India Flat Steel Bar Market Size, Statistics, Growth Trend Analysis, and Forecast Report, 2023 – 2033

The India Stainless Steel Flat Products Market is segmented By Type (Mild Steel Flat Bars, Stainless Steel Flat Bars, Alloy Steel Flat Bar), By Application (Improvements and additions, Industrial artwork, Renewable energy, Home appliances, Construction industry, Mainstream industrial works, Fabrication works, Marine components, Medical device components), and By Geography (North, Northeast, East, Central, West, South).

- Report ID : MD2975 |

- Pages : 220 |

- Tables : 46 |

- Formats :

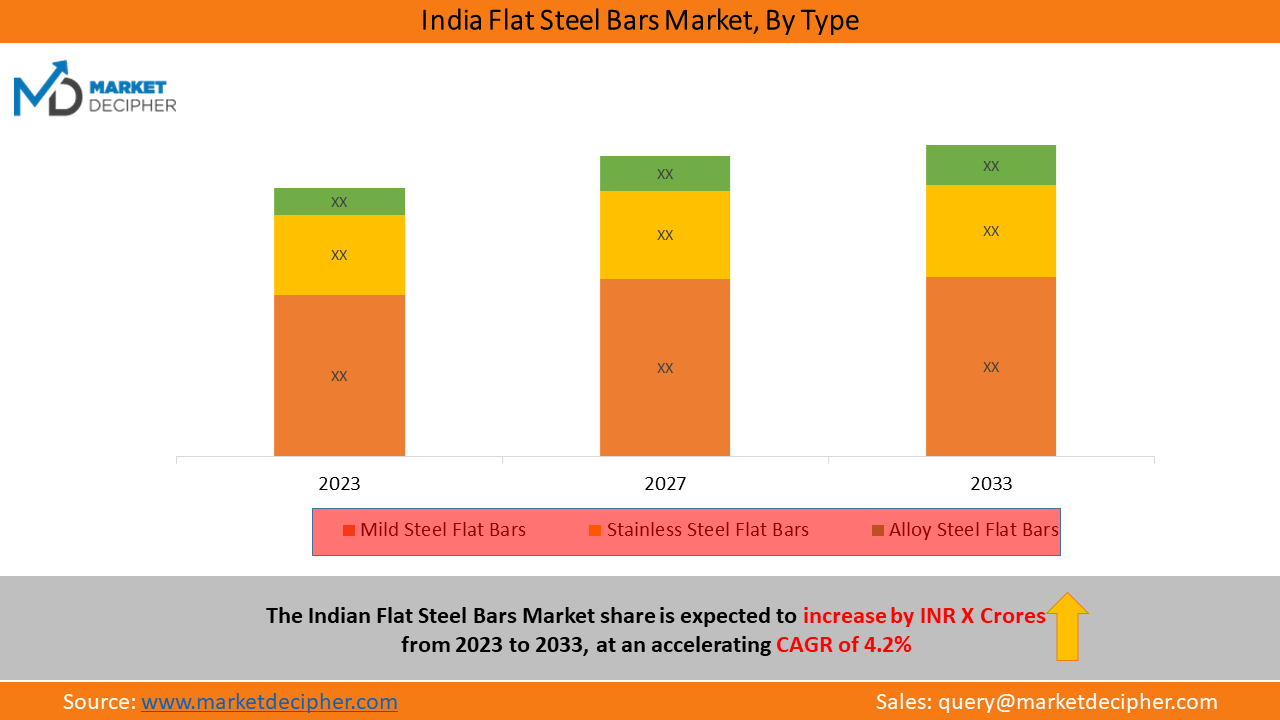

The India Flat Steel Bar Market shall reach a value of INR X Crores in 2033, growing with a CAGR of 4.2% during the forecast period of 2023 to 2033

A vibrant area of the steel industry, the flat steel bar market serves a variety of industrial applications. The flat steel bar market is thoroughly examined in this study, along with its present situation, the potential for growth, major driving forces, new trends, important competitors, and forecasts for the future.

The manufacture, sale, and consumption of flat steel bars, which are steel items having a rectangular cross-section, are referred to as the flat steel bar market. These bars are widely employed across a variety of sectors, including infrastructure, manufacturing, and construction. They are prized for their adaptability, power, and toughness.

End-use Industries

The following industries typically employ flat steel bars:

Construction and infrastructure: Used in the construction of buildings, bridges, and roads. Manufacturing: Used in the production of tools, machinery, and other industrial components. Wind turbines, power transmission towers, and other energy-related structures all use the terms energy and power. Other: Used in industries including consumer products, agriculture, and shipbuilding.

Indias brisk construction and infrastructure development drive the countrys flat steel bar market.

The expansion of infrastructure in India, including the building of roads, bridges, airports, and smart cities, is a major market driver for flat steel bars. Due to the demands of these massive projects, there is a rising need for flat steel bars, which is propelling market expansion.

To accomplish its $5 trillion economic development goal for 2025, India must improve its infrastructure.

India must invest in its transport infrastructure to keep up with the countrys population expansion and economic development. This includes improvements to its highways, trains, aircraft, shipping, and inland waterways.

The demand for and effectiveness of transit is multiplied by infrastructure development, which also expands business and entrepreneurial potential. In June 2022, the Bihar cities of Patna and Hajipur saw the opening of 15 national highway projects totaling Rs. 13,585 crores ($1.7 billion). In October 2021, the governments of Dubai and India signed a deal for the construction of infrastructure, including industrial parks, information technology towers, multifunctional towers, logistics hubs, medical colleges, and specialized hospitals, in Jammu and Kashmir.

Fiscal reforms and measures to support the Industry

In the Budget for the fiscal year 2023-24, an initiative has been introduced to extend the 50-year interest-free loan to state governments for an additional year. This measure aims to stimulate investment in infrastructure and incentivize states to implement complementary policy actions. The loan extension comes with a substantial allocation of Rs. 1.3 lakh crore (US$ 16 billion) to support these efforts. Projects with a cumulative value of Rs. 108 trillion (US$ 1.3 trillion) under the National Infrastructure Pipeline (NIP) are currently in different stages of completion. To encourage investment across diverse sectors in India, the National Investment and Infrastructure Fund (NIIF) was established in November 2022. Acting as a collaborative investment platform, the NIIF brings together the Government of India, international investors, multilateral development banks (MDBs), and domestic financial institutions. This platform aims to facilitate investments through an India-Japan Fund, supporting various infrastructure projects in the country.

The growth of the flat steel bar market is being driven by the governments investments and endeavours to expand Indias infrastructure, which has a high demand for these building supplies.

Indias expanding manufacturing sector and industrial expansion are likely to enhance demand for flat steel bars.

The growing manufacturing sector in India is fuelling demand for flat steel bars. These bars are necessary for the production of machinery, equipment, and fabricated items, which contributes to the markets growth. The manufacturing industry in India is a significant contribution to the countrys economic growth. It contributes to around 15% of Indias GDP and employs approximately 12% of the workforce. Textiles, medicines, autos, and consumer durables are among the industries represented in the sector.

The Indian government has adopted a number of efforts to improve the manufacturing industry in recent years, including the "Make in India" campaign, which aims to enhance manufacturings part of the countrys GDP and support local manufacturing growth. In order to encourage international investment in the industry, the government has also established a number of special economic zones (SEZs). Positive advances in the manufacturing sector, fuelled by increased production capacity, government policy support, increased M&A activity, and PE/VC-led investment, are laying the groundwork for the countrys long-term economic prosperity.

Expansion of the automobile sector

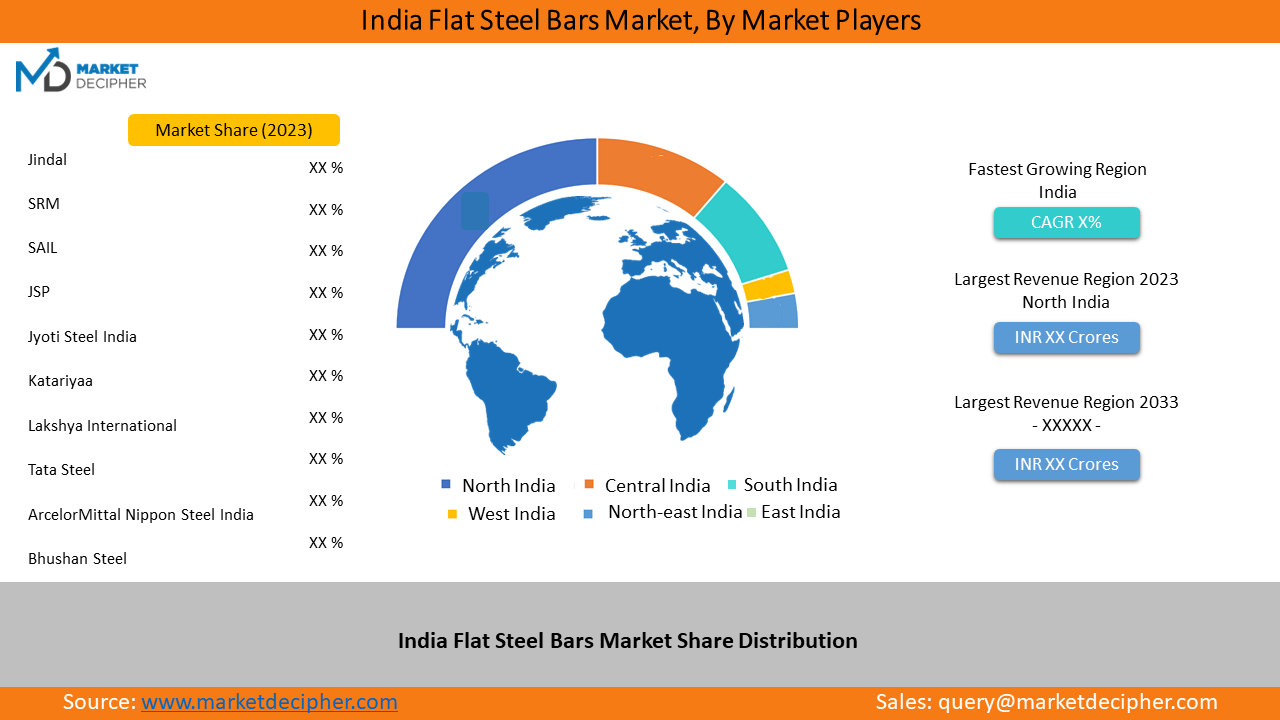

Indias expanding automobile sector, driven by increased domestic consumption and disposable incomes, produces a major need for flat steel bars. These bars are used in the manufacture of vehicle chassis, frames, and suspension systems, which contributes to the markets expansion. India has witnessed a significant increase in vehicle exports. Automobile exports climbed by 35.9% in 2021-22, from 4,134,047 in 2020-21 to 5,617,246 in 2021-22. In addition, Between April 2000 and September 2022, the automotive industry attracted cumulative equity FDI inflows of around US$33.77 billion. By 2023, the Indian government anticipates that the vehicle industry would bring in $8–10 billion in domestic and foreign investments. Jindal, SRM, and Calico Metals are the dominant market players in India and hold the highest market share in the Indian steel industry. In addition, other established players have also boosted sales in recent years.

Years considered for this report

- Historical Years: 2021 - 2022

- Base Year: 2022

- Forecast Period: 2023-2033

India Flat Steel Bar Market Research Report Analysis Highlights

- Historical data available (as per request)

- Estimation/projections/forecast for revenue and unit sales (2022 – 2032)

- Data breakdown for application Industries (2022 – 2032)

- Integration and collaboration analysis of companies

- Capacity analysis with application sector breakdown

- Business trend and expansion analysis

- Import and export analysis

- Competition analysis/market share

- Supply chain analysis

- Client list and case studies

- Market entry strategies adopted by emerging companies

Industry Segmentation and Revenue Breakdown

By Type Analysis (Revenue, INR Crores, 2022 - 2032)

- Mild Steel Flat Bars

- Stainless Steel Flat Bars

- Alloy Steel Flat Bars

By Application (Revenue, INR Crores, 2022 - 2032)

- Improvements and additions

- Industrial artwork

- Renewable energy

- Home appliances

- Construction industry

- Mainstream industrial works

- Fabrication works

- Marine components

- Medical device components

Flat Steel Bar Market companies:

- Jindal

- SRM

- Calico Metals

- JSP

- Jyoti Steel India

- Katariyaa

- nascent

- Lakshya International

- Tata Steel

- ArcelorMittal Nippon Steel India

- Bhushan Steel

- Hindalco Industries

- Steel Authority of India Limited

Available Versions of Flat Steel Bars Market Report:

Global Flat Steel Bars Market Research Report

US Flat Steel Bars Market Research Report

GCC Flat Steel Bars Market Research Report

APAC Flat Steel Bars Market Research Report

Europe Flat Steel Bars Market Research Report

Customization can be done in the existing research scope to cater to your specific requirements without any extra charges* (terms and conditions apply).

- Send us a query to get the Table of Contents and Research Scope along with the research proposal.

Related Reports Available:

India Hot Rolled Coil Market Research Report

India Cold Rolled Coil Market Research Report

India Long Steel Products Market Research Report

India Flat Steel Products Market Research Report

India Structural Steel Market Research Report

India Stainless Steel Bright Bars Market Research Report

India Stainless Steel Fasteners Market Research Report

India Steel Bars and Rods Market Research Report

India Semi-finished Steel Market Research Report

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved