Weight Loss and Obesity Management Market

Weight Loss and Obesity Management market is segmented by Diet (meals, beverages, and supplements), equipment (Fitness Equipment, and Surgical Equipment), service (Fitness center and health clubs, slimming centers and commercial weight loss center, consulting services, and online weight loss programs) and region (United States, Canada, Mexico, France, Germany, Italy, Spain, United Kingdom, Russia, China, India, Philippines, Malaysia, Australia, Austria, South Korea, Middle East, Japan, Africa and Rest of World)

- Report ID : MD1670 |

- Pages : 200 |

- Tables : 88 |

- Formats :

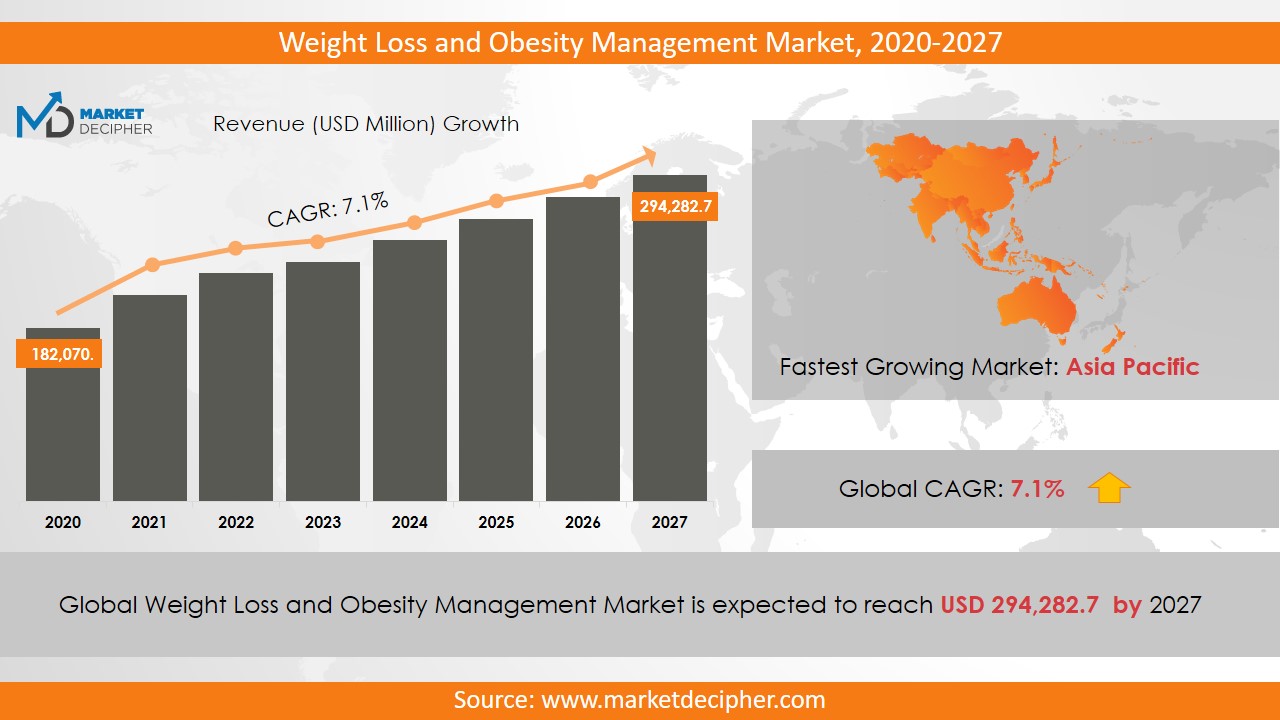

Weight Loss and Obesity Management Market size was estimated at $182,070 Million in 2019 and is expected to reach $294,282.7 Million by 2027, growing at a CAGR of 7.1% during the forecast period of 2020 to 2027.

Weight Loss and Obesity Management Market Growth Factors

Recent years have seen sedentary lifestyles and poor eating habits contribute to the obesity epidemic. Nearly 1.9 billion adults were obese or overweight in 2018, with 650 million children facing health issues. This huge number of the population facing health issues is driving the growth of the weight loss and obesity management market. Obesity further impacts health in several ways, including being associated with chronic diseases (such as heart disease, obstructive sleep disorder, osteoarthritis, depression, cancer, and high blood pressure), resulting in a decline in life expectancy, which is likely to accelerate the overall market growth. The increasing preference for junk foods across the world is also expected to drive market growth. The market is bolstered as well by factors such as, physical inactivity, hectic routine, and growing stress. Further, the rising number of bariatric surgeries, surging fitness center numbers, the growing popularity of online weight loss and weight management programs, and the rising disposable income in developing economies as well as the expanding healthcare sector will also contribute to market growth.

Social security lockdowns and isolation restrictions were implemented following the COVID-19 outbreak. Consequently, the supply chain was stifled, technology conferences were cancelled, sales and production decreased, and new developments were stopped, leading to a weaker market. In spite of this, the market grew moderately thanks to an increase in online sales and online programs. Industrial operations are also being automated to decrease the number of employees. Automating repetitive processes, such as assembly lines, has gained attention during the epidemic, as has autonomous materials movement and predictive maintenance. Although most companies allow their employees to work from home, this will lead to significantly reduced physical activity, which will lead to weight gain and other related problems, which will allow weight loss and obesity management to thrive in the next few years. Moreover, manufacturers are focusing on the latest developments, innovations, and market trends that will accelerate the growth of the market.

Weight Loss and Obesity Management Market Segmentation

By 2032, the market will surpass USD 3,844.4 million, representing a CAGR of 7.9% during the forecast period of 2022-2032. Despite the surge in obese populations and increased consumption of dietary supplements across a range of economies, the "dietary supplements" segment will be the largest diet segment in the weight loss and obesity management market within the forecasted period. Dietary supplements, meals, and beverages compose the diet segment of the market. Among dietary supplements, there are four subcategories: proteins, fibers, green tea extract, and conjugated linoleic acid. There are sub-categories of meals including meal replacements, low-calorie sweeteners, low-calorie food, and organic food. Slimming water, herbal tea, diet soft drinks, and other low-calorie beverages are among the sub-segments of beverages.

Increasing obesity rates and increased consumption of dietary supplements across all economies are expected to drive growth in the dietary supplement segment. Depending on the equipment, the weight loss and obesity management market is divided into fitness equipment, strength training equipment, fitness monitoring equipment, cardiovascular training equipment, body composition analysis equipment, minimally invasive surgical equipment, surgical equipment, and non-invasive surgical equipment. There are several types of cardiovascular training equipment, including treadmills, stationary bikes, elliptical trainers, stair steppers, rowing machines, and other cardiovascular training equipment. Under strength training equipment, there are single-station, benches, plate-loaded, and racks, multi-station, free weights, and accessories. Surgical equipment for minimally invasive procedures is classified into laparoscopic sleeve gastrectomy, gastric bypass, gastric banding, duodenal switch, biliopancreatic diversion, and revision surgery. In non-invasive surgical equipment, there are intragastric balloon systems, endobarriers, endosutures, and stomaphyxes.

Weight Loss and Obesity Management Market Share and Competition

Herbalife Ltd., Atkins Nutritional, Inc., Nutrisystem Ltd., and Kellogg Company are some of the top players contributing significantly to the weight loss and weight management market. Covidien, plc., Ethicon, Inc., Apollo Endosurgery, and Olympus Corporation rank among the major players in the surgical equipment market, while Brunswick Corporation, Amer Sports, Ltd., Cybex International, Johnson Health Technology, and Technogym offer fitness equipment. In recent years, Brunswick dominated the market for weight loss and weight management fitness equipment. The company introduced the Integrity Series cardio line, which featured treadmills, elliptical cross-trainers, and upright and recumbent. Brunswick gained access to opportunities in weight loss and weight management by acquiring Cybex.

Report Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue and unit sales (2018 – 2032)

• Data breakdown for every market segment (2018 – 2032)

• Gross margin and profitability analysis of companies

• Price analysis of each product type

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategy

Industry Segmentation and Revenue Breakdown

Diet Analysis (Revenue, USD Million, 2018 - 2032)

• Meals

o Meal Replacements

o Low-calorie Sweeteners

o Low-calorie Food

o Organic Food

• Beverages

o Diet Soft Drinks

o Herbal Tea

o Slimming Water

o Other Low-calorie Beverages

• Supplements

o Protein

o Fiber

o Green Tea Extract

o Conjugate Linoleic Acid

Equipment Analysis (Revenue, USD Million, 2018 - 2032)

• Fitness Equipment

• Cardiovascular Training Equipment

o Treadmills

o Elliptical Trainers

o Stationary Cycles

o Rowing Machines

o Stair Steppers

o Other Cardiovascular Training Equipment

• Strength Training Equipment

o Single-station Equipment

o Plate-loaded Equipment

o Benches and Racks

o Multistation Equipment

o Free Weights

o Accessories

• Fitness Monitoring Equipment

• Body Composition Analyzers

• Surgical Equipment

• Minimally Invasive Surgical Equipment

o Gastric Bypass Equipment

o Laparoscopic Sleeve Gastrectomy Equipment

o Laparoscopic Adjustable Gastric Banding Systems

o Biliopancreatic Diversion Surgery/Duodenal Switch Equipment

o Revision Surgery Equipment

• Noninvasive surgical equipment

o Intragastric Balloon Systems

o EndoBarrier

o Endosuturing Devices

o StomaphyX

Service Analysis (Revenue, USD Million, 2018 - 2032)

• Fitness Centers

• Slimming Centers

• Consulting Services

• Online Weight Loss Programs

Region Analysis (Revenue, USD Million, 2018 - 2032)

• United States

• Canada

• Mexico

• France

• Germany

• Italy

• Spain

• United Kingdom

• Russia

• China

• India

• Philippines

• Malaysia

• Australia

• Austria

• South Korea

• Middle East

• Japan

• Africa

• Rest of World

Weight Loss and Obesity Management Market Companies

• Atkins Nutritionals, Inc. (US)

• Herbalife Ltd. (US)

• Nutrisystem Ltd. (US)

• Kellogg Company (US)

• Ethicon, Inc. (US)

• Covidien, plc. (US)

• Apollo Endosurgery (US)

• Olympus Corporation (Olympus) (Japan)

• Weight Watchers International (US)

• Jenny Craig (US)

• eDiets.com (US)

• The Gold’s Gym International (US)

• Brunswick Corporation (US)

• Amer Sports (Finland)

• Johnson Health Tech (Taiwan)

• Technogym SpA (Italy)

Available Versions:-

United States Weight Loss and Obesity Management Market Industry Research Report

Europe Weight Loss and Obesity Management Market Industry Research Report

Asia Pacific Weight Loss and Obesity Management Market Industry Research Report

With increased awareness towards healthcare facilities, and improvised lifestyle have driven people towards weight loss and obesity management. Surmounting work pressure and decreased time for self-care has led to adversities in body shapes of the youth, however, with a proper management and implementation system, weight loss can be made possible and a better lifestyle can be followed. Certified experts and dieticians play as an intermediate to the user at high-end, with proper consultations and diet plan which also includes the form of exercises that suits ones body type are leading factors which has rendered people to tend themselves with Weight loss and Obesity Management Market. Losing weight doesnt always link to appearance, Obesity can even lead to chronic diseases within the due course of time. The treatment of these diseases require huge sums of money and to avoid such consequences, people believe that adapting to Weight loss management systems is a much better choice in the long haul. On the contrary, the extravagant process of weight-loss programs and post programs along with dietary plans culminate to produce a huge expenditure which is usually not affordable by all. The market also incurs dieticians and experts who take advantage of their entitlement and offer deceptive strategies and call it as a low-calorie diet, this way they con people and decline the name of the whole market. However, Verifications of all experts in the system and implementing more organized and proficient functioning will help in surging back more customers in the global market.

Gelesis, a major Biotechnology company, has announced its partnership with China Medical Systems on 18 June 2020. The partnership introduced a Weight Loss pill named ‘Plenity’. The pill was approved in April 2019 and Gelesis is the main manufacturer for this product. Boris Johnson made an obesity crackdown and is set to launch a new drive to tackle Britain’s increasing Obesity crisis as the situation may worsen due to Covid-19.

Visus Inc., a Biopharma company, has launched a new anti-obesity drug named ‘Qsymia’ on 19 February 2020. This launch took place in the Republic of South Korea. The CEO of the multinational pharma company Visus Inc. said, “We believe that Qsymia has significant unrealized clinical and commercial value, and the South Korean launch of this important tool for helping patients achieve and maintain a healthy body-mass index will advance our strategy for unlocking this potential.” Nutrisystems, a Tech-Health company, has launched a new personal weight loss plan on 26 December 2019. They envision to have an impact on the weight loss plans across the globe with their new platform ‘NuMi’.

Need Report on a particular Country OR need a Tailored/Customized Research? Budget Limits/Price Discounts Query...!

Email to David Correa

OR Fill the below "Sample Request FORM" with your queries in the message box.

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved