Security Testing Market

By Application services (Enterprise/desktop application, Web application, Mobile application and Cloud application), ByApplication type (Dynamic Application security testing and Static Application Security testing), ByTools (Penetration testing tools, Automated testing tools, Code review tools and Web testing tools), By Deployment models (On-Premise and Cloud),By Industry Verticals (Retail, IT & Telecom, Healthcare & life sciences, BFSI and Government & Public utilities), By Network services (Virtual Private Network (VPN) testing, Intrusion Detection System, Intrusion Prevention System (IDS/IPS) testing, firewall testing and Universal Resource Locator (URL) / Unified Threat Management (UTM) testing), By Region(North America, Europe, APAC,MEA and Latin America)

- Report ID : MD1094 |

- Pages : 198 |

- Tables : 87 |

- Formats :

A significant rise in cyber crimes, hacking cases, and data theft or loss cases are the factors supporting the growth of the market significantly. Further, as many organizations have confidential data such as in banking sector the personal information of a user, user id and login passwords, etc. is the sensitive data and it is necessary to make sure that this kind of information is secured properly and thus security testing is becoming significant in many sectors. The main aim of the security testing services is to check the vulnerability of a system and to prevent unauthorized access to the system resulting in any kind of interruption in the security of the system. Cloud computing is playing a significant role in uplifting the market growth as the excessive use of cloud application is making it highly vulnerable to the threat of being attacked by an attacker and hence is expected to support the augmentation of the market significantly. Further, security testing services ensure whether the system is free from any kind of loophole or not, and this is one of the main features of this service propelling the growth of the market. The rising development of the applications based on mobile, web and desktop further boost up the market revenue at a substantial rate. However, the increasing deployment and the cost of the service hinder market growth. Also, the lack of awareness about various security solutions is one of the major factors limiting market growth.

The market revenue of Security Testing shall reach a value of $15.6 Billion in 2031, growing with a CAGR of 27.8% during the forecast period of 2022 to 2031.

REGIONAL ANALYSIS

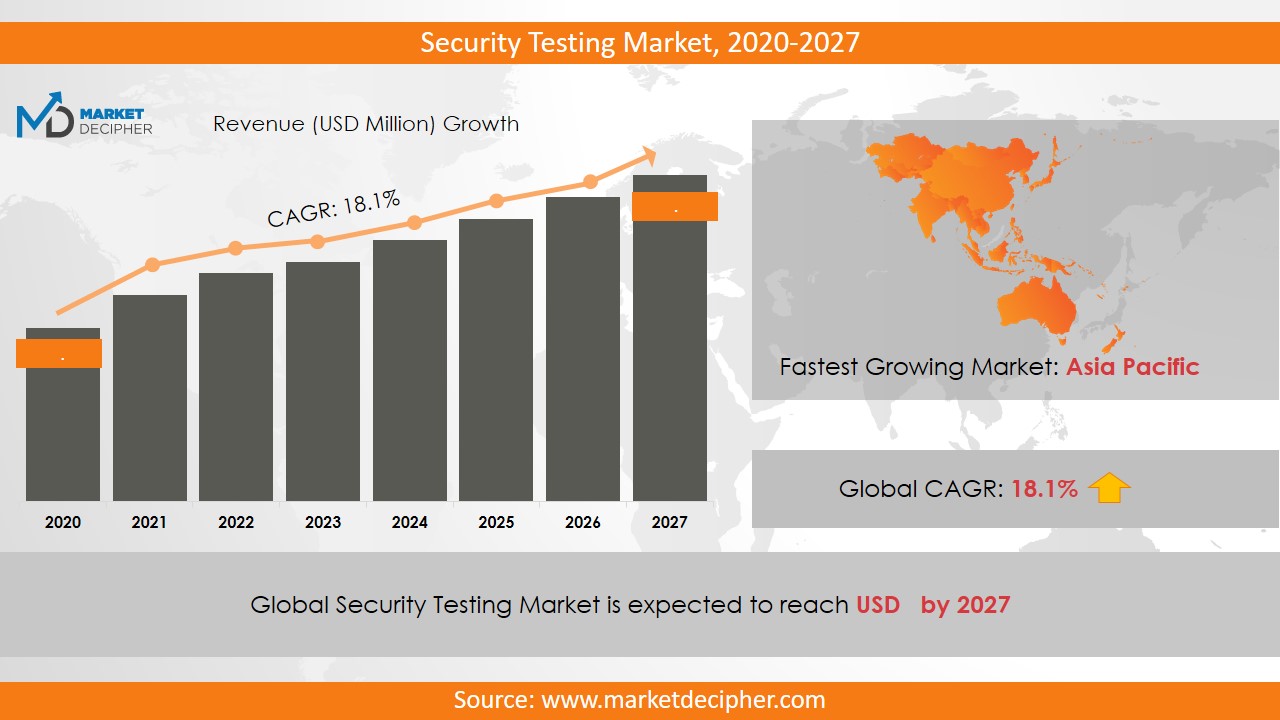

Based on the region, the market has been segmented as Latin America, Western Europe, North America, Japan, Asia Pacific, Eastern Europe and the Middle East and Africa. Owing to the increasing trend of BYOD policy in Western Europe, this region is supporting the growth of the market revenue. Further, the Asia Pacific region is anticipated to augment the market revenue substantially over the forecast period due to the ongoing technological advancements and increasing investments in the market in the region.

SEGMENT ANALYSIS

The bifurcation of the market has been done on the basis of application services, application type, tools, deployment, industry verticals, network services and by region. In terms of application services, the market has been segmented as Enterprise/desktop application, Web application, Mobile application, and Cloud application. On the basis of application type, the market has been segmented as Dynamic Application security testing(DAST)and Static Application Security Testing (SAST). In terms of deployment, the market has been segmented as on-premise and cloud. Cloud computing has also significantly enhanced market revenue in the last few years. On the basis of tools, the market has been bifurcated as Penetration testing tools, Automated testing tools, Code review tools, and Web testing tools. And in terms of the industry vertical, the market has been segmented as Retail, IT & Telecom, Healthcare & life sciences, BFSI, and Government & Public utilities. By network services, the market has been segmented as Virtual Private Network (VPN) testing, Intrusion Detection System, Intrusion Prevention System (IDS/IPS) testing, firewall testing and Universal Resource Locator (URL) / Unified Threat Management (UTM) testing.

MARKET PLAYER ANALYSIS

Major market players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These players include Cenzic, Cisco, McAfee, NT objectives, Accenture, Applause, Veracode, IBM Corporation, HP and White Hat Security. Other industries in this domain that are growing at a high CAGR include Wireless Network security Market and Smartphone security Market.

COVERAGE HIGHLIGHTS

• Market Revenue Estimation and Forecast (2022 – 2031)

• Market Sales Estimation and Forecast (2022 – 2031)

• Breakdown of Revenue by Segments (2022 – 2031)

• Breakdown of Sales by Segments (2022 – 2031)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Application Services Outlook ($Revenue, 2022-2031)

· Enterprise/desktop application

· Web application

· Mobile application

· Cloud application

By Application Type Outlook ($Revenue, 2022-2031)

· Dynamic Application security testing(DAST)

· Static Application Security Testing (SAST)

By Deployment Type Outlook ($Revenue, 2022-2031)

· On-premise

· Cloud

By Tools Outlook ($Revenue, 2022-2031)

· Penetration testing tools

· Automated testing tools

· Code review tools

· Web testing tools

By Industry verticals Outlook ($Revenue, 2022-2031)

· Retail

· IT & Telecom

· Healthcare & life sciences

· BFSI

· Government

· Public utilities

By Network Services Outlook ($Revenue, 2022-2031)

· Virtual Private Network (VPN) testing

· Intrusion Detection System

· Intrusion Prevention System (IDS/IPS) testing

· firewall testing

· Universal Resource Locator (URL) / Unified Threat Management (UTM) testing

By Regional Outlook ($Revenue and Unit Sales, 2022-2031)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• U.K

• France

• Netherlands

• Austria

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• South Korea

• Australia

• Rest of Asia Pacific

• The Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East

• Africa

• South America

• Brazil

• Argentina

• Rest of South America

Market Players

· Cenzic

· Cisco Systems Incorporated

· McAfee

· NT objectives

· Accenture

· Applause

· Veracode

· IBM Corporation

· HP

· White Hat Security

Need Report on a particular Country OR need a Tailored/Customized Research? Budget Limits/Price Discounts Query...!

Email to David Correa

OR Fill the below "Sample Request FORM" with your queries in the message box.

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. SECURITY TESTING MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL SECURITY TESTING MARKET DEMAND SIDE ANALYSIS

2.1. SECURITY TESTING MARKET CONSUMPTION VOLUME (BILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (BILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.6. SECURITY TESTING MARKET REVENUE SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL SECURITY TESTING MARKET SUPPLY SIDE ANALYSIS

3.1. SECURITY TESTING MARKET PRODUCTION VOLUME (BILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL SECURITY TESTING MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL SECURITY TESTING MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL SECURITY TESTING MARKET BY APPLICATION SERVICES

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY APPLICATION SERVICES, $BILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY APPLICATION SERVICES, BILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY APPLICATION SERVICES, BILLION UNITS, 2018 – 2025

6.4. ENTERPRISE/DESKTOP APPLICATION

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. WEB APPLICATION

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

6.6. MOBILE APPLICATION

6.6.1. Market determinants and trend analysis

6.6.2. Market revenue, sales and production volume, 2018 – 2025

6.7. CLOUD APPLICATION

6.7.1. Market determinants and trend analysis

6.7.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL SECURITY TESTING MARKET BY APPLICATION TYPE

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY APPLICATION TYPE, $BILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY APPLICATION TYPE, BILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY APPLICATION TYPE, BILLION UNITS, 2018 – 2025

7.4. DYNAMIC APPLICATION SECURITY TESTING (DAST)

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. STATIC APPLICATION SECURITY TESTING (SAST)

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL SECURITY TESTING MARKET BY DEPLOYMENT TYPE

8.1. SEGMENT OUTLINE

8.2. REVENUE SHARE BY DEPLOYMENT TYPE, $BILLION, 2018 – 2025

8.2. CONSUMPTION SHARE BY DEPLOYMENT TYPE, BILLION UNITS, 2018 - 2025

8.3. PRODUCTION SHARE BY DEPLOYMENT TYPE, BILLION UNITS, 2018 – 2025

8.4. ON PREMISE

8.4.1. Market determinants and trend analysis

8.4.2. Market revenue, sales and production volume, 2018 – 2025

8.5. CLOUD

8.5.1. Market determinants and trend analysis

8.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 9. GLOBAL SECURITY TESTING MARKET BY TOOLS

9.1. SEGMENT OUTLINE

9.2. REVENUE SHARE BY TOOLS, $BILLION, 2018 – 2025

9.2. CONSUMPTION SHARE BY TOOLS, BILLION UNITS, 2018 - 2025

9.3. PRODUCTION SHARE BY TOOLS, BILLION UNITS, 2018 – 2025

9.4. PENETRATION TESTING TOOLS

9.4.1. Market determinants and trend analysis

9.4.2. Market revenue, sales and production volume, 2018 – 2025

9.5. AUTOMATED TESTING TOOLS

9.5.1. Market determinants and trend analysis

9.5.2. Market revenue, sales and production volume, 2018 – 2025

9.6. CODE REVIEW TOOLS

9.6.1. Market determinants and trend analysis

9.6.2. Market revenue, sales and production volume, 2018 – 2025

9.7. WEB TESTING TOOLS

9.7.1. Market determinants and trend analysis

9.7.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 10. GLOBAL SECURITY TESTING MARKET BY INDUSTRY VERTICALS

10.1. SEGMENT OUTLINE

10.2. REVENUE SHARE BY INDUSTRY VERTICALS, $BILLION, 2018 – 2025

10.2. CONSUMPTION SHARE BY INDUSTRY VERTICALS, BILLION UNITS, 2018 - 2025

10.3. PRODUCTION SHARE BY INDUSTRY VERTICALS, BILLION UNITS, 2018 – 2025

10.4. RETAIL

10.4.1. Market determinants and trend analysis

10.4.2. Market revenue, sales and production volume, 2018 – 2025

10.5. IT & TELECOM

10.5.1. Market determinants and trend analysis

10.5.2. Market revenue, sales and production volume, 2018 – 2025

10.6. HEALTHCARE & LIFE SCIENCES

10.6.1. Market determinants and trend analysis

10.6.2. Market revenue, sales and production volume, 2018 – 2025

10.7. BFSI

10.7.1. Market determinants and trend analysis

10.7.2. Market revenue, sales and production volume, 2018 – 2025

10.8. GOVERNMENT

10.8.1. Market determinants and trend analysis

10.8.2. Market revenue, sales and production volume, 2018 – 2025

10.9. PUBLIC UTILITIES

10.9.1. Market determinants and trend analysis

10.9.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 11. GLOBAL SECURITY TESTING MARKET BY NETWORK SERVICES

11.1. SEGMENT OUTLINE

11.2. REVENUE SHARE BY NETWORK SERVICES, $BILLION, 2018 – 2025

11.2. CONSUMPTION SHARE BY NETWORK SERVICES, BILLION UNITS, 2018 - 2025

11.3. PRODUCTION SHARE BY NETWORK SERVICES, BILLION UNITS, 2018 – 2025

11.4. VIRTUAL PRIVATE NETWORK (VPN) TESTING

11.4.1. Market determinants and trend analysis

11.4.2. Market revenue, sales and production volume, 2018 – 2025

11.5. INTRUSION DETECTION SYSTEM

11.5.1. Market determinants and trend analysis

11.5.2. Market revenue, sales and production volume, 2018 – 2025

11.6. INTRUSION PREVENTION SYSTEM (IDS/IPS) TESTING

11.6.1. Market determinants and trend analysis

11.6.2. Market revenue, sales and production volume, 2018 – 2025

11.7. FIREWALL TESTING

11.7.1. Market determinants and trend analysis

11.7.2. Market revenue, sales and production volume, 2018 – 2025

11.8. UNIVERSAL RESOURCE LOCATOR (URL) / UNIFIED THREAT MANAGEMENT (UTM) TESTING

11.8.1. Market determinants and trend analysis

11.8.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 12. GLOBAL SECURITY TESTING MARKET BY REGIONS

12.1. REGIONAL OUTLOOK

12.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

12.3. NORTH AMERICA

12.3.1. Current Trends and Future Prospects

12.3.2. North America market revenue, sales and production volume, 2018 – 2025

12.3.3. U.S.

12.3.3.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.3.3.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.3.3.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.3.4. Canada

12.3.4.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.3.4.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.3.4.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.3.5. Mexico

12.3.5.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.3.5.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.3.5.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.4. EUROPE

12.4.1. Current Trends and Future Prospects

12.4.2. Europe market revenue, sales and production volume, 2018 – 2025

12.4.3. U.K

12.4.3.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.4.3.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.4.3.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.4.4. Germany

12.4.4.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.4.4.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.4.4.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.4.5. France

12.4.5.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.4.5.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.4.5.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.4.6. Italy

12.4.6.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.4.6.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.4.6.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.4.7. Rest of Europe

12.4.7.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.4.7.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.4.7.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.5. ASIA PACIFIC

12.5.1. Current Trends and Future Prospects

12.5.2. Europe market revenue, sales and production volume, 2018 – 2025

12.5.3. India

12.5.3.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.5.3.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.5.3.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.5.4. Japan

12.5.4.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.5.4.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.5.4.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.5.5. China

12.5.5.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.5.5.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.5.5.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.5.6. South Korea

12.5.6.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.5.6.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.5.6.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.5.7. Rest of APAC

12.5.7.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.5.7.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.5.7.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.6. REST OF THE WORLD

12.6.1. Current Trends and Future Prospects

12.6.2. Europe market revenue, sales and production volume, 2018 – 2025

12.6.3. Latin America

12.6.3.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.6.3.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.6.3.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.6.4. Middle East

12.6.4.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.6.4.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.6.4.3. Security Testing Market Production BILLION Units (2018 – 2025)

12.6.5. Africa

12.6.5.1. Security Testing Market Revenue $BILLION (2018 – 2025)

12.6.5.2. Security Testing Market Consumption BILLION Units (2018 – 2025)

12.6.5.3. Security Testing Market Production BILLION Units (2018 – 2025)

CHAPTER 13. KEY VENDOR PROFILES

13.1. Cenzic

13.1.1. Company overview

13.1.2. Portfolio Analysis

13.1.3. Estimated revenue from security testing business and market share

13.1.4. Regional & business segment Revenue Analysis

13.2. Cisco

13.2.1. Company overview

13.2.2. Portfolio Analysis

13.2.3. Estimated revenue from security testing business and market share

13.2.4. Regional & business segment Revenue Analysis

13.3. McAfee

13.3.1. Company overview

13.3.2. Portfolio Analysis

13.3.3. Estimated revenue from security testing business and market share

13.3.4. Regional & business segment Revenue Analysis

13.4. NT objectives

13.4.1. Company overview

13.4.2. Portfolio Analysis

13.4.3. Estimated revenue from security testing business and market share

13.4.4. Regional & business segment Revenue Analysis

13.5. Accenture

13.5.1. Company overview

13.5.2. Portfolio Analysis

13.5.3. Estimated revenue from security testing business and market share

13.5.4. Regional & business segment Revenue Analysis

13.6. Applause

13.6.1. Company overview

13.6.2. Portfolio Analysis

13.6.3. Estimated revenue from security testing business and market share

13.6.4. Regional & business segment Revenue Analysis

13.7. Veracode

13.7.1. Company overview

13.7.2. Portfolio Analysis

13.7.3. Estimated revenue from security testing business and market share

13.7.4. Regional & business segment Revenue Analysis

13.8. IBM Corporation

13.8.1. Company overview

13.8.2. Portfolio Analysis

13.8.3. Estimated revenue from security testing business and market share

13.8.4. Regional & business segment Revenue Analysis

13.9. HP

13.9.1. Company overview

13.9.2. Portfolio Analysis

13.9.3. Estimated revenue from security testing business and market share

13.9.4. Regional & business segment Revenue Analysis

13.10. White Hat Security

13.10.1. Company overview

13.10.2. Portfolio Analysis

13.10.3. Estimated revenue from security testing business and market share

13.10.4. Regional & business segment Revenue Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved