DNS, DHCP AND IPAM market

By Component (Software and Hardware), By service (Integrated, Managed and Overlay DDI services), By Infrastructure (On-Premise and Cloud), By Version (IPv4 and IPv6), By Application (Mobile Computers, Wireless Communication Devices, IP Telephony, Virtual machines and POS Terminals), By End-Use (Large enterprises and SMBs), By Region (North America, Europe, APAC and Rest of the World)

- Report ID : MD1082 |

- Pages : 194 |

- Tables : 96 |

- Formats :

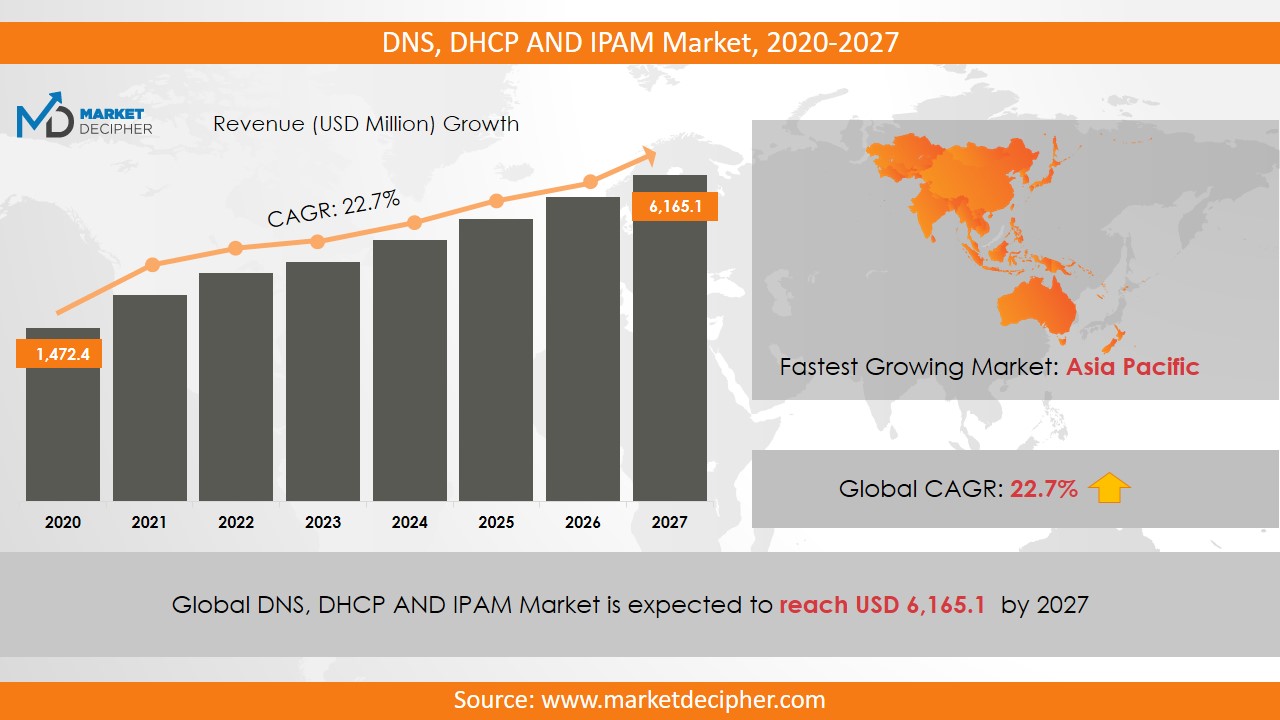

The DNS, DHCP and IPAM market is anticipated to witness tremendous growth in its revenue owing to the huge demand for IP devices nowadays. Due to the increase in cyber-attacks and increasing vulnerability to confidential information, various industries have adopted cloud for securing and storing their data. However, due to the high adoption of cloud and increasing data stored on the cloud, this application has become more vulnerable to threats. Hence, the enhanced use of cloud computing is one of the major factors driving the DNS, DHCP and IPAM market shares.

DNS, DHCP and IPA market revenue shall reach a value of $3.8 Billion in 2031, growing with a CAGR of 20.16% during the forecast period of 2022 to 2031.

The financial sector widely uses internet services to work and for communication purpose which is further making their confidential data and information more vulnerable and thereby contributing to expanding the DNS, DHCP and IPAM market size. The prominent trends such as increasing use of the Internet of Things, increasing demand for BYOD policy and the growing cyber-attacks on DNS server are the major factors which are anticipated responsible for the market to show a tremendous growth over the forecast period. DDI helps in automating distribution and management of private network operations. It can reduce the cost of operation of DNS, DHCP, and IPAM by 50%. DDI helps in the efficient management of electronic equipment and enhances profit and is, therefore, being adopted by several industries. Financial services make heavy use of Internet services because they depend on the internet to provide services as a result of which, the continuation of the service is needed, and thus security is the most important aspect.

REGIONAL ANALYSIS

The North America region is estimated to account for more than 54% of the total revenue of the market in 2022 owing to the increasing use of the Internet of Things in the region. Further, the Asia Pacific region is expected to show a significant rate over the forecast period.

SEGMENT ANALYSIS

Based on components, the market has been segmented as software and hardware. In terms of version, the market has been segmented as IPv6 and IPv4. Based on infrastructure, the market has been segmented as on-premise and cloud. Based on services, the market has been segmented as integrated, managed and overlay DDI services. Major application areas are Mobile Computers, Wireless Communication Devices, IP Telephony, Virtual machines, and POS Terminals. The mobile computer segment has grown significantly and is anticipated to attain a CAGR of more than 23% over the forecast period. Major end-use industries are large enterprises and SMBs. The large enterprise segment dominated the market revenue and hold over 82% of the total market revenue.

E-learning technology is seeing a significant increase in recent years. With the help of this technology, training practice in many industries has become very easy. The IT sector is increasing the markets growth due to enhancing e-learning technologies. The DDI network enables the financial sector to provide services more efficiently by eliminating services and hence support the business.

INDUSTRY PLAYER ANALYSIS

Major industry players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These industry players include Infoblox, BT Diamond, SolarWinds Incorporated, BlueCat, Fusion Layer, Applian Sys Limited, Incognito Software Systems Incorporated, Microsoft Corporation, Men & Mice, Alcatel-Lucent, Efficient IP, and INVETICO. Various industry players are adopting new strategies to expand the DNS, DHCP and IPAM business size. Other industries in this domain that are growing at a high CAGR include Device Vulnerability Management Market and Software Defined Storage Market.

COVERAGE HIGHLIGHTS

• Revenue Estimation and Forecast (2022 – 2031)

• Sales Estimation and Forecast (2022 – 2031)

• Breakdown of Revenue by Segments (2022 – 2031)

• Breakdown of Sales by Segments (2022 – 2031)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Regional Analysis and Data Breakdown

SEGMENTAL ANALYSIS

By Component Outlook ($Revenue, 2022-2031)

· Software

· Hardware

By Service Outlook ($Revenue, 2022-2031)

· Integrated service

· Managed Service

· Overlay DDI Service

By Infrastructure Outlook ($Revenue,2022-2031)

· Cloud

· On-premise

By Version Outlook ($Revenue,2022-2031)

• IPv6

• IPv4

By Application Outlook ($Revenue, 2022-2031)

· Mobile Computers

· Wireless Communication Devices

· IP Telephony

· Virtual machines

· POS Terminals

By End-Use Outlook ($Revenue,2022-2031)

· Large enterprise

· SMBs

By Regional Outlook ($Revenue and Unit Sales, 2022-2031)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• U.K

• France

• Netherlands

• Austria

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• South Korea

• Australia

• Rest of Asia Pacific

• The Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East

• Africa

• South America

• Brazil

• Argentina

• Rest of South America

INDUSTRY PLAYERS ANALYSIS:

· Infoblox

· BT Diamond

· SolarWinds Incorporated

· BlueCat

· Fusion Layer

· ApplianSys Limited

· Incognito Software Systems Incorporated

· Microsoft Corporation

· Men & Mice

· Alcatel-Lucent

· Efficient IP

· INVETICO

Need Report on a particular Country OR need a Tailored/Customized Research? Budget Limits/Price Discounts Query...!

Email to David Correa

OR Fill the below "Sample Request FORM" with your queries in the message box.

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. DNS, DHCP AND IPAM MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL DNS, DHCP AND IPAM MARKET DEMAND SIDE ANALYSIS

2.1. DNS, DHCP AND IPAM MARKET CONSUMPTION VOLUME (BILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (BILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.6. DNS, DHCP AND IPAM MARKET REVENUE SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL DNS, DHCP AND IPAM MARKET SUPPLY SIDE ANALYSIS

3.1. DNS, DHCP AND IPAM MARKET PRODUCTION VOLUME (BILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL DNS, DHCP, AND IPAM MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL DNS, DHCP, AND IPAM MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL DNS, DHCP AND IPAM MARKET BY COMPONENT

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY COMPONENT, $BILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY COMPONENT, BILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY COMPONENT, BILLION UNITS, 2018 – 2025

6.4. SOFTWARE

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. HARDWARE

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL DNS, DHCP AND IPAM MARKET BY SERVICE

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY SERVICE, $BILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY SERVICE, BILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY SERVICE, BILLION UNITS, 2018 – 2025

7.4. INTEGRATED SERVICE

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. MANAGED SERVICE

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

7.6. OVERLAY DDI SERVICE

7.6.1. Market determinants and trend analysis

7.6.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL DNS, DHCP AND IPAM MARKET BY INFRASTRUCTURE

8.1. SEGMENT OUTLINE

8.2. REVENUE SHARE BY INFRASTRUCTURE, $BILLION, 2018 – 2025

8.2. CONSUMPTION SHARE BY INFRASTRUCTURE, BILLION UNITS, 2018 - 2025

8.3. PRODUCTION SHARE BY INFRASTRUCTURE, BILLION UNITS, 2018 – 2025

8.4. CLOUD

8.4.1. Market determinants and trend analysis

8.4.2. Market revenue, sales and production volume, 2018 – 2025

8.5. ON PREMISE

8.5.1. Market determinants and trend analysis

8.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 9. GLOBAL DNS, DHCP AND IPAM MARKET BY VERSION

9.1. SEGMENT OUTLINE

9.2. REVENUE SHARE BY VERSION, $BILLION, 2018 – 2025

9.2. CONSUMPTION SHARE BY VERSION, BILLION UNITS, 2018 - 2025

9.3. PRODUCTION SHARE BY VERSION, BILLION UNITS, 2018 – 2025

9.4. IPv6

9.4.1. Market determinants and trend analysis

9.4.2. Market revenue, sales and production volume, 2018 – 2025

9.5. IPv4

9.5.1. Market determinants and trend analysis

9.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 10. GLOBAL DNS, DHCP AND IPAM MARKET BY APPLICATION

10.1. SEGMENT OUTLINE

10.2. REVENUE SHARE BY APPLICATION, $BILLION, 2018 – 2025

10.2. CONSUMPTION SHARE BY APPLICATION, BILLION UNITS, 2018 - 2025

10.3. PRODUCTION SHARE BY APPLICATION, BILLION UNITS, 2018 – 2025

10.4. MOBILE COMPUTERS

10.4.1. Market determinants and trend analysis

10.4.2. Market revenue, sales and production volume, 2018 – 2025

10.5. WIRELESS COMMUNICATION DEVICES

10.5.1. Market determinants and trend analysis

10.5.2. Market revenue, sales and production volume, 2018 – 2025

10.6. IP TELEPHONY

10.6.1. Market determinants and trend analysis

10.6.2. Market revenue, sales and production volume, 2018 – 2025

10.7. VIRTUAL MACHINES

10.7.1. Market determinants and trend analysis

10.7.2. Market revenue, sales and production volume, 2018 – 2025

10.8. POS TERMINALS

10.8.1. Market determinants and trend analysis

10.8.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 11. GLOBAL DNS, DHCP AND IPAM MARKET BY END-USE

11.1. SEGMENT OUTLINE

11.2. REVENUE SHARE BY END-USE, $BILLION, 2018 – 2025

11.2. CONSUMPTION SHARE BY END-USE, BILLION UNITS, 2018 - 2025

11.3. PRODUCTION SHARE BY END-USE, BILLION UNITS, 2018 – 2025

11.4. LARGE ENTERPRISE

11.4.1. Market determinants and trend analysis

11.4.2. Market revenue, sales and production volume, 2018 – 2025

11.5. SMBs

11.5.1. Market determinants and trend analysis

11.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 12. GLOBAL DNS, DHCP AND IPAM MARKET BY REGIONS

12.1. REGIONAL OUTLOOK

12.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

12.3. NORTH AMERICA

12.3.1. Current Trends and Future Prospects

12.3.2. North America market revenue, sales and production volume, 2018 – 2025

12.3.3. The U.S.

12.3.3.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.3.3.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.3.3.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.3.4. Canada

12.3.4.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.3.4.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.3.4.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.3.5. Mexico

12.3.5.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.3.5.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.3.5.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.4. EUROPE

12.4.1. Current Trends and Future Prospects

12.4.2. Europe market revenue, sales and production volume, 2018 – 2025

12.4.3. U.K

12.4.3.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.4.3.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.4.3.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.4.4. Germany

12.4.4.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.4.4.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.4.4.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.4.5. France

12.4.5.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.4.5.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.4.5.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.4.6. Italy

12.4.6.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.4.6.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.4.6.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.4.7. Rest of Europe

12.4.7.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.4.7.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.4.7.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.5. ASIA PACIFIC

12.5.1. Current Trends and Future Prospects

12.5.2. Europe market revenue, sales and production volume, 2018 – 2025

12.5.3. India

12.5.3.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.5.3.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.5.3.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.5.4. Japan

12.5.4.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.5.4.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.5.4.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.5.5. China

12.5.5.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.5.5.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.5.5.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.5.6. South Korea

12.5.6.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.5.6.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.5.6.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.5.7. Rest of APAC

12.5.7.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.5.7.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.5.7.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.6. REST OF THE WORLD

12.6.1. Current Trends and Future Prospects

12.6.2. Europe market revenue, sales and production volume, 2018 – 2025

12.6.3. Latin America

12.6.3.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.6.3.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.6.3.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.6.4. Middle East

12.6.4.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.6.4.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.6.4.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

12.6.5. Africa

12.6.5.1. DNS, DHCP and IPAM Market Revenue $BILLION (2018 – 2025)

12.6.5.2. DNS, DHCP and IPAM Market Consumption BILLION Units (2018 – 2025)

12.6.5.3. DNS, DHCP and IPAM Market Production BILLION Units (2018 – 2025)

CHAPTER 13. KEY VENDOR PROFILES

13.1. Infoblox

13.1.1. Company overview

13.1.2. Portfolio Analysis

13.1.3. Estimated revenue from DNS, DHCP and IPAM business and market share

13.1.4. Regional & business segment Revenue Analysis

13.2. BT Diamond

13.2.1. Company overview

13.2.2. Portfolio Analysis

13.2.3. Estimated revenue from DNS, DHCP and IPAM business and market share

13.2.4. Regional & business segment Revenue Analysis

13.3. SolarWinds Incorporated

13.3.1. Company overview

13.3.2. Portfolio Analysis

13.3.3. Estimated revenue from DNS, DHCP and IPAM business and market share

13.3.4. Regional & business segment Revenue Analysis

13.4. BlueCat

13.4.1. Company overview

13.4.2. Portfolio Analysis

13.4.3. Estimated revenue from DNS, DHCP and IPAM business and market share

13.4.4. Regional & business segment Revenue Analysis

13.5. Fusion Layer

13.5.1. Company overview

13.5.2. Portfolio Analysis

13.5.3. Estimated revenue from DNS, DHCP and IPAM business and market share

13.5.4. Regional & business segment Revenue Analysis

13.6. Applian Sys Limited

13.6.1. Company overview

13.6.2. Portfolio Analysis

13.6.3. Estimated revenue from DNS, DHCP and IPAM business and market share

13.6.4. Regional & business segment Revenue Analysis

13.7. Incognito Software Systems Incorporated

13.7.1. Company overview

13.7.2. Portfolio Analysis

13.7.3. Estimated revenue from DNS, DHCP and IPAM business and market share

13.7.4. Regional & business segment Revenue Analysis

13.8. Microsoft Corporation

13.8.1. Company overview

13.8.2. Portfolio Analysis

13.8.3. Estimated revenue from DNS, DHCP and IPAM business and market share

13.8.4. Regional & business segment Revenue Analysis

13.9. Men & Mice

13.9.1. Company overview

13.9.2. Portfolio Analysis

13.9.3. Estimated revenue from DNS, DHCP and IPAM business and market share

13.9.4. Regional & business segment Revenue Analysis

13.10. Alcatel-Lucent

13.10.1. Company overview

13.10.2. Portfolio Analysis

13.10.3. Estimated revenue from DNS, DHCP and IPAM business and market share

13.10.4. Regional & business segment Revenue Analysis

13.11. Efficient IP

13.11.1. Company overview

13.11.2. Portfolio Analysis

13.11.3. Estimated revenue from DNS, DHCP and IPAM business and market share

13.11.4. Regional & business segment Revenue Analysis

13.12. INVETICO

13.12.1. Company overview

13.12.2. Portfolio Analysis

13.12.3. Estimated revenue from DNS, DHCP and IPAM business and market share

13.12.4. Regional & business segment Revenue Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved