- Report ID : MD1642 |

- Pages : 200 |

- Tables : 88 |

- Formats :

Email sales@marketdecipher.com

Contact +91 6201075429

Pharmaceutical Excipients Market is segmented by Product (Organic Chemicals (Carbohydrates, Petrochemicals) inorganic chemicals), Functionality (Fillers, Diluents, Coatings, Disintegrants), Formulation (Tablet, Capsule, Topical, Parenteral), and Region (United States, Canada, Mexico, France, Germany, Italy, Spain, United Kingdom, Russia, China, India, Philippines, Malaysia, Australia, Austria, South Korea, Middle East, Japan, Africa and Rest of World)

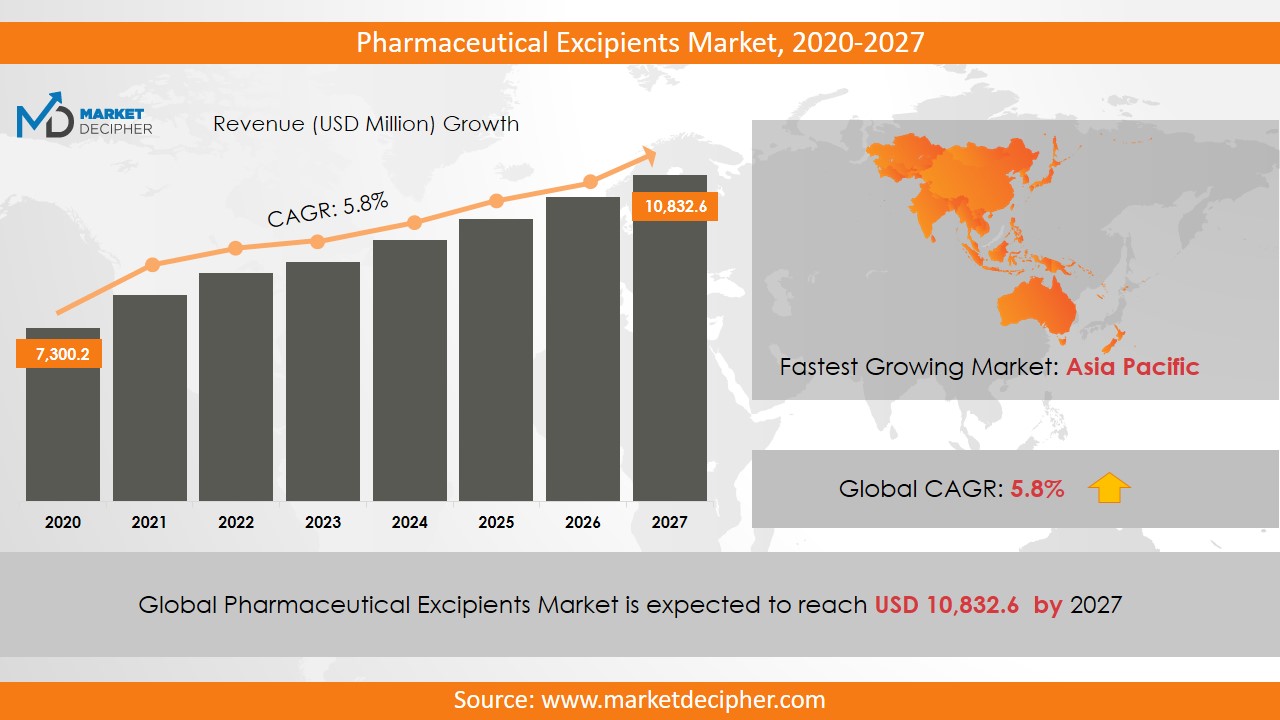

Pharmaceutical Excipients Market size was estimated at $2,012.1 Million in 2019 and is expected to reach $3,005.6 Million by 2027, growing at a CAGR of 5.9% during the forecast period of 2020 to 2027.

Pharmaceutical Excipients Market Growth Factors

Pharmaceutical excipients help to activate pharmaceutical constituents to greater efficiency such as longer life and render a competitive edge in the manufacturing process. Pharmaceutical excipients are used in drugs to protect, enhance stability, and availability of the drug The surge in demand for medicines worldwide is pushing the pharmaceutical excipients market to new avenues. This is led by the increasing number of chronic diseases, more awareness towards physical well-being and a greater prevalence of lifestyle caused diseases such as diabetes and obesity. This has been accelerating the demand as well as the production of drugs and excipients.

Growing demand for oral solid drug is opening newer horizons for the pharmaceutical excipients market. Oral dosage forms need more amount of excipients than other forms during production. More than half the number of patients find it difficult to swallow hard tablets. This encourages manufacturers to innovate solid oral product forms. This creates stellar demand for excipients in the upcoming years

It has been reported that there has been an increasing demand for cheaper quality excipients from emerging economies as a result of a high requirement in the local drug manufacturing sector. Government initiatives in various countries are driving revenues derived from healthcare services and drug manufacturing in emerging economies are expected to contribute to increasing demand for excipients over the coming period.

Developed countries with sophisticated manufacturing practices, where demand for better quality excipients is increasing is at a lower rate than that in developing countries. Regulatory hurdles restricting research and development of initiatives related to advanced excipients. If a new drug approval fails, the excipient also fails. Furthermore, clinical trial data from that failed excipient is unusable. This leads to financial losses to both the drug and the excipient manufacturer. This leads to other critical threats like decreasing investment and longer duration of production which are holding back the growth of the market. However, opportunities like using pharmaceutical excipients in preventing the drug from acting early in places where it could damage tender tissue could help maintain the growth rate.

Pharmaceutical Excipients Market Segmentation

Pharmaceutical Excipients Market Country Analysis

The global pharmaceutical excipients market is estimated to grow by 3 billion in the forecast period (2020-2024), translating to a CAGR of 7%. Currently, North America holds a substantial share of this market, and the trend is expected to continue over the forecast period. The fast-paced market growth in this region can be attributed to increased expenditure in research and development (R&D), adoption of cutting-edge technologies, and the growing demand for pharmaceuticals across the globe. The emerging markets of Asia Pacific are projected to register the highest CAGR due to the rising demand for efficient drug delivery systems, implementation of novel technologies, and the growing demand for biological drugs. Ferro Corporation, Evonik Industries Ag, and P&G Chemicals are some of the top players in this market.

Pharmaceutical Excipients Market Share and Competition

Key companies operating in this industry are: Ashland Global Holdings (US), BASF SE (Germany), DuPont (US), Roquette Feres (France), Evonik Industries AG (Germany), Associated British Foods (UK), Archer Daniels Midland Company (US), Lubrizol Corporation (US), and Croda International (UK). Other players in this market are Innophous Holdings (US), Kerry Group (Ireland), WACKER Chemie AG (Germany), Colorcon (US), DFE Pharma (Germany), JRS Pharma (Germany), and Air Liquide (France). Ajinomoto Bio-Pharma, a pharmaceutical manufacturing company, has recently announced the launch of its new platform ‘Ajility’, on 30 June 2020. The platform is designed for therapeutic and vaccines including drug products that can be used in Covid-19 trials. Foods and Drugs Authority (FDA) has provided boosted litheness by leveraging the platform. “The Ajility platform offers flexibility and time savings, which is an enormous boost for those clients with drug products that need to get to clinical trials quickly.”, informed the Associate Director of Commercial Operations at Ajinomoto Pharma, Dustin Campbell.

La Jolla Pharmaceutical Company, a developer of innovative therapies and their commercialization, has announced a merger with Tetraphase Pharmaceuticals Inc. on 24 June 2020. The merger is set to commercialize a conjointly developed product of the two global leading companies, Tetracycline Xerava. “Combining with La Jolla, which markets GIAPREZA, the first new treatment for patients suffering from septic or another distributive shock in more than a decade, should help accelerate XERAVA’s availability to patients in need.”, said the President and Chief Executive Officer at Tetraphase, Larry Edwards.

Report Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue and unit sales (2020 – 2027)

• Data breakdown for every market segment (2020 – 2027)

• Gross margin and profitability analysis of companies

• Price analysis of each product type

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategy

Industry Segmentation and Revenue Breakdown

Product Analysis (Revenue, USD Million, 2020 - 2027)

• Organic Chemicals

• Inorganic Chemicals

• Other Devices

Functionality Analysis (Revenue, USD Million, 2020 - 2027)

• Fillers and Diluents

• Suspending and Viscosity Agents

• Coating Agents

• Binders

• Flavouring Agents and Sweeteners

• Disintegrants

• Colorants

• Lubricants and Glidants

• Preservatives

• Emulsifying Agents

• Other Functionalities

Formulation Analysis (Revenue, USD Million, 2020 - 2027)

• Oral Formulations

• Topical Formulations

• Parenteral Formulations

• Other Formulations

Region Analysis (Revenue, USD Million, 2020 - 2027)

• United States

• Canada

• Mexico

• France

• Germany

• Italy

• Spain

• United Kingdom

• Russia

• China

• India

• Philippines

• Malaysia

• Australia

• Austria

• South Korea

• Middle East

• Japan

• Africa

• Rest of World

Pharmaceutical Excipients Market Companies

• Ashland Global Holdings (US)

• BASF SE (Germany)

• DuPont (US)

• Roquette Feres (France)

• Evonik Industries AG (Germany)

• Associated British Foods (UK)

• Archer Daniels Midland Company (US)

• Lubrizol Corporation (US)

• Croda International (UK)

• Innophous Holdings (US)

• Kerry Group (Ireland)

• WACKER Chemie AG (Germany)

• Colorcon (US)

• DFE Pharma (Germany)

• JRS Pharma (Germany)

• Air Liquide (France)

Available Versions:-

United States Pharmaceutical Excipients Market Industry Research Report

Europe Pharmaceutical Excipients Market Industry Research Report

Asia Pacific Pharmaceutical Excipients Market Industry Research Report

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Please fill in the form below to Request for free Sample Report

Office Hours Mon - Sat 10:00 - 16:00

Call Us +91 6201075429

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved