- Report ID : MD1040 |

- Pages : 97 |

- Tables : 86 |

- Formats :

Email sales@marketdecipher.com

Contact +91 6201075429

By Technology (Camera, Radar, and Ultrasound), By Application ( Forward Collision Warming System and Parking Assistance), By Region (North America, Europe, APAC and Rest of the World)

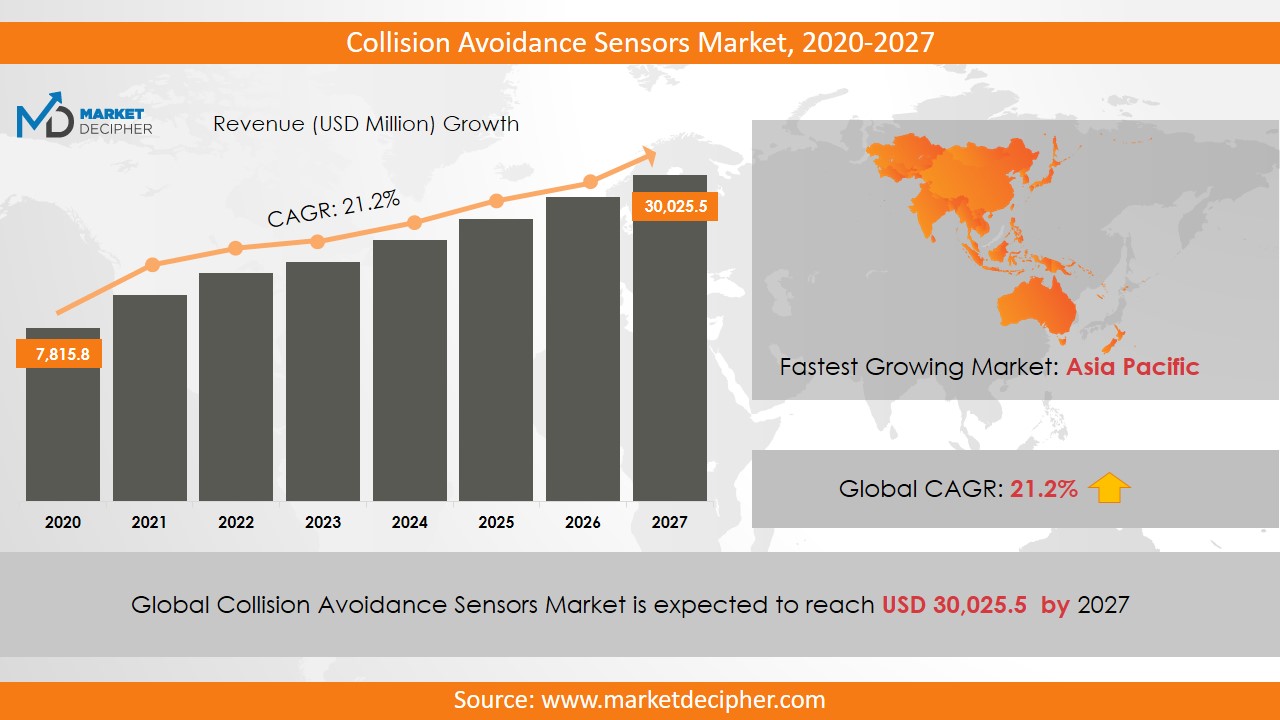

Collisions Avoidance Sensors market revenue shall reach a value of $14.26 Billion in 2026, growing with a CAGR of 20.12% during the forecast period of 2018 to 2026. In terms of volume sales, the market is anticipated to reach XX Units.

The collision avoidance system is a motor vehicle system, also known as the pre-accident system with the main purpose of reducing the severity of the collision. The increasing trend of technologies like radar, camera, ultrasound, and LIDAR and the heavy investments by automobile industry on sensors to avoid accidents and to achieve high performance and safety measures is driving the market growth. In this way, the automobile industry, which avoids confrontation, is making great contributions to increasing the collisions avoidance market size. Due to rising living standards of consumers, in recent years there has been a significant increase in collision prevention sensor market sales. Also, the number of accidents is increasing rapidly, due to which there is a high demand for safeguards while driving.

In 2016, a report by Insurance Institute for Highway Safety and National Highway Traffic Safety Administration stated that about 99% of automobile manufacturers in the US will be including the collisions avoidance sensors to their automobiles throughout the forecast period. It is estimated that the use of these sensors in automobile industries will reduce the number of collisions significantly. Many advanced features of Collision avoidance sensors such as associated vehicles, automatic parking, etc. attract more industries and consumers. However, the high cost of these sensors may limit the market growth to a certain extent. Increasing awareness about safety and security in the automotive sector to avoid any conflict shall affect the development of the sensor market trend positively.

US is expected to invest spectacularly in the collisions avoidance sensors market:

The North American region has contributed substantially in 2018 owing to the stringent government rules to provide better passenger experience and is anticipated to continue the same trend over the forecast period. Due to similar reasons, the Asia Pacific region is anticipated to increase the collisions avoidance sensors market size significantly over the forecast period. Further, owing to the increase in purchasing power of the consumers, increasing sales of luxury cars and enhanced standards of living will increase the collisions avoidance sensors market sale in this region over the forecast period.

INDUSTRIAL SEGMENTS ANALYSIS:

In terms of technology, the segmentation has been done as a camera, radar, and ultrasound. Ultrasound systems are cheaper and the LiDAR-based anti-collision sensors provide a detailed view and can draw pictures with their description. However, LiDAR sensors are of high cost and a large space of the vehicle is also required for installation. The radar segment has shown its dominance in terms of revenue and is estimated to continue the same trend over the forecast period. Based on application, the collisions avoidance sensors market report provides a deep analysis of forwarding collision warning system and parking assistance. The forward collision warning system dominated over the collisions avoidance sensors market shares in 2018. In terms of geography, the bifurcation can be done as North America, Asia Pacific, Europe and the Rest of the World.

MARKET PLAYER ANALYSIS:

Major market players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These market players include Robert Bosch GmbH, Delphi Automotive, NXP Semiconductors, Continental AG, Murata Manufacturing Corporation Limited, Takata Corporation, Panasonic Corporation, Sensata Technologies Incorporated, Infineon Technologies AG and Texas Instruments Incorporated. Other industries in this domain that is growing at a high CAGR include Magnetic Sensor Market and Gas Sensor Market.

COVERAGE HIGHLIGHTS

• Market Revenue Estimation and Forecast (2018 – 2026)

• Market Production Estimation and Forecast (2018 – 2026)

• Market Sales/Consumption Volume Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production by Segments (2018 – 2026)

• Breakdown of Sales Volume by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Technology Outlook ($Revenue and Unit Sales, 2018-2026)

• Camera

• Radar

• Ultrasound

By Application Outlook ($Revenue and Unit Sales, 2018-2026)

• The forward collision warning system

• Parking assistance

By Regional Outlook ($Revenue and Unit Sales, 2018-2026)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• France

• U.K

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• Rest of Asia Pacific

• Rest of the world

• Middle East

• Africa

• Latin America

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. COLLISIONS AVOIDANCE SENSORS MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL COLLISIONS AVOIDANCE SENSORS MARKET DEMAND SIDE ANALYSIS

2.1. COLLISIONS AVOIDANCE SENSORS MARKET CONSUMPTION VOLUME (BILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (BILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.6. COLLISIONS AVOIDANCE SENSORS MARKET REVENUE SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL COLLISIONS AVOIDANCE SENSORS MARKET SUPPLY SIDE ANALYSIS

3.1. COLLISIONS AVOIDANCE SENSORS MARKET PRODUCTION VOLUME (BILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL COLLISIONS AVOIDANCE SENSORS MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL COLLISIONS AVOIDANCE SENSORS MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL COLLISIONS AVOIDANCE SENSORS MARKET BY TECHNOLOGY

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY TECHNOLOGY, $BILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY TECHNOLOGY, BILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY TECHNOLOGY, BILLION UNITS, 2018 – 2025

6.4. CAMERA

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. RADAR

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

6.6. ULTRASOUND

6.6.1. Market determinants and trend analysis

6.6.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL COLLISIONS AVOIDANCE SENSORS MARKET BY APPLICATION

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY APPLICATION, $BILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY APPLICATION, BILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY APPLICATION, BILLION UNITS, 2018 – 2025

7.4. FORWARD COLLISION WARNING SYSTEM

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. PARKING ASSISTANCE

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL COLLISIONS AVOIDANCE SENSORS MARKET BY REGIONS

8.1. REGIONAL OUTLOOK

8.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

8.3. NORTH AMERICA

8.3.1. Current Trends and Future Prospects

8.3.2. North America market revenue, sales and production volume, 2018 – 2025

8.3.3. U.S.

8.3.3.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.3.3.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.3.3.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.3.4. Canada

8.3.4.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.3.4.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.3.4.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.3.5. Mexico

8.3.5.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.3.5.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.3.5.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.4. EUROPE

8.4.1. Current Trends and Future Prospects

8.4.2. Europe market revenue, sales and production volume, 2018 – 2025

8.4.3. U.K

8.4.3.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.4.3.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.4.3.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.4.4. Germany

8.4.4.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.4.4.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.4.4.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.4.5. France

8.4.5.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.4.5.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.4.5.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.4.6. Italy

8.4.6.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.4.6.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.4.6.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.4.7. Rest of Europe

8.4.7.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.4.7.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.4.7.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.5. ASIA PACIFIC

8.5.1. Current Trends and Future Prospects

8.5.2. Europe market revenue, sales and production volume, 2018 – 2025

8.5.3. India

8.5.3.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.5.3.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.5.3.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.5.4. Japan

8.5.4.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.5.4.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.5.4.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.5.5. China

8.5.5.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.5.5.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.5.5.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.5.6. South Korea

8.5.6.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.5.6.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.5.6.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.5.7. Rest of APAC

8.5.7.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.5.7.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.5.7.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.6. REST OF THE WORLD

8.6.1. Current Trends and Future Prospects

8.6.2. Europe market revenue, sales and production volume, 2018 – 2025

8.6.3. Latin America

8.6.3.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.6.3.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.6.3.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.6.4. Middle East

8.6.4.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.6.4.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.6.4.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

8.6.5. Africa

8.6.5.1. Collisions Avoidance Sensors Market Revenue $BILLION (2018 – 2025)

8.6.5.2. Collisions Avoidance Sensors Market Consumption BILLION Units (2018 – 2025)

8.6.5.3. Collisions Avoidance Sensors Market Production BILLION Units (2018 – 2025)

CHAPTER 9. KEY VENDOR PROFILES

9.1. Robert Bosch GmbH

9.1.1. Company overview

9.1.2. Portfolio Analysis

9.1.3. Estimated revenue from collisions avoidance sensors business and market share

9.1.4. Regional & business segment Revenue Analysis

9.2. Delphi Automotive

9.2.1. Company overview

9.2.2. Portfolio Analysis

9.2.3. Estimated revenue from collisions avoidance sensors business and market share

9.2.4. Regional & business segment Revenue Analysis

9.3. NXP Semiconductors

9.3.1. Company overview

9.3.2. Portfolio Analysis

9.3.3. Estimated revenue from collisions avoidance sensors business and market share

9.3.4. Regional & business segment Revenue Analysis

9.4. Continental AG

9.4.1. Company overview

9.4.2. Portfolio Analysis

9.4.3. Estimated revenue from collisions avoidance sensors business and market share

9.4.4. Regional & business segment Revenue Analysis

9.5. Murata Manufacturing Corporation Limited

9.5.1. Company overview

9.5.2. Portfolio Analysis

9.5.3. Estimated revenue from collisions avoidance sensors business and market share

9.5.4. Regional & business segment Revenue Analysis

9.6. Takata Corporation

9.6.1. Company overview

9.6.2. Portfolio Analysis

9.6.3. Estimated revenue from collisions avoidance sensors business and market share

9.6.4. Regional & business segment Revenue Analysis

9.7. Panasonic Corporation

9.7.1. Company overview

9.7.2. Portfolio Analysis

9.7.3. Estimated revenue from collisions avoidance sensors business and market share

9.7.4. Regional & business segment Revenue Analysis

9.8. Sensata Technologies Incorporated

9.8.1. Company overview

9.8.2. Portfolio Analysis

9.8.3. Estimated revenue from collisions avoidance sensors business and market share

9.8.4. Regional & business segment Revenue Analysis

9.9. Infineon Technologies AG

9.9.1. Company overview

9.9.2. Portfolio Analysis

9.9.3. Estimated revenue from collisions avoidance sensors business and market share

9.9.4. Regional & business segment Revenue Analysis

9.10. Texas Instruments Incorporated

9.10.1. Company overview

9.10.2. Portfolio Analysis

9.10.3. Estimated revenue from collisions avoidance sensors business and market share

9.10.4. Regional & business segment Revenue Analysis

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Please fill in the form below to Request for free Sample Report

Office Hours Mon - Sat 10:00 - 16:00

Call Us +91 6201075429

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved