Lithium-Sulfur Battery Market Size, Statistics, Growth Trend Analysis, and Forecast Report, 2022 – 2032

The Lithium-Sulfur Battery Market is segmented By Type (Low Energy Density, High Energy Density), By Battery Capacity (Less than 500 mAh, Between 501 to 1000 mAh, More than 1000 mAh), By End Use (Aviation, Automotive, Electronic Devices, Power and Energy, Others), By Region (Canada, Germany, France, U.K., Italy, Spain, Nordic Region, Rest of Europe, China, Japan, India, ASEAN, Rest of Asia Pacific, Brazil, Mexico, Rest of Latin America, GCC, South Africa, Rest of the Middle East & Africa).

- Report ID : MD2916 |

- Pages : 221 |

- Tables : 82 |

- Formats :

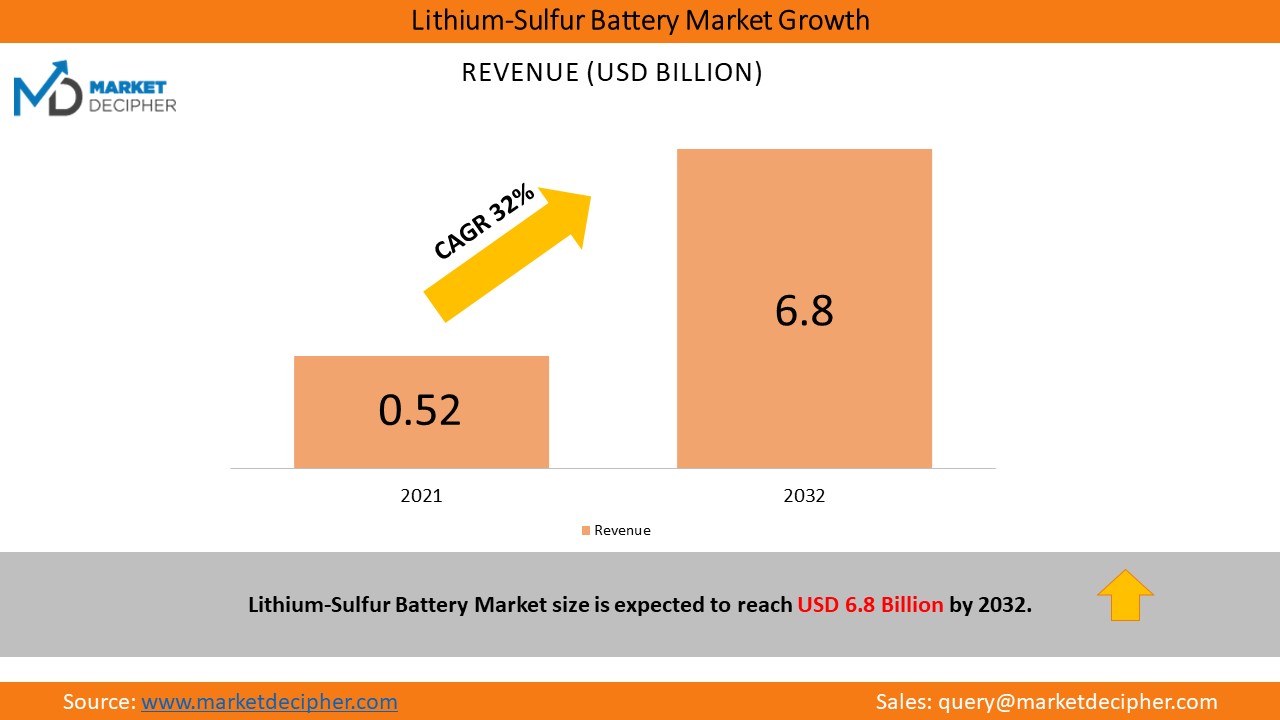

The Lithium-Sulfur Battery Market size is estimated at $502 Million in 2021 and is expected to reach $6.8 Billion by 2032, growing at a CAGR of 32% during the forecast period of 2022 to 2032.

The use of Electric vehicles is escalating as people become aware of CO2 emission, its influence on global warming, and the depletion of fossil fuels. Governments around the world are primarily driving the market for Lithium-Sulfur Batteries by their mounting inclination towards electrification in the transportation sector, coupled with their various initiatives for promoting the use of electric vehicles to curb carbon emissions. Lithium-Sulfur batteries are gaining popularity owing to their, high capacity, lightweight, rechargeability, and copious availability. The lithium-sulfur batteries are adopted across electrical, automotive, and manufacturing industries worldwide owing to these excellent characteristics.

“Lithium-sulfur battery holds 3 times more energy per kilogram as compared to other conventional lithium-ion batteries. These batteries use lithium metal as an anode and carbon-sulfur as a cathode that dissipates high energy density providing large energy storage ability. The North American region leads the global automotive lithium-sulfur battery market due to its advancement in the energy and power sector and high sales of Electronic Vehicles”. Lithium-sulfur nanotechnology-enabled batteries can deliver an energy density that is at least three times higher than traditional Li-ion batteries. Thus, the use of nanotechnology will further boost the lithium-sulfur battery market growth during the forecast period.

Driving Factors:

Sulfur is one of the most abundant elements on Earth and has an average price of $0.25 per Kg, which is very economical when compared to Lithium-Cobalt Oxide ($40 per Kg). AESBs based on Li-ion intercalation chemistry are responsible for around 50% of the cost of electric vehicles and have been stalling the electrification of road transportation. It is more cost-effective to recycle sulfur than the metal elements in conventional cathode materials because of sulfur’s easier solubilization and sublimation. Therefore, lithium-sulfur batteries are cheaper than lithium-ion batteries and can be used in a wide range of applications.

Significant investments by governments & private sectors in renewable energy after the removal of lockdown significantly boosted the demand for highly efficient automotive energy storage systems, such as lithium-sulfur batteries. The production of Lithium-ion batteries involves the use of toxic materials due to the lack of safer substitutes. The Government of China shut down most of its Lithium-ion battery manufacturing plants to curb lead poisoning. It requires a high quantity of lead, and a portion of this lead is often mixed with discharged fumes, which lead to health problems caused by air pollution. As a result, governments have enforced stringent regulations and standards for battery disposal and production. Improper dumping of batteries in landfills can lead to the seeping of sulfuric and lead into groundwater. This contaminates the drinking water supply and leads to lead poisoning. With increasing awareness about using environmentally friendly products among people, the use of lithium-sulfur batteries is more likely to increase dramatically across several producers worldwide. Many batteries, car manufacturers & research institutes are taking up initiatives and investing huge amounts of money in the R&D of lithium-sulfur batteries to make them commercially available.

Restraining Factor:

Lithium-sulfur batteries have a complex working mechanism, making it difficult to get these batteries commercialized. Lithium-sulfur batteries have low electrical conductivity and high-volume changes associated with the sulfur cathode. In addition to this, the limited projected volumetric energy density of lithium-sulfur batteries makes it difficult to compete with lithium-ion technology for applications where there is limited space like electric passenger vehicles.

Aviation Sector Exhibiting Fastest Growth

The demand for Lithium-sulfur batteries is propelling in the aviation industry as they are ultra-light in weight and aim to double the range of electric airplanes. The use of batteries in electric aerospace propulsion is also burgeoning, aiming to make vertical take-off and landing (VTOL) a reality for electric passenger aircraft.

The relatively high energy density, longer cycle life, lower cost, and safer alternative to Lithium-ion are driving the demand for Lithium-sulfur batteries in electric aviation. Moreover, the escalating application of drones is likely to strongly contribute to the overall market growth.

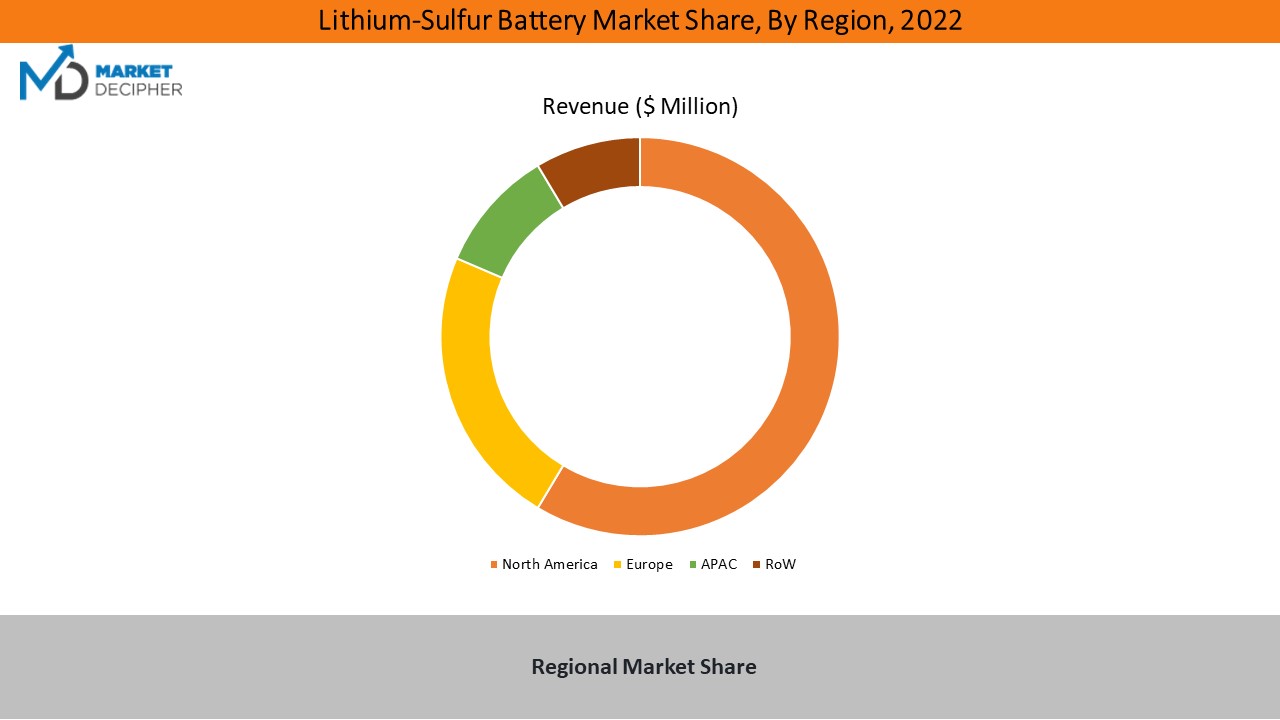

Regional Analysis:

The North American region dominates the lithium-sulfur battery market due to rapid innovation and decreasing production costs of electric and electric hybrid vehicles. The increase of renewable energy share in global energy consumption has created a huge requirement for lithium-sulfur batteries. The presence of state policy toward electronic vehicles and the presence of electronic vehicle giant Tesla have boosted the need for lithium-sulfur batteries in the market. North America is also witnessing rapid developments in energy storage equipment and monitoring equipment that have further boosted the demand for lithium-sulfur batteries. Lyten, a high-level materials organization, is disturbing the electric vehicle battery industry with the launch of its LytCell E lithium-sulfur battery stage. This most recent development is intended to deliver multiple times the gravimetric energy density when compared to conventional lithium-ion batteries.

Asia-Pacific is the second largest market for lithium-sulfur batteries and is projected to show the fastest growth due to growing demand from the aviation industry and increasing awareness about renewable energy devices in this region. China holds the majority of the market share in the Asia-Pacific Region. China saw the highest sales of Electronic Vehicles in 2021 owing to its growing adoption of renewable energy and a boost by the government through investment in electric vehicles and subsidies provided to companies who sell these vehicles. According to India Brand Equity Foundation; the Aviation industry is the fastest growing and is the third largest industry in India. Around 450 aircraft are manufactured yearly in India. Therefore, the rise in the aviation industry leads to a dominant residence for lithium-sulfur batteries in this region.

Latin America, the Middle East, and Africa are also holding a significant share of the global market due to the increase in awareness of renewable energy and upcoming projects which will promote the use of these efficient batteries in Electric Vehicles.

Key Industry Development:

• Researchers from the University of Michigan used Kevlar fibers with lithium-sulfur batteries. As lithium-sulfur batteries provide five times more energy compared to lithium-ion batteries but get unstable over time, this problem is solved by using fibers that provide stability to lithium-ion batteries.

• Lyten, an advanced materials company, introduced the LytCell EV Lithium-Sulfur battery platform, designed specifically for the EV industry and delivering thrice more gravimetric energy density than conventional lithium-ion batteries.

• A group of scientists developed a permeable 3D carbon fiber network doped with a cobalt matrix for concurrent fabrication anodes and cathodes of Li-S batteries.

• LG Chem Ltd. successfully tested its lithium-sulfur battery in a solar unmanned aerial vehicle (EAV-3) into the stratosphere. The leader has also announced to extensively produce these batteries with energy density twice more than the lithium-ion battery after 2025.

Key Players:

Some of the major companies in Automotive Lithium Sulphur Battery Markets are Oxis Energy, Sion Power, Advanced Energy Materials, Ilika PLC, Johnson Matthey, LG Chem, Morrow Batteries NOHMs Technologies, PolyPlus, Williams Advanced, etc.

Market Report Scope

Years considered for this report

• Historical Years: available on request

• Base Year: 2021

• Forecast Period: 2022-2032

Lithium-Sulfur Battery Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue and unit sales (2022 – 2032)

• Data breakdown for application Industries (2022 – 2032)

• Integration and collaboration analysis of companies

• Capacity analysis with application sector breakdown

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategies adopted by emerging companies

Industry Segmentation and Revenue Breakdown

Global Lithium-sulfur Battery Market, By Type (Revenue, USD Million, 2022 - 2032)

• Low Energy Density

• High Energy Density

Global Lithium-sulfur Battery Market, by Battery Capacity (Revenue, USD Million, 2022 - 2032)

• Less than 500 mAh

• Between 501 to 1000 mAh

• More than 1000 mAh

Global Lithium-sulfur Battery Market, By End Use (Revenue, USD Million, 2022 - 2032)

• Aviation

• Automotive

• Electronic Devices

• Power and Energy

• Others

Global Lithium-sulfur Battery Market, By Region (Revenue, USD Million, 2022 - 2032)

• North America

o U.S.

o Canada

• Europe

o Germany

o France

o U.K.

o Italy

o Spain

o Nordic Region

o Rest of Europe

• Asia Pacific

o China

o Japan

o India

o ASEAN

o Rest of Asia Pacific

• Latin America

o Brazil

o Mexico

o Rest of Latin America

• Middle East & Africa

o GCC

o South Africa

o Rest of Middle East & Africa

Key Players Operating in Automotive Lithium-sulfur Battery Market

The global automotive lithium-sulfur battery market is highly consolidated. A few of the key players working in the global automotive lithium-sulfur battery market are:

• Oxis Energy

• Sion Power

• Advanced Energy Materials

• Ilika PLC

• Johnson Matthey

• LG Chem

• Morrow Batteries

• NOHMs Technologies

• PolyPlus

• Williams Advanced

Available Versions: -

The United States Lithium-Sulfur Batteries Market Research Report

Europe Lithium-Sulfur Batteries Market Research Report

Asia Pacific Lithium-Sulfur Batteries Market Research Report

Indian Lithium-Sulfur Batteries Market Research Report

• Customization can be done in the existing research scope to cater to your specific requirements without any extra charges* (terms and conditions apply)

• Send us a query to get the Table of Contents and Research Scope along with the research scope and proposal.

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved