- Report ID : MD2992 |

- Pages : 220 |

- Tables : 44 |

- Formats :

Email sales@marketdecipher.com

Contact +91 6201075429

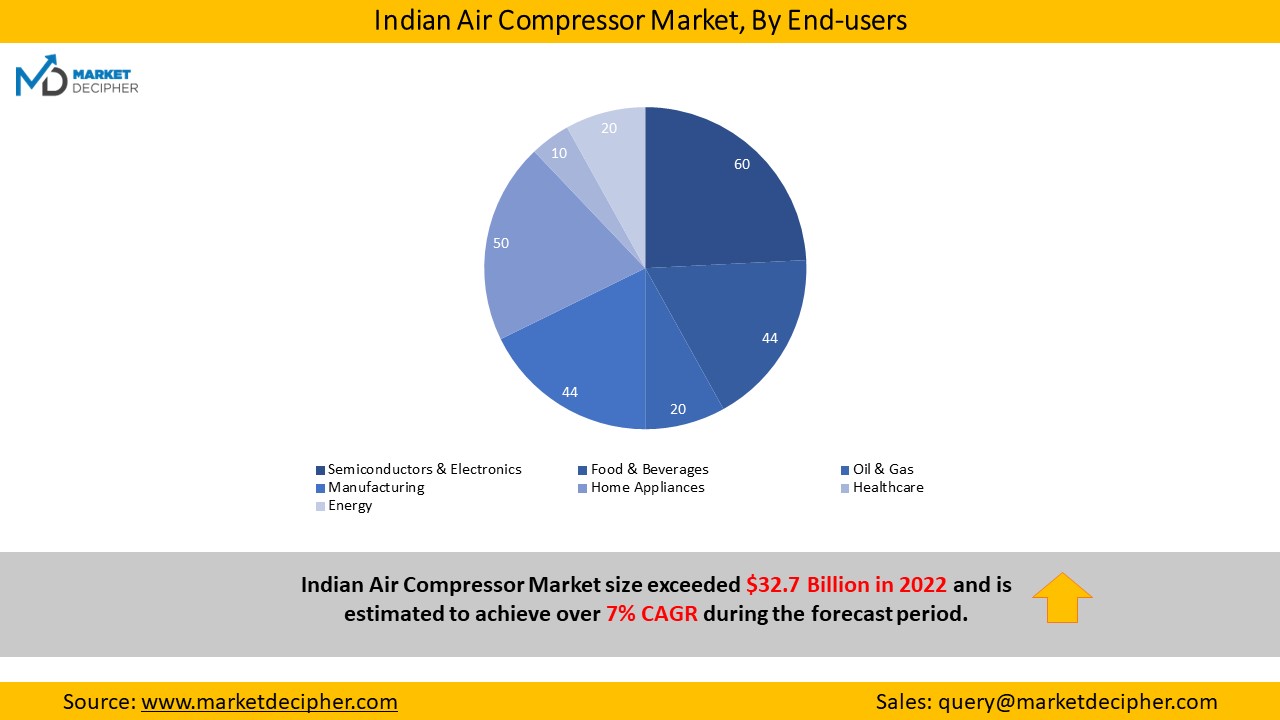

Indian Air Compressor Market is segmented by Technology type (Positive Displacement and Dynamic Displacement), by Design type (Stationary and Rotatory), by Seal type (Oil Flooded and Oil Free), by End- User Industry (Semiconductors & Electronics, Food & Beverages, Oil & Gas, Manufacturing, Home Appliances, Healthcare & Energy).

Indian Air Compressor Market size exceeded $32.7 Billion in 2021 and is estimated to achieve over 7% CAGR during the forecast period

The Indian Air Compressor Market has grown significantly in recent years. The market has been steadily rising due to strong industrialization and infrastructure development. Air compressor demand has been fueled by industries such as manufacturing, oil and gas, and healthcare, which require compressed air for a variety of applications. To achieve notable growth, the market has demonstrated resilience and adaptability, overcoming challenges and capitalising on opportunities. The air compressor market in India is also experiencing a surge in popularity, owing to the constant innovation seen in newer models. Indias manufacturers have been at the forefront of introducing cutting-edge reciprocating and rotary screw air compressors with improved performance, durability, and operational efficiency. These technological advancements have resulted in air compressors that are better suited to meet the demands of various industries, catering to a wide range of industrial applications.

Continuous Growth of Indian Sectors Fuels Demand for Indian Air Compressors

The Indian air compressor market is expanding steadily and is expected to expand further in the coming years. Demand for Indian air compressors is being driven by the continuous growth of Indian sectors, particularly in developing regions. Compressed air is required for a variety of applications, including powering machinery, pneumatic tools, and automation systems, as manufacturing, construction, and infrastructure projects expand. Further, compressor technology advancements are having a positive impact on market growth. The market is growing due to the expansion of the Indianization and manufacturing sectors, as well as the increasing demand for compressed air in Indian processes.

Energy-Saving Solutions Propelling the Indian Air Compressor Market

Another significant driver is the adoption of energy-efficient solutions, which is motivated by environmental concerns as well as cost savings. Customers seeking advanced and dependable compressed air systems are drawn to technological advancements and innovative solutions, such as smart technologies and predictive maintenance. End-user industry expansion, a focus on safety, and product quality all contribute to market growth. The growing use of automation and robotics in industries to boost productivity, cut labour costs, and improve precision is driving up demand for compressed air. Compressed air is essential for running pneumatic components and automating processes.

These factors all contribute to the expansion of the Indian air compressor market. The demand for reliable and efficient compressed air systems is expected to rise as industries continue to expand, upgrade their infrastructure, and prioritize energy efficiency. And with these factors at play, the Indian air compressor market is expected to grow further in the coming years.

Market Dominance: Positive Displacement and Stationary Air Compressors Retain Their Leading Share

Positive displacement Indian air compressors, which include reciprocating and rotary models, are expected to have a larger market share. These compressors are versatile and adaptable, providing dependable, energy-efficient, and versatile compressed air solutions. They are used in a variety of industries, including manufacturing, construction, oil and gas, and automotive, for pneumatic tools, automation, and material handling. Further, the market for stationary air compressors is poised for significant growth during the forecast period. As industries continue to grow and prioritize efficiency, there is a greater need for dependable, high-capacity compressed air solutions. Stationary air compressors are ideal for Indian applications due to their stability, durability, and high air delivery capacity. Stationary air compressors are recognized as long-term investments because they provide a reliable source of compressed air for industries, contributing to their growing market presence.

250kW-500kW and Air-Cooled Air Compressors Emerges as the Ideal Output Power and Coolant for the Indian Air Compressor Market

The 250 kW- 500kW segment of Indian air compressor output power is expected to have a larger market share. Higher-powered compressors are required to meet the compressed air needs of industries with expanding operations and heavy-duty applications. This segment provides the necessary power to support large-scale machinery, pneumatic tools, and high-demand Indian processes. Furthermore, compressors in this power range are used by energy-intensive industries to meet their large air requirements. Further, air-cooled compressors stand out here because they do not require additional cooling systems or water connections, they are easier to install and operate. They are also better suited to environments where water availability or quality is an issue. The air-cooled segment ensures reliable performance and prevents overheating by providing efficient cooling via ambient air. These compressors are versatile and can be used in a variety of Indian applications, making them a popular choice for businesses looking for efficient and low-maintenance compressed air solutions. Furthermore, air-cooled compressors are frequently compact in design, making them suitable for installations with limited space.

Moreover, the Indian air compressor market is being driven by the chemical and petrochemical industries. They rely heavily on compressed air for a wide range of applications and critical processes. Stringent regulations and the need for customized solutions drive demand for Indian air compressors in these industries. With the ongoing expansion of chemical and petrochemical plants around the world, driven by rising demand for chemicals, feedstocks, and energy, the demand for Indian air compressors is expected to rise enhancing their prominence in these industries.

Asia-Pacific Region’s Rapid Indianization makes it the most favorable market for Air Compressors

The Asia- Pacific Indian Air Compressor Industry is expected to witness 8% gains in the period of 2023- 2033. Several factors are expected to drive Asia Pacific to become the largest market for Indian air compressors. The regions rapid Indianization, expanding manufacturing sector, and increasing infrastructure development investments are key drivers of market growth. Furthermore, rising demand for compressed air in various industries such as automotive, oil and gas, chemicals, and electronics fuels the Asia Pacific market. With their expanding Indian base and robust manufacturing activities, emerging economies such as China and India contribute significantly to the regions market dominance.

Recent Strategic Development

Years considered for this report

Indian Air Compressor Market Research Report Analysis Highlights

Industry Segmentation and Revenue Breakdown

Technology Type Analysis (Revenue, INR Crores, 2023 - 2033)

Design Type Analysis (Revenue, INR Crores, 2023 - 2033)

Seal Type Analysis (Revenue, INR Crores, 2023 - 2033)

End-User Industry Analysis (Revenue, INR Crores, 2023 - 2033)

Key Market Players in Indian Air Compressor Market

Available Versions of Air Compressor Market Report: -

Customization can be done in the existing research scope to cater to your specific requirements without any extra charges* (terms and conditions apply).

Send us a query to get the Table of Contents and Research Scope along with the research proposal.

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Please fill in the form below to Request for free Sample Report

Office Hours Mon - Sat 10:00 - 16:00

Call Us +91 6201075429

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved