Wireless Gigabyte Market Revenue & Trend Forecasts Report, 2019-2026

By Type (802.11ad and 802.11ac), By Product (Network devices and Consumer products), By Application (Healthcare, Government, BFSI, IT and Telecom, Retail and Others), By End-Use (SMBs, Large enterprises and Residential), By Region (North America, Europe, APAC and Rest of the World)

- Report ID : MD1079 |

- Pages : 192 |

- Tables : 98 |

- Formats :

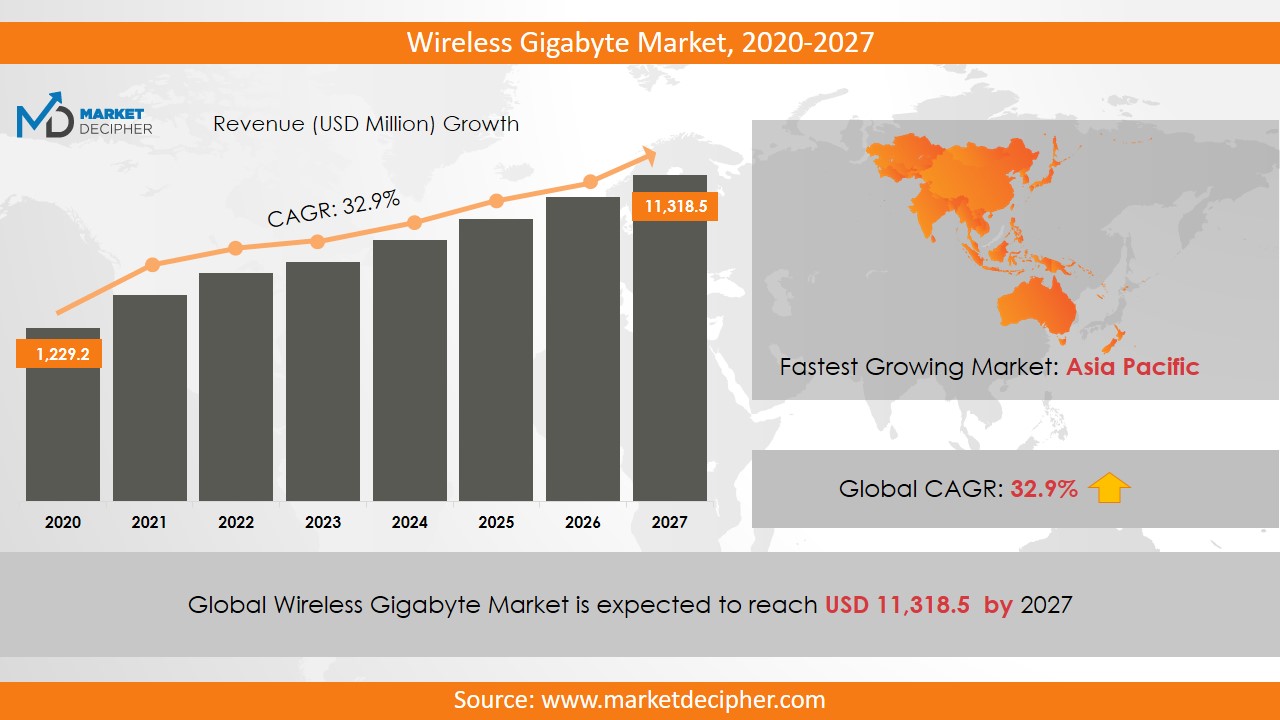

Wireless Gigabyte market revenue shall reach a value of $5.2 Billion in 2026, growing with a CAGR of 32.11% during the forecast period of 2018 to 2026. In terms of volume sales, the market is anticipated to reach XX Units.

The increasing use of electronic devices such as smartphones are increasing the demand for data with high speed and consequently increasing the need for the wireless gigabyte and hence strengthening the augmentation of the overall revenue. Further, the high demand for the gigabyte IPs helps in shooting up the market growth significantly. Moreover, the growing production of routers and Ethernet switches are the major drivers of the wireless gigabyte industry shares. Owing to the number of applications of the wireless gigabyte in various sectors such as retail, healthcare, BFSI, education and others, the market is anticipated to grow significantly over the forecast period.

Wireless gigabyte technology locates its comprehensive application in the healthcare sector as the healthcare sector is contributing significantly to the growth of the market shares. Further, the business sector is expected to drive market growth substantially over the forecast period. Further, the more complex electronic gadgets such as tablets, ultrabooks, etc., require high-speed data. It uses a radio module of 32 antennas on the device and creates an access point and is the dynamically very narrow beam that focuses on specific users. Further, the integrated circuit chip technology is used extensively in wireless gigabyte solutions. Also, the shifting preferences of the market players from IPv4 to IPv6 are expected to support market growth.

REGIONAL ANALYSIS

The Asia Pacific region is estimated to account for more than 46% of the market share in 2018 and is anticipated to expand the market at a significant rate over the forecast period. Further, the growing economies such as Japan, China, and India are contributing to the overall revenue of the market. Also, North America is anticipated to witness significant growth in the coming few years. This region is the center of all the high tech and advanced technologies. Therefore, increasing the penetration of advanced technologies such as IoT, BYOD, and cloud in this region is responsible for market growth.

SEGMENT ANALYSIS

Based on type, the wireless gigabyte market report provides an analysis of 802.11ad and 802.11ac. Based on products, the classification has been done as network devices and consumer products. Based on application, the market has been segmented as Healthcare, Government, BFSI, IT and Telecom, Retail and Others. The rapid development of the health care sector is increasing market revenue at a critical rate. The data flow has become a much easier task with the use of connected devices. Further, the adoption of electronic equipment for health records of patients is expected to increase the demand for wireless gigabyte solutions in recent years.

Apart from this, large scale deployment of smartphones in this sector for communication between doctors and patients is increasing overall revenue. Major end-use industries are SMBs, large enterprises and residential. Based on the type, the 802.11ad section has established its dominance in terms of revenue due to the advanced facilities provided by it such as downloading and sharing 4K videos in no time.

INDUSTRY PLAYER ANALYSIS

Major industry players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These industry players include Qualcomm, Nvidia Corporation, Intel Corporation, Broadcom Corporation, Marvell Technology Group Limited, Azurewave Technologies Incorporated, Panasonic Corporation, MediaTek, Cisco Systems Incorporated and NEC Corporation.

COVERAGE HIGHLIGHTS

• Revenue Estimation and Forecast (2018 – 2026)

• Production Estimation and Forecast (2018 – 2026)

• Sales/Consumption Volume Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production by Segments (2018 – 2026)

• Breakdown of Sales Volume by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Data Breakdown

SEGMENTAL ANALYSIS

By Type Outlook ($Revenue, 2018-2026)

· 802.11ad

· 802.11ac

By Product Outlook ($Revenue, 2018-2026)

· Networking devices

· Consumer Products

By Application Outlook ($Revenue, 2018-2026)

• Healthcare

• Government

• BFSI

• IT and Telecom

• Retail

• Others

By End-Use Outlook ($Revenue,2018-2026)

· SMBs

· Large enterprises

· Residential

By Regional Outlook ($Revenue and Unit Sales, 2018-2026)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• U.K

• France

• Netherlands

• Austria

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• South Korea

• Australia

• Rest of Asia Pacific

• The Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East

• Africa

• South America

• Brazil

• Argentina

• Rest of South America

INDUSTRY PLAYERS ANALYSIS

· Qualcomm

· Nvidia Corporation

· Intel Corporation

· Broadcom Corporation

· Marvell Technology Group Limited

· Azurewave Technologies Incorporated

· Panasonic Corporation

· MediaTek

· Cisco Systems Incorporated

· NEC Corporation

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. WIRELESS GIGABYTE MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL WIRELESS GIGABYTE MARKET DEMAND SIDE ANALYSIS

2.1. WIRELESS GIGABYTE MARKET CONSUMPTION VOLUME (BILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (BILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.6. WIRELESS GIGABYTE MARKET REVENUE SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL WIRELESS GIGABYTE MARKET SUPPLY SIDE ANALYSIS

3.1. WIRELESS GIGABYTE MARKET PRODUCTION VOLUME (BILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL WIRELESS GIGABYTE MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL WIRELESS GIGABYTE MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL WIRELESS GIGABYTE MARKET BY TYPE

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY TYPE, $BILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY TYPE, BILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY TYPE, BILLION UNITS, 2018 – 2025

6.4. 802.11AD

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. 802.11AC

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL WIRELESS GIGABYTE MARKET BY PRODUCT

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY PRODUCT, $BILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY PRODUCT, BILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY PRODUCT, BILLION UNITS, 2018 – 2025

7.4. NETWORKING DEVICES

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. CONSUMER PRODUCTS

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL WIRELESS GIGABYTE MARKET BY APPLICATION

8.1. SEGMENT OUTLINE

8.2. REVENUE SHARE BY APPLICATION, $BILLION, 2018 – 2025

8.2. CONSUMPTION SHARE BY APPLICATION, BILLION UNITS, 2018 - 2025

8.3. PRODUCTION SHARE BY APPLICATION, BILLION UNITS, 2018 – 2025

8.4. HEALTHCARE

8.4.1. Market determinants and trend analysis

8.4.2. Market revenue, sales and production volume, 2018 – 2025

8.5. GOVERNMENT

8.5.1. Market determinants and trend analysis

8.5.2. Market revenue, sales and production volume, 2018 – 2025

8.6. BFSI

8.6.1. Market determinants and trend analysis

8.6.2. Market revenue, sales and production volume, 2018 – 2025

8.7. IT AND TELECOM

8.7.1. Market determinants and trend analysis

8.7.2. Market revenue, sales and production volume, 2018 – 2025

8.8. RETAIL

8.8.1. Market determinants and trend analysis

8.8.2. Market revenue, sales and production volume, 2018 – 2025

8.9. OTHERS

8.9.1. Market determinants and trend analysis

8.9.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 9. GLOBAL WIRELESS GIGABYTE MARKET BY END-USE

9.1. SEGMENT OUTLINE

9.2. REVENUE SHARE BY END-USE, $BILLION, 2018 – 2025

9.2. CONSUMPTION SHARE BY END-USE, BILLION UNITS, 2018 - 2025

9.3. PRODUCTION SHARE BY END-USE, BILLION UNITS, 2018 – 2025

9.4. SMBs

9.4.1. Market determinants and trend analysis

9.4.2. Market revenue, sales and production volume, 2018 – 2025

9.5. LARGE ENTERPRISES

9.5.1. Market determinants and trend analysis

9.5.2. Market revenue, sales and production volume, 2018 – 2025

9.6. RESIDENTIAL

9.6.1. Market determinants and trend analysis

9.6.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 10. GLOBAL WIRELESS GIGABYTE MARKET BY REGIONS

10.1. REGIONAL OUTLOOK

10.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

10.3. NORTH AMERICA

10.3.1. Current Trends and Future Prospects

10.3.2. North America market revenue, sales and production volume, 2018 – 2025

10.3.3. The U.S.

10.3.3.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.3.3.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.3.3.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.3.4. Canada

10.3.4.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.3.4.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.3.4.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.3.5. Mexico

10.3.5.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.3.5.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.3.5.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.4. EUROPE

10.4.1. Current Trends and Future Prospects

10.4.2. Europe market revenue, sales and production volume, 2018 – 2025

10.4.3. U.K

10.4.3.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.4.3.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.4.3.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.4.4. Germany

10.4.4.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.4.4.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.4.4.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.4.5. France

10.4.5.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.4.5.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.4.5.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.4.6. Italy

10.4.6.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.4.6.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.4.6.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.4.7. Rest of Europe

10.4.7.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.4.7.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.4.7.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.5. ASIA PACIFIC

10.5.1. Current Trends and Future Prospects

10.5.2. Europe market revenue, sales and production volume, 2018 – 2025

10.5.3. India

10.5.3.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.5.3.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.5.3.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.5.4. Japan

10.5.4.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.5.4.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.5.4.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.5.5. China

10.5.5.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.5.5.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.5.5.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.5.6. South Korea

10.5.6.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.5.6.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.5.6.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.5.7. Rest of APAC

10.5.7.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.5.7.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.5.7.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.6. REST OF THE WORLD

10.6.1. Current Trends and Future Prospects

10.6.2. Europe market revenue, sales and production volume, 2018 – 2025

10.6.3. Latin America

10.6.3.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.6.3.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.6.3.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.6.4. Middle East

10.6.4.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.6.4.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.6.4.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

10.6.5. Africa

10.6.5.1. Wireless Gigabyte Market Revenue $BILLION (2018 – 2025)

10.6.5.2. Wireless Gigabyte Market Consumption BILLION Units (2018 – 2025)

10.6.5.3. Wireless Gigabyte Market Production BILLION Units (2018 – 2025)

CHAPTER 11. KEY VENDOR PROFILES

11.1. Qualcomm

11.1.1. Company overview

11.1.2. Portfolio Analysis

11.1.3. Estimated revenue from wireless gigabyte business and market share

11.1.4. Regional & business segment Revenue Analysis

11.2. Nvidia Corporation

11.2.1. Company overview

11.2.2. Portfolio Analysis

11.2.3. Estimated revenue from wireless gigabyte business and market share

11.2.4. Regional & business segment Revenue Analysis

11.3. Intel Corporation

11.3.1. Company overview

11.3.2. Portfolio Analysis

11.3.3. Estimated revenue from wireless gigabyte business and market share

11.3.4. Regional & business segment Revenue Analysis

11.4. Broadcom Corporation

11.4.1. Company overview

11.4.2. Portfolio Analysis

11.4.3. Estimated revenue from wireless gigabyte business and market share

11.4.4. Regional & business segment Revenue Analysis

11.5. Marvell Technology Group Limited

11.5.1. Company overview

11.5.2. Portfolio Analysis

11.5.3. Estimated revenue from wireless gigabyte business and market share

11.5.4. Regional & business segment Revenue Analysis

11.6. Azurewave Technologies Incorporated

11.6.1. Company overview

11.6.2. Portfolio Analysis

11.6.3. Estimated revenue from wireless gigabyte business and market share

11.6.4. Regional & business segment Revenue Analysis

11.7. Panasonic Corporation

11.7.1. Company overview

11.7.2. Portfolio Analysis

11.7.3. Estimated revenue from wireless gigabyte business and market share

11.7.4. Regional & business segment Revenue Analysis

11.8. MediaTek

11.8.1. Company overview

11.8.2. Portfolio Analysis

11.8.3. Estimated revenue from wireless gigabyte business and market share

11.8.4. Regional & business segment Revenue Analysis

11.9. Cisco Systems Incorporated

11.9.1. Company overview

11.9.2. Portfolio Analysis

11.9.3. Estimated revenue from wireless gigabyte business and market share

11.9.4. Regional & business segment Revenue Analysis

11.10. NEC Corporation

11.10.1. Company overview

11.10.2. Portfolio Analysis

11.10.3. Estimated revenue from wireless gigabyte business and market share

11.10.4. Regional & business segment Revenue Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved