Facility Management is a relatively new market in Kuwait, even though multiple local companies have been operating there for the past two to three decades. Market players have recently been trying to increase awareness specifically among governmental sectors. The preference is due to the fact that most of the buildings constructed in the country are government-funded and are turning into smart buildings. Aside from this, the new technologies used in these buildings offer existing players a chance to upskill their FM services in tandem with them.

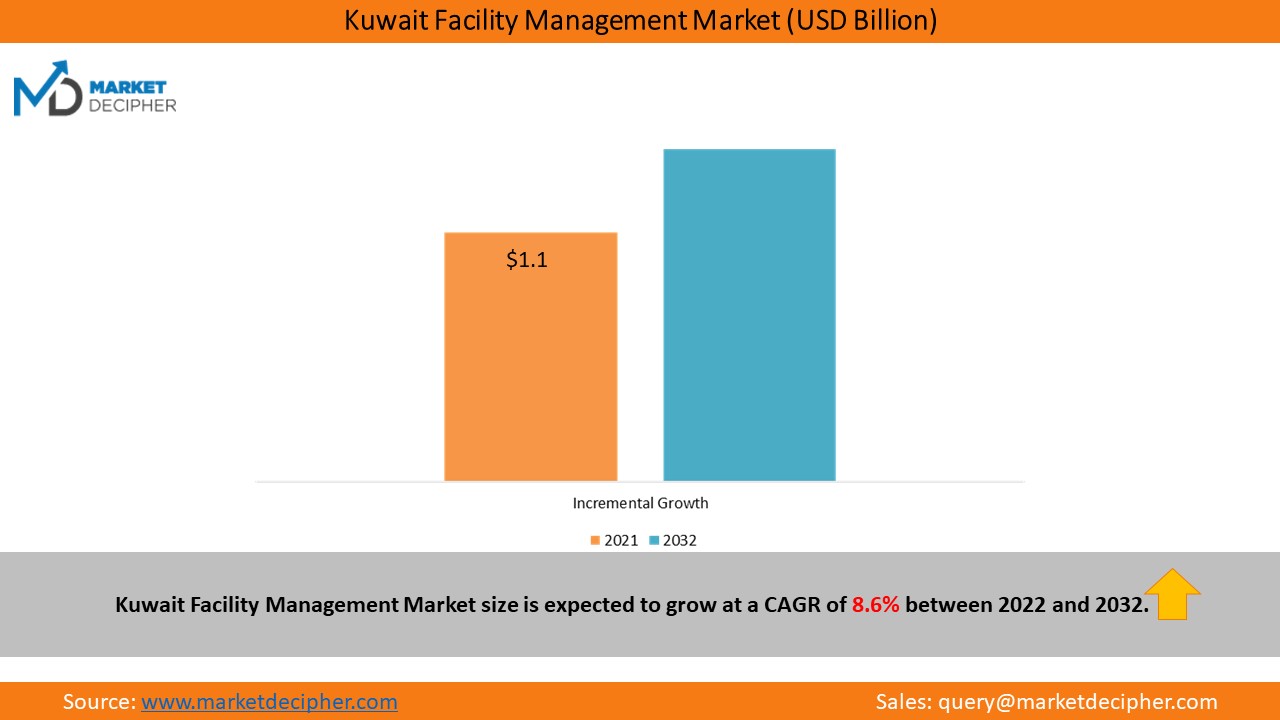

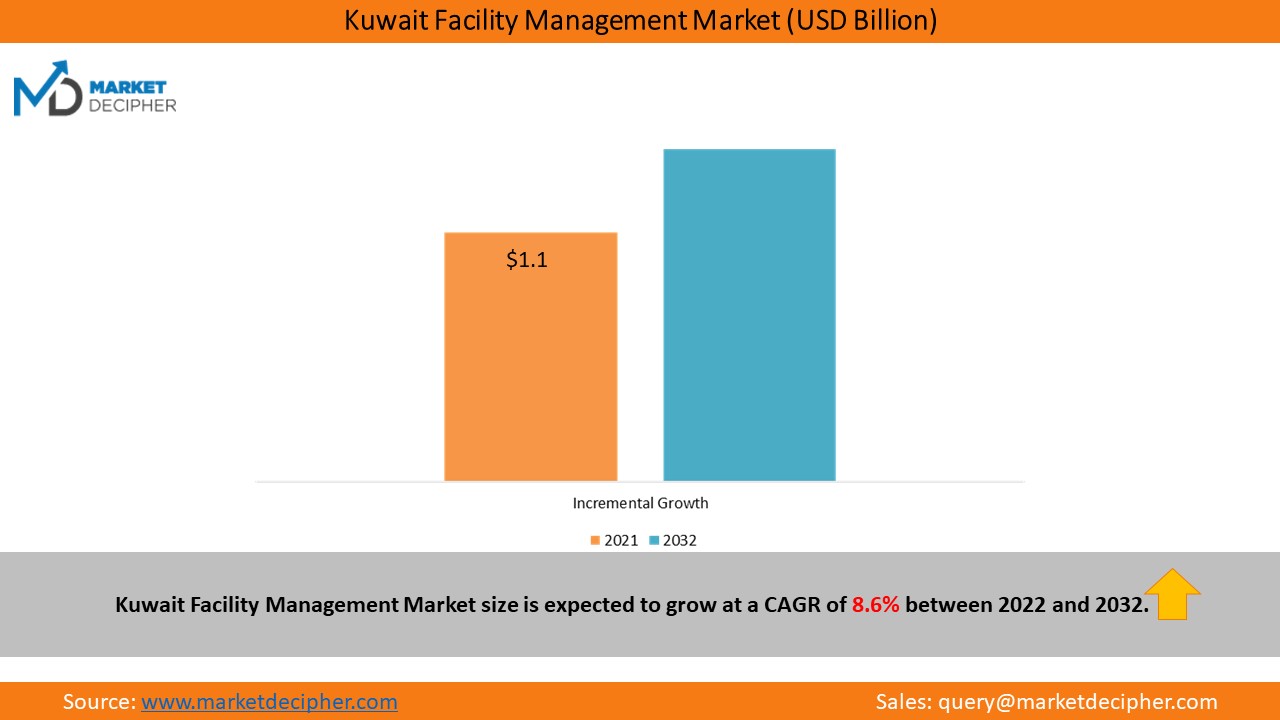

Kuwaits facility management market generated revenue of $1,113.2 million in 2021, and it is expected to grow at a rate of 8.6% between 2022 and 2032.

• Multi-local players are offering cradle-to-grave solutions to their clients. This provides a competitive advantage as well as attracts GCC or global players to the market.

• Facilities management is increasingly in demand due to the large-scale construction of hospitals and tourist attractions that attract large crowds in Kuwait.

• A $495-million deal between the Kuwaiti government and private sector has been struck for the development of industrial, residential, and warehousing infrastructure in Kuwait, which also drives the markets growth.

• Third-party service providers continue to be deployed by organizations to manage facilities, avoiding the need to maintain a large staff and enabling them to focus on their core business.

• There is a high demand for property services in the country since they are instrumental in the day-to-day operation of built infrastructure; they include mechanical & electrical maintenance, HVAC maintenance, and a variety of support services.

• Kuwaits government places a strong focus on the hospital, tourism, retail, education, and other commercial sectors as the biggest users of facility management services.

• A huge scale of infrastructure development is expected to bring further opportunities for Kuwaits facility management market players as part of Kuwait Vision 2035.

Cleaning Services and Hard Services Will See High Growth during the forecast period

Based on service, Kuwaits facility management market is expected to record the fastest growth in the cleaning service category from 2022 to 2032. Health and sanitation are experiencing a higher demand due to the COVID-19 pandemic. Since the pandemic began, people expect clean, hygienic, and germ-free workplaces and public spaces. In addition, scanners and sensors are quickly being deployed and innovated for the safety of sanitation in enterprises and governments.

In terms of type, the hard service category is expected to grow at the highest CAGR during the forecast period. The reason may have to do with the increased investment by the government in industries like transport, energy, construction, and others, which have led to the expansion of the infrastructure sector.

Market share to be dominated by the commercial segment

Offices that provide business services, such as manufacturers, insurance companies, and other service providers, occupy commercial buildings. Facility management services are in high demand in the commercial sector due to a growing awareness among users about how to optimize their commercial building management expenditures. Additionally, the commercial sector is expected to grow significantly during the forecast period, primarily due to the growth in the number of malls, hotels, commercial centers, and other commercial sites in the country. The growing employment rate in the service sector is expected to drive the Kuwait Facility Management market in the country.

“Malls and retail outlets in the country were closed down due to the COVID-19 pandemic. The reopening of these entities with certain restrictions helped the market gain traction. Additionally, the demand for facility management services in the country has increased post-pandemic due to strict government guidelines for cleanliness and other measures.”

| Report Attribute |

Details |

| Historical Years |

2018-2021 |

| Forecast Years |

2022-2032 |

| Base Year (2021) Market Size |

$1,113.2 Million |

| Forecast Period CAGR |

8.6% |

| Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19;Companies’ Strategic Developments; List of Mega Projects; Major Contracts Won by Key Players; End User Capacity & Workforce Analysis; Company Profiling

|

| Market Size by Segments |

By Service Type, By Mode, By End User |

• Kuwaits hospitality market is relatively small as compared to some of its GCC neighbors, but new hotel projects are expected in the country with the launch of Kuwait Vision 2035. Hyatt Hotels Corporation, for instance, recently reintroduced the Hyatt Regency brand in Kuwait with the opening of Hyatt Regency Al Kout Mall. The Grand Hyatt Kuwait opened in 2020, the second Hyatt property in collaboration with Tamdeen Group.

• Several vendors provide Facility Management services in the country. In fact, UFM was one of the first companies in the country to offer comprehensive property and facility management services that primarily incorporated innovation, technology, and operational standards. UFM provides facilities management services to government buildings, commercial and residential complexes, and multi-purpose buildings, among others.

Facility Management Market in Kuwait is fragmented and has few key players that have adopted various strategies to grow their market shares, such as mergers and acquisitions, new product launches, expansions, joint ventures, partnerships, and others. The major players in the market are KHARAFI National, ECOVERT FM, PIMCO KUWAIT, Al Mazsya Holding Company KSCP, among others.

January 2020: A new integrated facilities management model was introduced by ENGIE Service General Contracting for Buildings Company Will and Taiba Hospital. It further facilitates and introduces Integrated Facilities Management (IFM) to Kuwait.

August 2020: Saudi Arabias King Salman Energy Park (SPARK) and Kuwaits National Petroleum Services Company (NAPESCO) invested SAR 375 million into an oilfield services equipment facility. Additionally, Target United Energy signed a deal to invest in another oilfield equipment and services facility. In July 2020, SPARK reached 60% of its Phase 1 construction, and the project was finished in 2021.

Years considered for this report

• Historical Years: Available on Request

• Base Year: 2021

• Forecast Period: 2022-2032

Kuwait Facility Management Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue (2022 – 2032)

• Data breakdown for every market segment (2022 – 2032)

• Gross margin and profitability analysis of companies

• Price analysis of each product type

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategy

Industry Segmentation and Revenue Breakdown

Service Type Analysis (Revenue, USD Million, 2022 - 2032)

• Property

• Heating, ventilation, and air conditioning (HVAC) maintenance

• Mechanical and electrical maintenance

• Cleaning

• Security

• Catering

• Support

• Environmental Management

End-User Analysis (Revenue, USD Million, 2022 - 2032)

• Commercial

• Industrial

• Residential

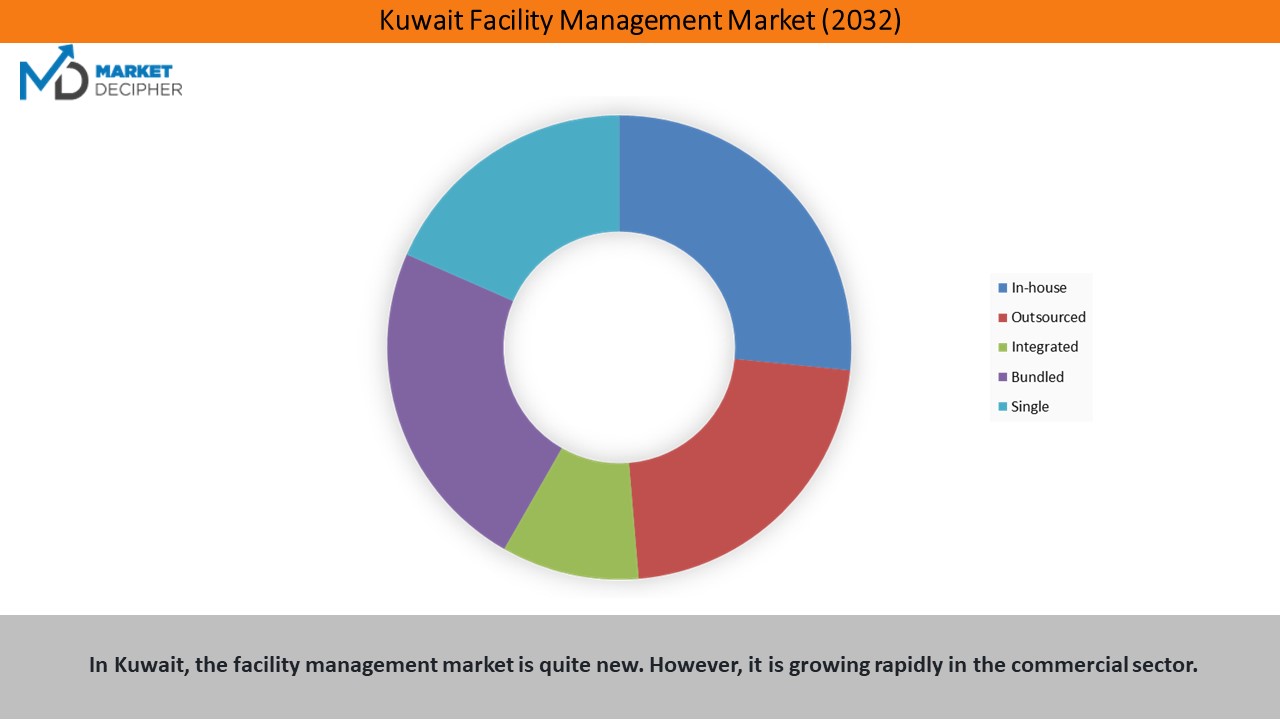

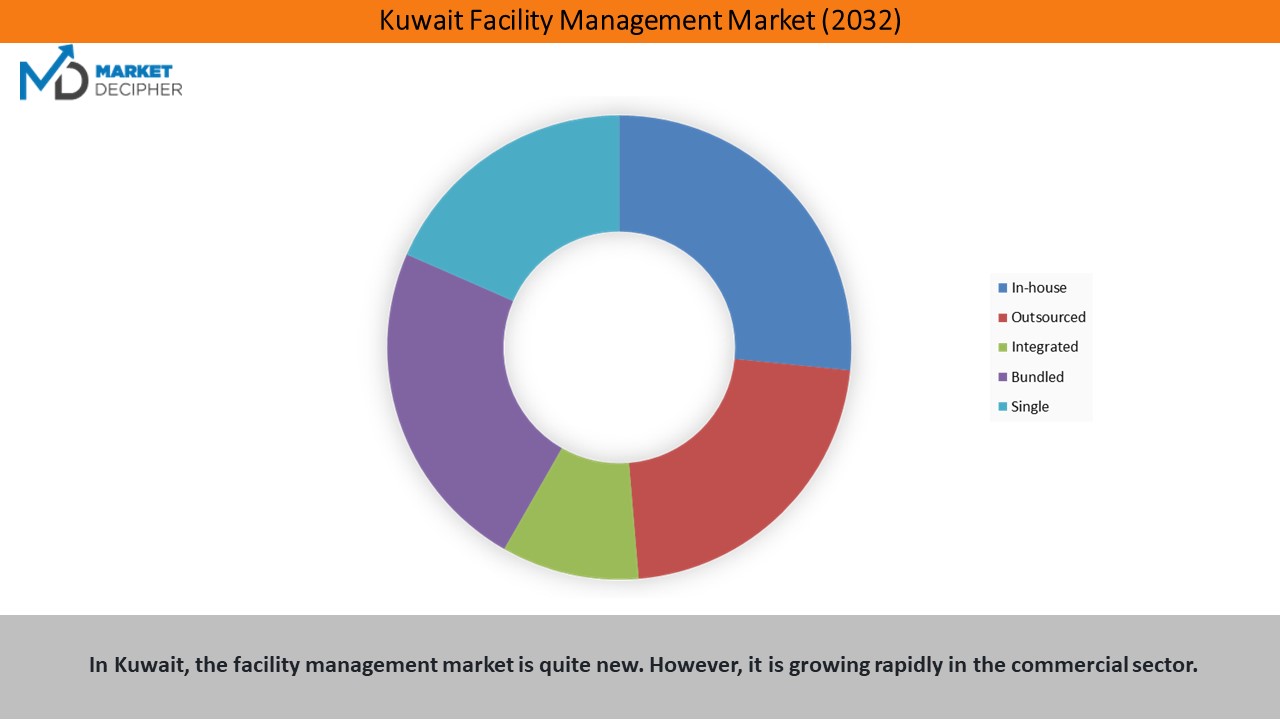

Mode Analysis (Revenue, USD Million, 2022 - 2032)

• In-house

• Outsourced

• Integrated

• Bundled

• Single

Kuwait Facility Management Market companies:

• Kharafi National for Infrastructure Projects Developments Construction and Services S.A.E

• O&G Engineering W.L.L.

• Fawaz Trading & Engineering Services Co. W.L.L.

• Ecovertfm Kuwait

• Al Mazaya Holding Company

• Al-Awsat United Real Estate Co.

• R&E Petroleum Co.

• Refrigeration Industries Co. (S.A.K.)

• Pimco

• United Facilities Management

• Al Mulla Group Holding Company K.S.C.C.

• Gulf Engineering Company K.S.C.C.

• Kazema Global Holding Company

• Universal Technical Co.

• Alghanim International

Available Versions: -

Qatar Facility Management Market Research Report

South Arabia Facility Management Market Research Report

U.A.E Facility Management Market Research Report

GCC Facility Management Market Research Report

• Customization can be done in the existing research scope to cater to your specific

requirements without any extra charges* (terms and conditions apply)

• Send us a query to get the Table of Contents and Research Scope along with the research

scope and proposal.

Fill the sample request form OR reach out directly to David Correa at his email: - david@marketdecipher.com