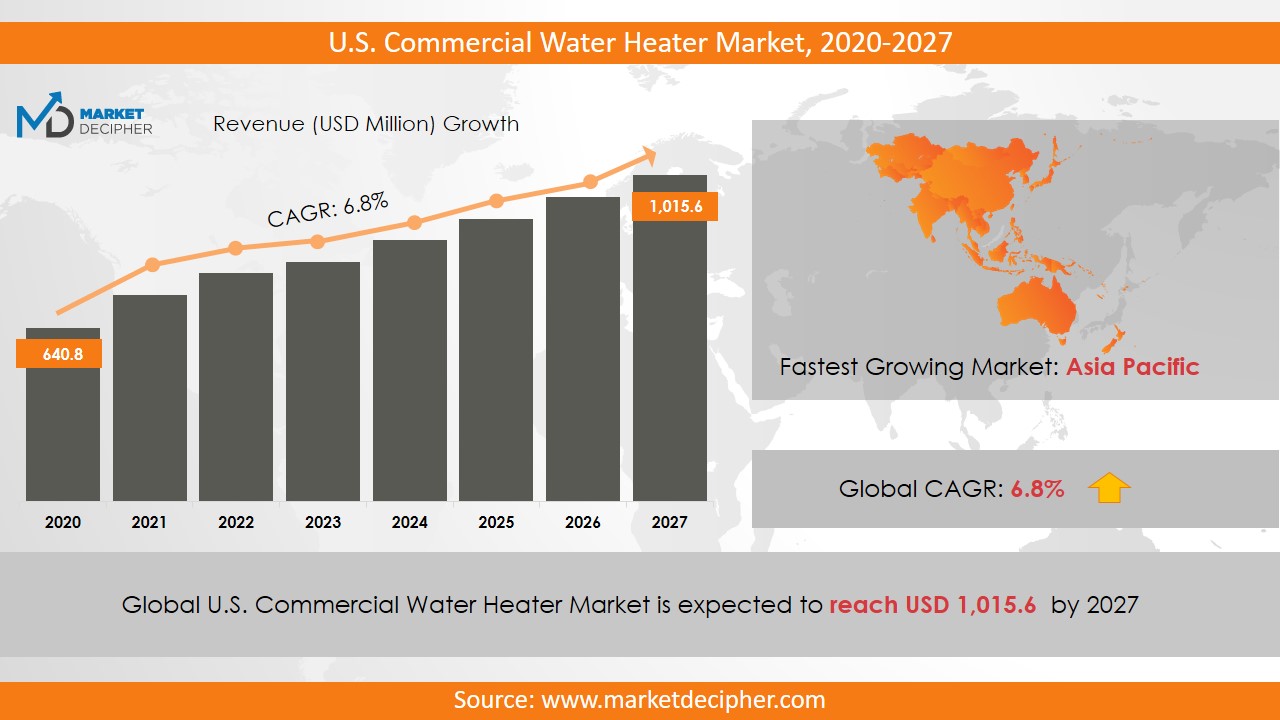

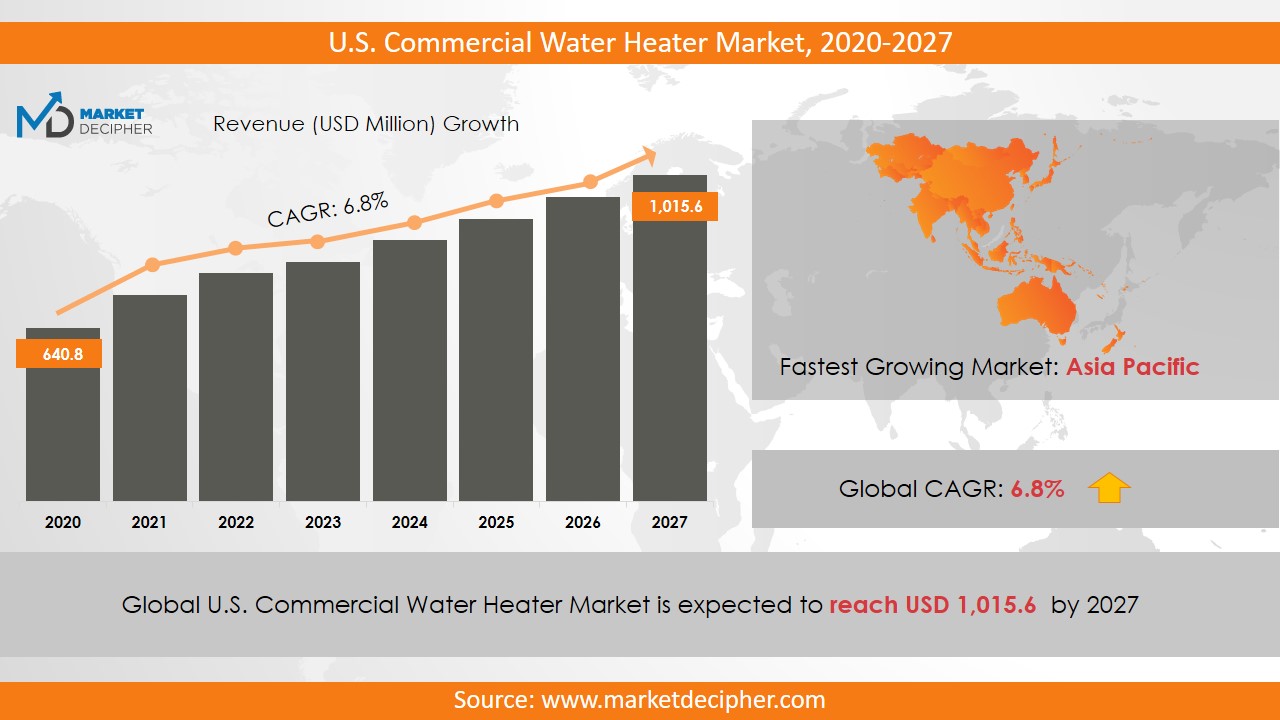

U.S. Commercial Water Heater market revenue is estimated to be $XX Billion in 2019 and shall grow with a CAGR of XX.X% during the forecast period of 2019 to 2026.

A water heater works on the principle of Heat Exchange from a heated element to a relatively cooler liquid, usually water. The heated water or steam produced is used for space heating and hot water requirements across a wide range of commercial establishments such as hotels, hospitals, colleges, and offices.

Analysis by Product

The product has two main segments: Instant and Storage. A U.S. Commercial Water Heater market report suggests that instant water heaters will be preferred by retail consumers owing to their affordable price, inexpensive upkeep, and low energy consumption. Storage heaters have a few safety features included and would thus appeal better to the relatively affluent customers.

Analysis by Energy Source

According to the Energy Source, the two major segments are Electric and Gas. The U.S. Commercial Water Heater market research foresees larger product volumes in the Electric Water Heater segment as electricity is much more readily available than Gas, which needs special infrastructure. Thus, the U.S. Commercial Water Heater market share will be dominated by electric water heaters in the forecasted period.

Analysis by Application

According to the application, the segments are College/University, Office, and Government/Military. The U.S. Commercial Water Heater market size is likely to be led by the Government/Military applications. This is on account of upgrades to the building codes for a large portion of government infrastructure.

Analysis by Capacity

According to the capacity, the segmentation is as follows: < 30 Liters, 30-100 Liters, 100-250 Liters, 250-400 Liters, > 400 Liters. U.S. Commercial Water Heater market estimation advocates large-scale use of 100-250 Liters water heaters. However, larger commercial establishments such as shopping centers would place demands for the 250-400 Liters capacity segment.

Analysis by Region

U.S. Commercial Water Heater market forecast predicts rapid demand in North-Eastern states as they are the coldest in Winters. Connecticut, Maine, and Massachusetts are some of the states which need hot water infrastructure as a necessity and not a luxury.

Analysis by Industry Leaders

U.S. Commercial Water Heater price trend is looking healthy for the upcoming period. The main U.S. Commercial Water Heater companies are Bosch Thermotechnology, A.O Smith, Bradford White, Rheem Manufacturing, Haier Electronics, Hubbell, Whirlpool and Viessmann Group. Industry collaborations are key to success in an ever-evolving market. The need for energy-efficient heaters will continue to be appreciated in the forecasted period. Other industries in this domain that are growing at a high CAGR include Storage Water Heater Market and Residential Water Purifiers Market.

COVERAGE HIGHLIGHTS

● Market Revenue Estimation and Forecast (2019 – 2026)

● Market Production Estimation and Forecast (2019 – 2026)

● Market Sales/Consumption Volume Estimation and Forecast (2019 – 2026)

● Breakdown of Revenue by Segments (2019 – 2026)

● Breakdown of Production by Segments (2019 – 2026)

● Breakdown of Sales Volume by Segments (2019 – 2026)

● Gross Margin and Profitability Analysis of Companies

● Business Trend and Expansion Analysis

● Import and Export Analysis

● Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Product Outlook ($Revenue and Unit Sales, 2019-2026)

• Instant

o Electric

o Gas

• Storage

o Electric

Below 30 Liters

30-100 Liters

100-250 Liters

250-400 Liters

Above 400 Liters

o Gas

Below 30 Liters

30-100 Liters

100-250 Liters

250-400 Liters

Above 400 Liters

By Energy Source Outlook ($Revenue and Unit Sales, 2019-2026)

• Electric

• Gas

o Natural Gas

o LPG

By Application Outlook ($Revenue and Unit Sales, 2019-2026)

• College/University

• Offices

• Government/Military

• Others

By Capacity Outlook ($Revenue and Unit Sales, 2019-2026)

• Below 30 Liters

• 30-100 Liters

• 100-250 Liters

• 250-400 Liters

• Above 400 Liters

By Regional Outlook ($Revenue and Unit Sales, 2019-2026)

• East North Central

o Illinois

o Indiana

o Michigan

o Ohio

o Wisconsin

• West South Central

o Arkansas

o Louisiana

o Oklahoma

o Texas

• South Atlantic

o Delaware

o Florida

o Georgia

o Maryland

o North Carolina

o South Carolina

o Virginia

o West Virginia

o Washington, D.C.

• North East

o Connecticut

o Maine

o Massachusetts

o New Hampshire

o Rhode Island

o Vermont

o New Jersey

o New York

o Pennsylvania

• East South Central

o Alabama

o Kentucky

o Mississippi

o Tennessee

• West North Central

o Iowa

o Kansas

o Minnesota

o Missouri

o Nebraska

o North Dakota

o South Dakota

• Pacific States

o Alaska

o California

o Hawaii

o Oregon

o Washington

• Mountain States

o Arizona

o Colorado

o Utah

o Nevada

o New Mexico

o Idaho

o Montana

o Wyoming

Industry Leaders

• A.O. Smith

• Ariston Thermo SpA

• Bosch Thermotechnology

• Bradford White Corporation

• General Electric Appliances

• Haier Electronics

• Rheem Manufacturing

• Whirlpool Corporation

• Rinnai Corporation

• State Water Heaters

• Viessmann Group

• Hubbell, Inc

• Havells India Ltd

• Watts Water Technologies

• Stiebel Eltron GmbH & Co.

• Westinghouse Electric Corporation

• American Standard Water Heaters