- Report ID : MD1031 |

- Pages : 189 |

- Tables : 84 |

- Formats :

Email sales@marketdecipher.com

Contact +91 6201075429

By Display (PMOLED and AMOLED), By Application (Notebooks, Monitor, Television, Tablets, Smartphone’s, Automotive and Others), By End- Use (Residential, Commercial and Industrial, By Region (North America, Europe, and APAC)

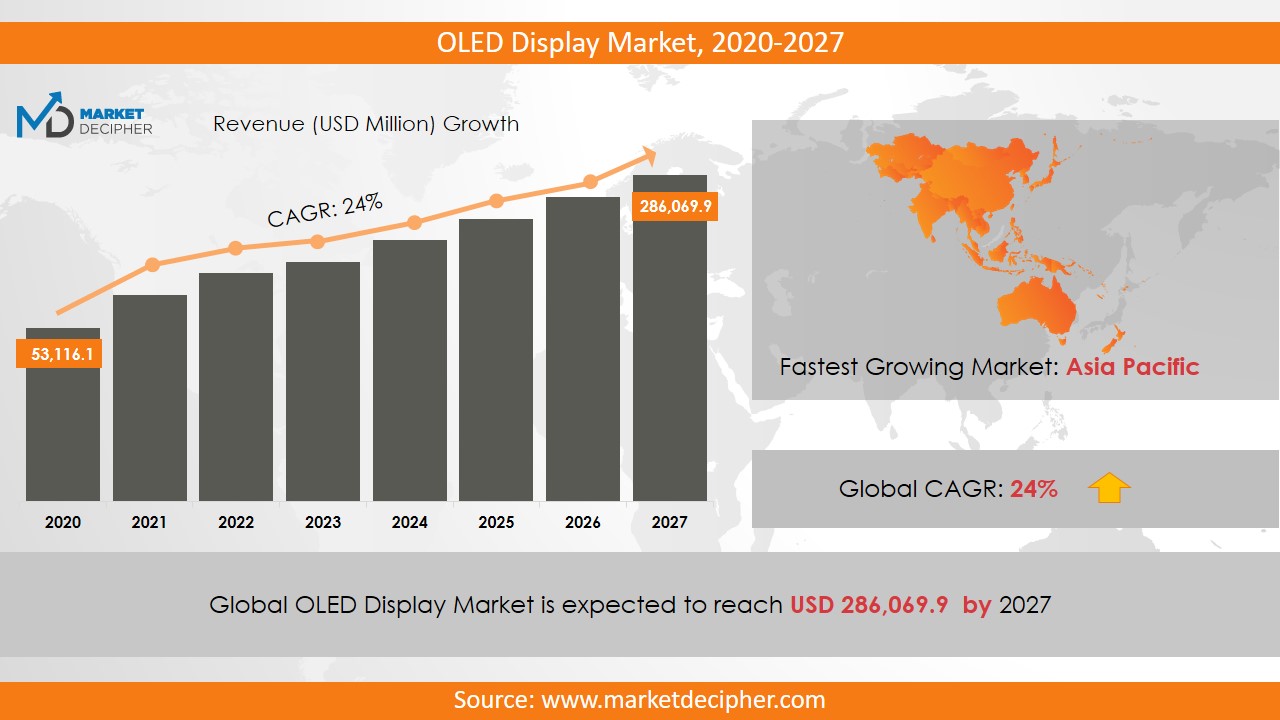

OLED Display market revenue shall reach a value of $75.1 Billion in 2026, growing with a CAGR of 18% during the forecast period of 2018 to 2026. In terms of volume sales, the market is anticipated to reach XX Units.

OLED is a light-emitting diode in which the light is emitted by a film of organic compounds. Its use in consumer electronics is increasing due to its efficient performance and better viewing experience. Also, various enhanced features such as high resolution, vibrant color, and quick response contribute significantly to OLED display growth. This display is a bit more advanced in terms of picture quality, brightness and weight as compared to other displays such as LCD and LED. But, the life span of the LED display is much higher than the OLED display. In comparison to LCD and LED display, OLED displays are expensive, due to which the growth of the market can be interrupted.

OLED technology provides high power efficiency and that is why they preferred more on incandescent bulbs and fluorescent tubes. However, they are quite expensive as compared to LCD and LED technology. Though, once it gets accepted at the global level, it is expected that its cost will fall. They are mainly used in gaming machines and there is no limit on size and connectivity. The OLED technology has many applications in several fields such as for back-window alerts, in the automotive sector for rear-view mirror of high-end vehicles and dashboard display which drive the OLED display market shares. Other consumer products like washing machines, microwaves and ovens are also made with OLEDs embedded in them owing to its environment-friendly nature.

OLED Display market Growth and Trends

The superior performance and the high demand for the Organic light-emitting diode (OLED,) is one of the key reasons for the growth of the OLED market.

The lights have superior exclusive properties such as lightweight, flexibility, transparency, and color tuning ability which them an ideal light sources and gives them a competitive edge in the market place. The demand for consumer and commercial products such as smartphones, TV, Signage, etc. is driving the growth of the OLED Market. The OLED being thin, flexible and cost-effective lighting solution is becoming populare especially in the backlight market comprising of consumer durables such as TV, smartphones, and commercial advertising such as signage.

OLED has advantages over traditional LED in terms of good contrast ratio, good viewing angles, good motion blur pictures, and fast response time. OLED are environmentally friendly as it does not contain mercury elements, this eliminates disposal and pollution problems associated with fluorescent lighting, making the lights more favorable in the environment-conscious era. Organic light-emitting diodes have penetrated the traditional LED lighting market by completely replacing the LED’s.

OLED market is distributed into Asia, Europe, North America, South America & Middle East & Africa (MEA). Asia Pacific market is projected to dominate the OLED market due to extensive use of OLED in T.V screens, mobile displays, and computer displays, and these products have high growth in the Asia Pacific region.

REGIONAL ANALYSIS

The Asia Pacific region dominated the market sales in 2018, due to the easy availability of raw materials at low cost and low labor cost in this region. Due to the easy availability of raw materials at comparatively low cost, China is the global hub of an OLED display. This country has the fastest growing consumer market in the world. LG wants to ally with Chinese retailers and TV manufacturers to promote their OLED panel business. Thus, the overall revenue of the OLED display market is witness to a tremendous increase in its market revenue. After that the North American region contributes significantly to the augmentation of the market. The regions Japan, Korea, and Taiwan also supported the augmentation of the OLED display market size.

SEGMENT ANALYSIS

In terms of application, the OLED display market report bifurcates as the Notebooks, Monitor, Television, Tablets, Smartphone’s, Automotive and Others. Further, the Smartphone segment has contributed to more than 80% of the total market revenue. These displays have been widely used in smartphones because smartphones are used as gaming devices.

By Display, the market has been segmented as PMOLED and AMOLED. Presently, the AMOLED is being used widely in mobile phones and other displays. Also, AMOLED technology is used largely as compared to PLOMED technology. PMOLED panels can only be used in a 3-inch display size, while AMOLED panels can be used in any size display. There is no such restriction in it. By End - Use, the market has been segmented as residential, commercial and industrial.

INDUSTRY PLAYER ANALYSIS

Major industry players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These industry players include Universal Display Corporation, OSRAM GmbH, LG Electronics Incorporated, Panasonic Corporation, Samsung Electronics Corporation Limited, and Koninklijke Phillips N.V. Other industries in this domain that is growing at a high CAGR include Solid State Lighting Display Market and Head Mounted Display Market.

COVERAGE HIGHLIGHTS

• Revenue Estimation and Forecast (2018 – 2026)

• Production Estimation and Forecast (2018 – 2026)

• Sales/Consumption Volume Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production by Segments (2018 – 2026)

• Breakdown of Sales Volume by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Data Breakdown

SEGMENTAL ANALYSIS:

By Display ($Revenue and Unit Sales, 2018-2026)

• PMOLED

• AMOLED

By Application ($Revenue and Unit Sales, 2018-2026)

• Notebooks

• Monitors

• Television

• Tablets

• Smartphone’s

• Automotive

• Others

By End-Use ($Revenue and Unit Sales, 2018-2026)

• Residential

• Commercial

• Industrial

By Geography ($Revenue and Unit Sales, 2018-2026)

• North America

• Mexico

• U.S

• Canada

• Europe

• France

• U.K

• Germany

• Russia

• Italy

• Rest of Europe

• Asia-Pacific

• South Korea

• India

• Japan

• China

• Rest of Asia-Pacific

• Rest of the World

• Middle East

• Latin America

• Africa

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. OLED DISPLAY MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL OLED DISPLAY MARKET DEMAND SIDE ANALYSIS

2.1. OLED DISPLAY MARKET CONSUMPTION VOLUME (BILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (BILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.6. OLED DISPLAY MARKET REVENUE SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL OLED DISPLAY MARKET SUPPLY SIDE ANALYSIS

3.1. OLED DISPLAY MARKET PRODUCTION VOLUME (BILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL OLED DISPLAY MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL OLED DISPLAY MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL OLED DISPLAY MARKET BY DISPLAY

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY DISPLAY, $BILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY DISPLAY, BILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY DISPLAY, BILLION UNITS, 2018 – 2025

6.4. PMOLED

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. AMOLED

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL OLED DISPLAY MARKET BY APPLICATION

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY APPLICATION, $BILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY APPLICATION, BILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY APPLICATION, BILLION UNITS, 2018 – 2025

7.4. NOTEBOOKS

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. MONITORS

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

7.6. TELEVISION

7.6.1. Market determinants and trend analysis

7.6.2. Market revenue, sales and production volume, 2018 – 2025

7.7. TABLETS

7.7.1. Market determinants and trend analysis

7.7.2. Market revenue, sales and production volume, 2018 – 2025

7.8. SMARTPHONE’S

7.8.1. Market determinants and trend analysis

7.8.2. Market revenue, sales and production volume, 2018 – 2025

7.9. AUTOMOTIVE

7.9.1. Market determinants and trend analysis

7.9.2. Market revenue, sales and production volume, 2018 – 2025

7.10. OTHERS

7.10.1. Market determinants and trend analysis

7.10.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL OLED DISPLAY MARKET BY END- USE

8.1. SEGMENT OUTLINE

8.2. REVENUE SHARE BY END- USE, $BILLION, 2018 – 2025

8.2. CONSUMPTION SHARE BY END- USE, BILLION UNITS, 2018 - 2025

8.3. PRODUCTION SHARE BY END- USE, BILLION UNITS, 2018 – 2025

8.4. RESIDENTIAL

8.4.1. Market determinants and trend analysis

8.4.2. Market revenue, sales and production volume, 2018 – 2025

8.5. COMMERCIAL

8.5.1. Market determinants and trend analysis

8.5.2. Market revenue, sales and production volume, 2018 – 2025

8.6. INDUSTRIAL

8.6.1. Market determinants and trend analysis

8.6.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 9. GLOBAL OLED DISPLAY MARKET BY REGIONS

9.1. REGIONAL OUTLOOK

9.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

9.3. NORTH AMERICA

9.3.1. Current Trends and Future Prospects

9.3.2. North America market revenue, sales and production volume, 2018 – 2025

9.3.3.U.S.

9.3.3.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.3.3.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.3.3.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.3.4. Canada

9.3.4.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.3.4.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.3.4.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.3.5. Mexico

9.3.5.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.3.5.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.3.5.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.4. EUROPE

9.4.1. Current Trends and Future Prospects

9.4.2. Europe market revenue, sales and production volume, 2018 – 2025

9.4.3. U.K

9.4.3.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.4.3.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.4.3.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.4.4. Germany

9.4.4.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.4.4.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.4.4.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.4.5. France

9.4.5.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.4.5.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.4.5.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.4.6. Italy

9.4.6.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.4.6.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.4.6.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.4.7. Rest of Europe

9.4.7.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.4.7.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.4.7.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.5. ASIA PACIFIC

9.5.1. Current Trends and Future Prospects

9.5.2. Europe market revenue, sales and production volume, 2018 – 2025

9.5.3. India

9.5.3.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.5.3.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.5.3.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.5.4. Japan

9.5.4.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.5.4.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.5.4.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.5.5. China

9.5.5.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.5.5.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.5.5.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.5.6. South Korea

9.5.6.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.5.6.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.5.6.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.5.7. Rest of APAC

9.5.7.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.5.7.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.5.7.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.6. REST OF THE WORLD

9.6.1. Current Trends and Future Prospects

9.6.2. Europe market revenue, sales and production volume, 2018 – 2025

9.6.3. Latin America

9.6.3.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.6.3.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.6.3.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.6.4. Middle East

9.6.4.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.6.4.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.6.4.3. OLED Display Market Production BILLION Units (2018 – 2025)

9.6.5. Africa

9.6.5.1. OLED Display Market Revenue $BILLION (2018 – 2025)

9.6.5.2. OLED Display Market Consumption BILLION Units (2018 – 2025)

9.6.5.3. OLED Display Market Production BILLION Units (2018 – 2025)

CHAPTER 10. KEY VENDOR PROFILES

10.1. Universal Display Corporation

10.1.1. Company overview

10.1.2. Portfolio Analysis

10.1.3. Estimated revenue from OLED display business and market share

10.1.4. Regional & business segment Revenue Analysis

10.2. OSRAM GmbH

10.2.1. Company overview

10.2.2. Portfolio Analysis

10.2.3. Estimated revenue from OLED display business and market share

10.2.4. Regional & business segment Revenue Analysis

10.3. LG Electronics Incorporated

10.3.1. Company overview

10.3.2. Portfolio Analysis

10.3.3. Estimated revenue from OLED display business and market share

10.3.4. Regional & business segment Revenue Analysis

10.4. Panasonic Corporation

10.4.1. Company overview

10.4.2. Portfolio Analysis

10.4.3. Estimated revenue from OLED display business and market share

10.4.4. Regional & business segment Revenue Analysis

10.5. Samsung Electronics Corporation Limited

10.5.1. Company overview

10.5.2. Portfolio Analysis

10.5.3. Estimated revenue from OLED display business and market share

10.5.4. Regional & business segment Revenue Analysis

10.6. Koninklijke Phillips N.V.

10.6.1. Company overview

10.6.2. Portfolio Analysis

10.6.3. Estimated revenue from OLED display business and market share

10.6.4. Regional & business segment Revenue Analysis

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Please fill in the form below to Request for free Sample Report

Office Hours Mon - Sat 10:00 - 16:00

Call Us +91 6201075429

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved