Managed Security Services Market

By Type (Managed Endpoint Threat Protection, DDoS, Managed SIEM and Unified Threat Management), ByDeployment (Cloud and On-Premise), By Organisation (Small, Medium and Large Enterprises), By Application (Retail, Manufacturing, Government and defense, IT and Telecom and Healthcare), By Region(North America, Europe, APAC and Rest of the World)

- Report ID : MD1087 |

- Pages : 196 |

- Tables : 87 |

- Formats :

Various organizations and stringent government rules and regulations to ensure the security of the valuable data of an organization are the factors that are driving the managed security service market share. Nowadays, there is a trend of Bring Your Own Device (BYOD) in various sectors which are further leading to more complications in the storage and securing the confidential data. Moreover, various features of cloud applications such as easy operation, flexibility, and affordable cost are leading to the wide use of the cloud for storing and securing the data tremendously. Thus, the growing adoption of services based on the cloud is one of the major drivers of the managed security services market growth.

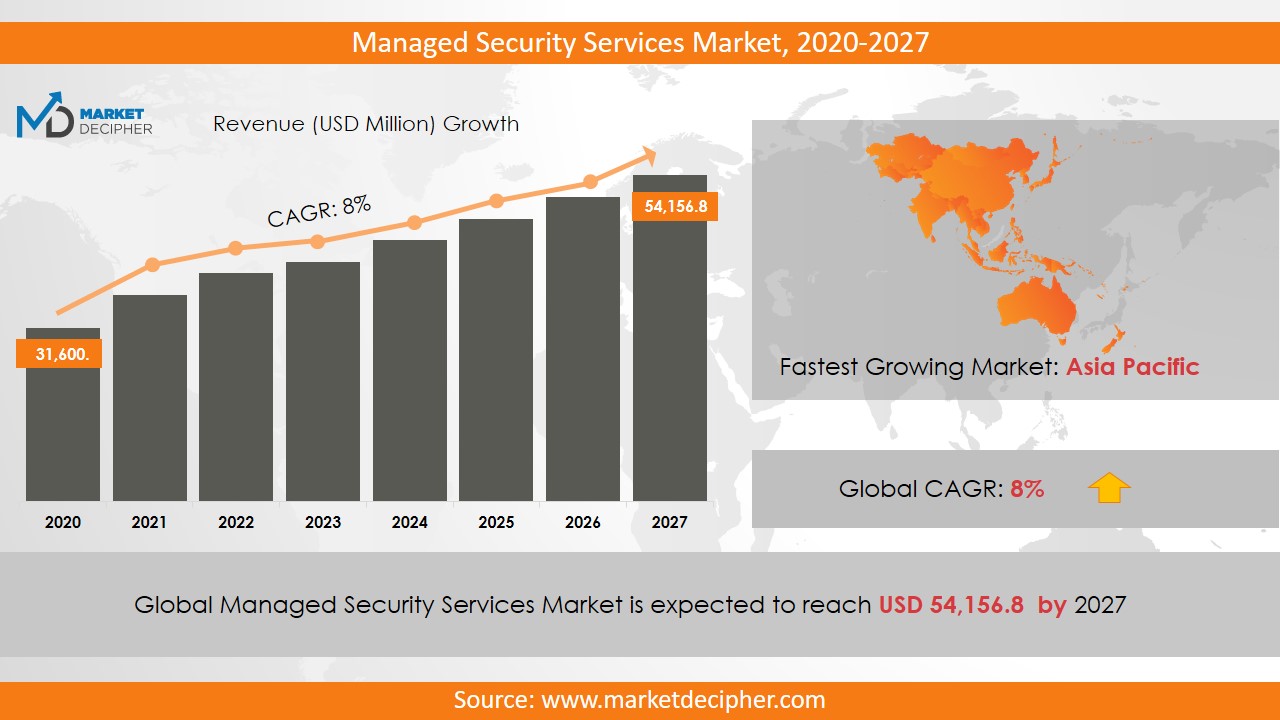

The market revenue of Managed Security Services shall reach a value of $59.78 Billion in 2031, growing with a CAGR of 14.52% during the forecast period of 2022 to 2031.

Further, the increasing use of electronic gadgets such as laptop, smartphones, tablets, etc., and various advancements in the technology are producing more complications in the security of the various confidential information leading it to be more vulnerable to threats and attacks and thereby is anticipated to expand the managed security services market size. Also, a rise in the awareness about security and maintaining the brand image is estimated to boost up the market growth in the near future. There is a huge requirement for the management of security services in the sectors like BFSI, retail, manufacturing, government and defense, IT And telecom and healthcare. In addition, the lack of security professionals has boosted up the need for managed security services.

REGIONAL ANALYSIS

North America has emerged as the dominant region in contributing to market growth in 2022. The rising number of service providers is driving the revenue of the market in North America. Further, the Asia Pacific region is expected to grow with the highest CAGR of 20.1% over the forecast period as a number of enterprises are establishing in the region. Owing to the digitization and stringent government laws for the management of security services, the managed security services market of India has shown a great increment in its revenue.

SEGMENT ANALYSIS

On the basis of type, the market has been segmented as Managed Endpoint Threat Protection, DDoS, Managed SIEM and Unified Threat Management. By deployment, the market has been bifurcated as cloud and on-premise. Out of which the on-premise segment has contributed to more than 54% of the total revenue of the market and the cloud segment is anticipated to dominate the market revenue during the forecast period.

On the basis of organization, the market has been segmented as small, medium and large enterprises. Major application areas are retail, manufacturing, Government and defense, IT And telecom and healthcare. The most targeted area is cybercrime and cyber fraud by BFSI. Thus, this segment is expected to flourish in the estimated period.

INDUSTRY PLAYER ANALYSIS

Major industry players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These industry players include Verizon Communications, Symantec Corporation, At &T, IBM Corporation, Deloitte, Cisco Systems Incorporated, Dell Secure works Incorporated, Ericsson, Accenture PLC, HP Enterprises, Trustwave Holdings Incorporated, and Computer Sciences Corporation. Industry players are adopting new strategies to expand the managed security services business size.

COVERAGE HIGHLIGHTS

• Revenue Estimation and Forecast (2022 – 2031)

• Production Estimation and Forecast (2022 – 2031)

• Sales/Consumption Volume Estimation and Forecast (2022 – 2031)

• Breakdown of Revenue by Segments (2022 – 2031)

• Breakdown of Production by Segments (2022 – 2031)

• Breakdown of Sales Volume by Segments (2022 – 2031)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Data Breakdown

SEGMENTAL ANALYSIS

By Type Outlook ($Revenue, 2022-2031)

• Managed Endpoint Threat Protection

• DDoS

• Managed SIEM

• Unified Threat Management

By Deployment Outlook ($Revenue, 2022-2031)

• Cloud-based

• On-premise

By Organisation Type Outlook ($Revenue, 2022-2031)

· Small enterprises

· Medium enterprises

· Large enterprises

By Application Outlook ($Revenue, 2022-2031)

· Retail

· Manufacturing

· Government and defense

· IT And telecom

· Healthcare

INDUSTRY PLAYERS ANALYSIS:

• Verizon Communications

• Symantec Corporation

• At & T

• IBM Corporation

• Deloitte

• Cisco Systems Incorporated

• Dell Secure works Incorporated

• Ericsson

• Accenture PLC

• HP Enterprise

• Trustwave Holdings Incorporated

• Computer Sciences Corporation

Need Report on a particular Country OR need a Tailored/Customized Research? Budget Limits/Price Discounts Query...!

Email to David Correa

OR Fill the below "Sample Request FORM" with your queries in the message box.

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. MANAGED SECURITY SERVICES MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL MANAGED SECURITY SERVICES MARKET DEMAND SIDE ANALYSIS

2.1. MANAGED SECURITY SERVICES MARKET CONSUMPTION VOLUME (BILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (BILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.6. MANAGED SECURITY SERVICES MARKET REVENUE SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL MANAGED SECURITY SERVICES MARKET SUPPLY SIDE ANALYSIS

3.1. MANAGED SECURITY SERVICES MARKET PRODUCTION VOLUME (BILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL MANAGED SECURITY SERVICES MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL MANAGED SECURITY SERVICES MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL MANAGED SECURITY SERVICES MARKET BY TYPE

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY TYPE, $BILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY TYPE, BILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY TYPE, BILLION UNITS, 2018 – 2025

6.4. MANAGED ENDPOINT THREAT PROTECTION

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. DDoS

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

6.6. MANAGED SIEM

6.6.1. Market determinants and trend analysis

6.6.2. Market revenue, sales and production volume, 2018 – 2025

6.7. UNIFIED THREAT MANAGEMENT

6.7.1. Market determinants and trend analysis

6.7.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL MANAGED SECURITY SERVICES MARKET BY DEPLOYMENT

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY DEPLOYMENT, $BILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY DEPLOYMENT, BILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY DEPLOYMENT, BILLION UNITS, 2018 – 2025

7.4. CLOUD-BASED

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. On-premise

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL MANAGED SECURITY SERVICES MARKET BY ORGANIZATION TYPE

8.1. SEGMENT OUTLINE

8.2. REVENUE SHARE BY ORGANIZATION TYPE, $BILLION, 2018 – 2025

8.2. CONSUMPTION SHARE BY ORGANIZATION TYPE, BILLION UNITS, 2018 - 2025

8.3. PRODUCTION SHARE BY ORGANIZATION TYPE, BILLION UNITS, 2018 – 2025

8.4. SMALL ENTERPRISES

8.4.1. Market determinants and trend analysis

8.4.2. Market revenue, sales and production volume, 2018 – 2025

8.5. MEDIUM ENTERPRISES

8.5.1. Market determinants and trend analysis

8.5.2. Market revenue, sales and production volume, 2018 – 2025

8.6. LARGE ENTERPRISES

8.6.1. Market determinants and trend analysis

8.6.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 9. GLOBAL MANAGED SECURITY SERVICES MARKET BY APPLICATION

9.1. SEGMENT OUTLINE

9.2. REVENUE SHARE BY APPLICATION, $BILLION, 2018 – 2025

9.2. CONSUMPTION SHARE BY APPLICATION, BILLION UNITS, 2018 - 2025

9.3. PRODUCTION SHARE BY APPLICATION, BILLION UNITS, 2018 – 2025

9.4. RETAIL

9.4.1. Market determinants and trend analysis

9.4.2. Market revenue, sales and production volume, 2018 – 2025

9.5. MANUFACTURING

9.5.1. Market determinants and trend analysis

9.5.2. Market revenue, sales and production volume, 2018 – 2025

9.6. GOVERNMENT AND DEFENSE

9.6.1. Market determinants and trend analysis

9.6.2. Market revenue, sales and production volume, 2018 – 2025

9.7. IT AND TELECOM

9.7.1. Market determinants and trend analysis

9.7.2. Market revenue, sales and production volume, 2018 – 2025

9.8. HEALTHCARE

9.8.1. Market determinants and trend analysis

9.8.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 10. GLOBAL MANAGED SECURITY SERVICES MARKET BY REGIONS

10.1. REGIONAL OUTLOOK

10.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

10.3. NORTH AMERICA

10.3.1. Current Trends and Future Prospects

10.3.2. North America market revenue, sales and production volume, 2018 – 2025

10.3.3. The U.S.

10.3.3.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.3.3.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.3.3.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.3.4. Canada

10.3.4.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.3.4.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.3.4.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.3.5. Mexico

10.3.5.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.3.5.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.3.5.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.4. EUROPE

10.4.1. Current Trends and Future Prospects

10.4.2. Europe market revenue, sales and production volume, 2018 – 2025

10.4.3. U.K

10.4.3.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.4.3.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.4.3.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.4.4. Germany

10.4.4.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.4.4.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.4.4.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.4.5. France

10.4.5.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.4.5.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.4.5.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.4.6. Italy

10.4.6.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.4.6.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.4.6.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.4.7. Rest of Europe

10.4.7.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.4.7.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.4.7.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.5. ASIA PACIFIC

10.5.1. Current Trends and Future Prospects

10.5.2. Europe market revenue, sales and production volume, 2018 – 2025

10.5.3. India

10.5.3.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.5.3.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.5.3.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.5.4. Japan

10.5.4.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.5.4.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.5.4.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.5.5. China

10.5.5.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.5.5.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.5.5.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.5.6. South Korea

10.5.6.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.5.6.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.5.6.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.5.7. Rest of APAC

10.5.7.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.5.7.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.5.7.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.6. REST OF THE WORLD

10.6.1. Current Trends and Future Prospects

10.6.2. Europe market revenue, sales and production volume, 2018 – 2025

10.6.3. Latin America

10.6.3.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.6.3.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.6.3.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.6.4. Middle East

10.6.4.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.6.4.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.6.4.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

10.6.5. Africa

10.6.5.1. Managed Security Services Market Revenue $BILLION (2018 – 2025)

10.6.5.2. Managed Security Services Market Consumption BILLION Units (2018 – 2025)

10.6.5.3. Managed Security Services Market Production BILLION Units (2018 – 2025)

CHAPTER 11. KEY VENDOR PROFILES

11.1. Verizon Communications

11.1.1. Company overview

11.1.2. Portfolio Analysis

11.1.3. Estimated revenue from managed security services business and market share

11.1.4. Regional & business segment Revenue Analysis

11.2. Symantec Corporation

11.2.1. Company overview

11.2.2. Portfolio Analysis

11.2.3. Estimated revenue from managed security services business and market share

11.2.4. Regional & business segment Revenue Analysis

11.3. At &T

11.3.1. Company overview

11.3.2. Portfolio Analysis

11.3.3. Estimated revenue from managed security services business and market share

11.3.4. Regional & business segment Revenue Analysis

11.4. IBM Corporation

11.4.1. Company overview

11.4.2. Portfolio Analysis

11.4.3. Estimated revenue from managed security services business and market share

11.4.4. Regional & business segment Revenue Analysis

11.5. Deloitte

11.5.1. Company overview

11.5.2. Portfolio Analysis

11.5.3. Estimated revenue from managed security services business and market share

11.5.4. Regional & business segment Revenue Analysis

11.6. Cisco Systems Incorporated

11.6.1. Company overview

11.6.2. Portfolio Analysis

11.6.3. Estimated revenue from managed security services business and market share

11.6.4. Regional & business segment Revenue Analysis

11.7. Dell Secure works Incorporated

11.7.1. Company overview

11.7.2. Portfolio Analysis

11.7.3. Estimated revenue from managed security services business and market share

11.7.4. Regional & business segment Revenue Analysis

11.8. Ericsson

11.8.1. Company overview

11.8.2. Portfolio Analysis

11.8.3. Estimated revenue from managed security services business and market share

11.8.4. Regional & business segment Revenue Analysis

11.9. Accenture PLC

11.9.1. Company overview

11.9.2. Portfolio Analysis

11.9.3. Estimated revenue from managed security services business and market share

11.9.4. Regional & business segment Revenue Analysis

11.10. HP Enterprises

11.10.1. Company overview

11.10.2. Portfolio Analysis

11.10.3. Estimated revenue from managed security services business and market share

11.10.4. Regional & business segment Revenue Analysis

11.11. Trustwave Holdings Incorporated

11.11.1. Company overview

11.11.2. Portfolio Analysis

11.11.3. Estimated revenue from managed security services business and market share

11.11.4. Regional & business segment Revenue Analysis

11.12. Computer Sciences Corporation

11.12.1. Company overview

11.12.2. Portfolio Analysis

11.12.3. Estimated revenue from managed security services business and market share

11.12.4. Regional & business segment Revenue Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved