GCC Fit-out Market Size, Statistics, Growth Trend Analysis and Forecast Report, 2022 - 2032

GCC Fit-out Market is segmented by Product Type (Newly Constructed and Rennovation), By Application (Healthcare, Leisure, Resorts, Restaurants, Offices, Retail), Region (Saudi Arabia, Kuwait, UAE, Qatar, Oman, and Bahrain) and GCC Fit-out market companies (A&T Group Interiors, Decolab Group, S&T, Interiors and Contracting, Hennessey LLC, Summertown, Horton Tech Interiors, Bond Interiors LLC, Plafond Fit-Out LLC, Al Tayer Stocks LLC and Xworks Interiors LLC)

- Report ID : MD2882 |

- Pages : 220 |

- Tables : 80 |

- Formats :

The GCC fit-out market is growing significantly since 2018. But this market has shown sudden growth of 87% in 2021

GCC fit-out Market Overview

The term fit-out means making a space fully functional. GCC fit-out market has dominated the world in annual revenue generation; assisted by the highly popular monuments of UAE. Being, the backbone of any design sector, there is massive competition in this market. Thus, the interior designing industry increasing the competition will boost GCC fit-out market revenue during the forecast period. GCC countries use digitally advanced solutions in construction processes. This will increase the productivity of the market by 20% during 2022-2032. This industry provides woodworks, soft and hard furnishings, partitions, lightings, flooring, kitchens, and bathroom fittings which cover 18% of the investment on construction projects. This market covers the pursuit of effective use of available space. The growing need for functional design and social developments created an urgency to create new technologies that can provide complex and modular architecture.

The dynamic growth of the fit-out market in GCC countries is assisted by the changed lifestyle of consumers post-COVID-19 outbreak.

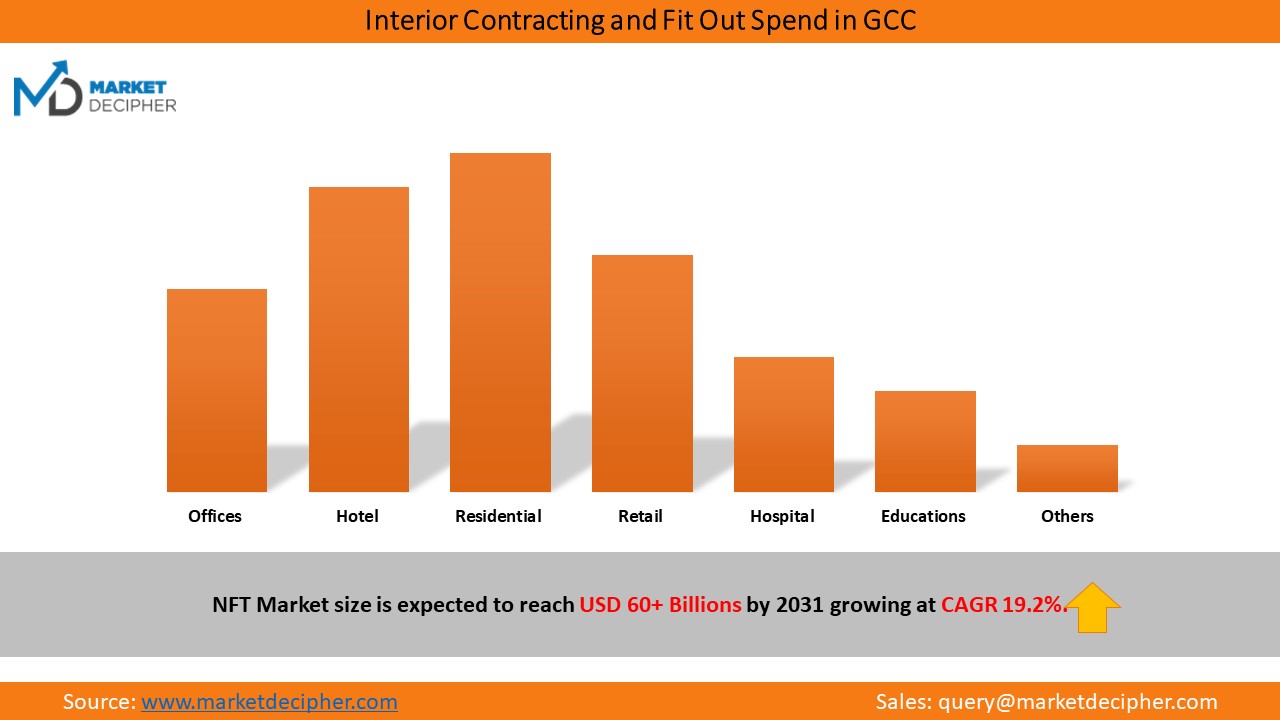

The GCC fit-out industry is growing significantly by the increasing number of building projects across the region. In 2021, the UAE completed building projects worth $90,836 million which influenced the overall GCC fit-out market. Fit-out contractors play a vital role in expanding the GCC fit-out business all over the world. Theyre using techniques such as phasing, planning, and refurbishing large-scale projects. Flexibility, at the contractor’s end, to make last-minute changes to a project for renovation is also equally important. More than 98% of the buildings require refurbishment to meet modern standards and consumer needs. Thus, the presence of smart fit-out contractors supports the market growth at a great level. Further, FNC passed a law to preserve ancient buildings. The main aim of this law was to evoke the memories of developments done by the UAE. Apart from that, the urgent need for environmental preservation supports the renovation projects. KSA is generating the highest GCC fit-out market revenue owing to its largest construction market. According to industry experts, the KSA fit-out market will grow at a fast pace of 16% in the coming years. Yet, an increase in oil prices may hamper the market growth. Also, the delivery of products in the given timeline is of huge importance. Sometimes, the market faces huge setbacks due to not meeting the timelines. The GCC fit-out industry is expanding in various industries such as residential, commercial, industrial, and others. There has been a long debate in the healthcare and residential sector regarding GCC without industry revenue. However, the residential sector supported the GCC fit-out market growth tremendously over the last decade. UAE is dominating the fit-out industry over Qatar and Saudi Arabia. The UAE fit-out market is anticipated to grow by 25% by the end of 2023. Qatar faced low-budget issues during 2017. Qatar GCC fit-out market grew significantly over the last few years. Further, increasing demand for highly advanced and innovative interiors in hotels is another major driving factor for the GCC fit-out industry market. Moreover, the market has earned significant revenue through the tourism industry as well. But this industry was the most affected during the pandemic times. Thus, the GCC fit-out market had to face dynamic trends. Moreover, the lockdown has changed many regular habits of the consumers. For example, nowadays people prefer to store many grocery items beforehand, and hence it requires convenient and sufficient space for storage. Thus, the demand for highly advanced interior designs for modular kitchens has increased over the past few years. Additionally, pandemic times have increased the trend of indoor workouts across the world. Thus, the fitness freak population has shown high interest in designing a little working out space at home. Along with this, the increasing interest of people in indoor greenery. Such new trends have created ample opportunities for the market to grow during the forecast period.

Increasing adoption of advanced technologies have brought positive changes to the fit-out market in GCC Countries.

GCC fit-out market operates in new property constructions and renovations. The renovation segment dominated over the new construction segment during the last decade. Healthcare sector, corporate offices, and educational institutions are re-decorating their buildings. These renovation projects are going to influence the GCC fit-out market growth in a positive way. Apart from that, the market finds its great application in sectors such as commercial, residential, and others. The increasing upper-middle-class population and increasing influence of different cultures supported the residential segment to dominate over the GCC fit-out market revenue. Moreover, the commercial sector is concerned about innovative and advanced workspaces which can create a better environment for their employees to work. Thus, this segment is expected to grow at a faster rate during the forecast period of 2022-2032. Major commercial sectors supporting the market growth are healthcare, leisure, resorts, restaurants, offices, retails, and others. However, the COVID-19 outbreak has been a game-changer for this market as most corporate offices started working from home. Thus, the demand for interiors in the commercial sector declined drastically which gave a major setback to the GCC fit-out market growth.

UAE dominated the GCC fit-out market in terms of annual revenue generation

Based on geographical parameters, UAE remains the largest GCC fit-out market shareholder. The significant growth of the market in this region is attributed to the increasing demand for modern interiors across several industries. In UAE, the new residential projects are generating significant market revenue. The UAE fit-out market is anticipated to generate a revenue of more than $900 million by the end of 2022. This exponential growth can be attributed to the fact that Abu Dhabi is the country’s commercial hub. Moreover, with the increasing need of adopting advanced interior designing technologies such as digital, modular, fabrication, and 3D laser scanning. The advent of new technologies has brought many positive changes to the GCC fit-out market. The ace of execution of various tasks has also increased due to the improved communication between clients and contractors.

Further, the increasing spending efficiency and enhanced partnerships by the government are generating significant market revenue for the KSA fit-out market. In 2020, Qatar spent 2% more on infrastructure projects as compared to 2019. Moreover, this country is anticipated to expand its budget exponentially during the forecast period. The finance ministry of the country is designing the budget for upcoming years to achieve maximum efficiency over the ongoing and upcoming projects. According to the World Bank, Qatar is the only country anticipated to expand its fit-out market tremendously during 2022-2032.

However, the market is growing tremendously Saudi Arabia in the last few years. It has successfully doubled its overall GCC interior market revenue. Thus, the strong growth of Saudi Arabia in this market is challenging the dominance of the UAE. Moreover, the investment made by the government for construction in residential, healthcare, education, and other projects is supporting the expansion of the market in Saudi Arabia. The overall expenditure on housing, health, education, and other sectors represented 35% of the total budget in 2021. Further, Qatar and Oman also recorded significant GCC fit-out market revenue during the last few years. But Kuwait recorded the highest share of the overall market by rising the revenue by 250%. However, Bahrain grew at a constant speed and did not perform well in increasing the market revenue. The future of fit-out the market in this region is very lucrative owing to the developments being done in the construction and real estate sectors.

GCC Fit-out Market Share & Competition

The top leading companies investing significantly in the GCC fit-out market are A&T Group Interiors, Decolab Group, S&T Interiors and Contracting, Hennessey LLC, Summertown, Horton Tech Interiors, Bond Interiors LLC, Plafond Fit-Out LLC, Al Tayer Stocks LLC, and Xworks Interiors LLC. Further, S&T Interiors and Contracting have been very active in participating in acquisitions and partnerships. Design middle east has compared several leading fit-out market firms in different regions as per their plans and ongoing projects. These companies got featured among the top fit-out industries by Design middle east. GCC fit-out market is the fastest-growing market especially in the UAE region and is anticipated to witness significant growth by generating market revenue of $975 million by the end of 2022. Apart from that, Al Shirawi Interiors Have supported the market growth significantly in providing highly advanced and cost-effective fit-outs in the UAE region over the last five years. The significant growth of this company is described to its sister companies providing electrical, mechanical, and joinery services, within tight timelines. This company provides highly advanced office interiors that are highly customizable as per the need of clients. Other than that, this company is focusing on expanding its business by providing the finest refurbishment work during the forecast period. Romeo Interiors, KPS, BW Interiors, Al Nabooda Interiors LLC, etc. are some of the other leading companies that record the largest market share.

Years considered for this report

• Historical Years: 2018-2020

• Base Year: 2021

• Forecast Period: 2022-2032

GCC Fit-out Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue and unit sales (2022 – 2032)

• Data breakdown for every market segment (2022 – 2032)

• Gross margin and profitability analysis of companies

• Funding by the UAE government

• Business trend and expansion analysis

• SMEs in UAE & Saudi Arabia

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategy

Industry Segmentation and Revenue Breakdown

Product Type Analysis (Revenue, USD Million, 2022 - 2032)

• Newly constructed

• Renovation

Application Analysis (Revenue, USD Million, 2022 - 2032)

• Healthcare

• Leisure

• Resorts

• Restaurants

• Offices

• Retail

By Country (Revenue, USD Million, 2022 - 2032):

• Saudi Arabia

• Kuwait

• UAE

• Qatar

• Oman

• Bahrain

GCC Fit-out market companies:

• A&T Group Interiors

• Decolab Group

• S&T Interiors and Contracting

• Hennessey LLC

• Summertown

• Horton Tech Interiors

• Bond Interiors LLC

• Plafond Fit-Out LLC

• Al Tayer Stocks LLC

• Xworks Interiors LLC

Available Versions of GCC Fit-out Market: -

Qatar Industry Research Report

Oman Industry Research Report

Kuwait Industry Research Report

Bahrain Industry Research Report

For a customized research report, please send your requirements to david@marketdecipher.com or fill the below form with details.

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved