

11.8.1. Company Overview

11.8.2. Financial Performance

11.8.3. SWOT Analysis

11.9. Elbit System

11.9.1. Company Overview

11.9.2. Financial Performance

11.9.3. SWOT Analysis

11.10. Gramin Ltd

11.10.1. Company Overview

11.10.2. Financial Performance

11.10.3. SWOT Analysis

11.11. GE Aviation

11.11.1. Company Overview

11.11.2. Financial Performance

11.11.3. SWOT Analysis

11.12. Harris Corporation

11.12.1. Company Overview

11.12.2. Financial Performance

11.12.3. SWOT Analysis

11.13. Honeywell International Inc.

11.13.1. Company Overview

11.13.2. Financial Performance

11.13.3. SWOT Analysis

11.14. Lockheed Martin Corporation

11.14.1. Company Overview

11.14.2. Financial Performance

11.14.3. SWOT Analysis

11.15. L3 Harris Corporation

11.15.1. Company Overview

11.15.2. Financial Performance

11.15.3. SWOT Analysis

11.16. Meggitt PLC

11.16.1. Company Overview

11.16.2. Financial Performance

11.16.3. SWOT Analysis

11.17. Northrop Grumman Corporation

11.17.1. Company Overview

11.17.2. Financial Performance

11.17.3. SWOT Analysis

11.18. Nucon Aerospace

11.18.1. Company Overview

11.18.2. Financial Performance

11.18.3. SWOT Analysis

11.19. Panasonic Corporation

11.19.1. Company Overview

11.19.2. Financial Performance

11.19.3. SWOT Analysis

11.20. Rolls Royce

11.20.1. Company Overview

11.20.2. Financial Performance

11.20.3. SWOT Analysis

11.21. Raytheon Company

11.21.1. Company Overview

11.21.2. Financial Performance

11.21.3. SWOT Analysis

11.22. Saab AB

11.22.1. Company Overview

11.22.2. Financial Performance

11.22.3. SWOT Analysis

11.23. Safran

11.23.1. Company Overview

11.23.2. Financial Performance

11.23.3. SWOT Analysis

11.24. Thales Group

11.24.1. Company Overview

11.24.2. Financial Performance

11.24.3. SWOT Analysis

11.25. Teledyne Technologies Inc.

11.25.1. Company Overview

11.25.2. Financial Performance

11.25.3. SWOT Analysis

11.26. Transdigm Group Inc.

11.26.1. Company Overview

11.26.2. Financial Performance

11.26.3. SWOT Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved